Manual asset lookups and configuration drift cost hours daily—automated tracking proves its value in weeks, not quarters.

AI-driven asset tracking delivers 40-60% reduction in manual lookups, 25-35% improvement in contract attachment rates, and 30-50% faster firmware compliance verification by automating configuration drift detection and lifecycle management across deployed router and switch populations.

Every firmware update check, every warranty validation, every upsell opportunity requires hunting through multiple systems to confirm what's actually deployed. Operators waste hours daily reconciling asset records with reality.

Missing serial numbers and configuration data mean service contracts can't be automatically linked to deployed equipment. Operators manually search for entitlement records during each customer interaction, slowing response times.

Firmware versions, module configurations, and software licenses drift from system records over time. Operators discover mismatches only during troubleshooting, extending resolution time and creating compliance risk.

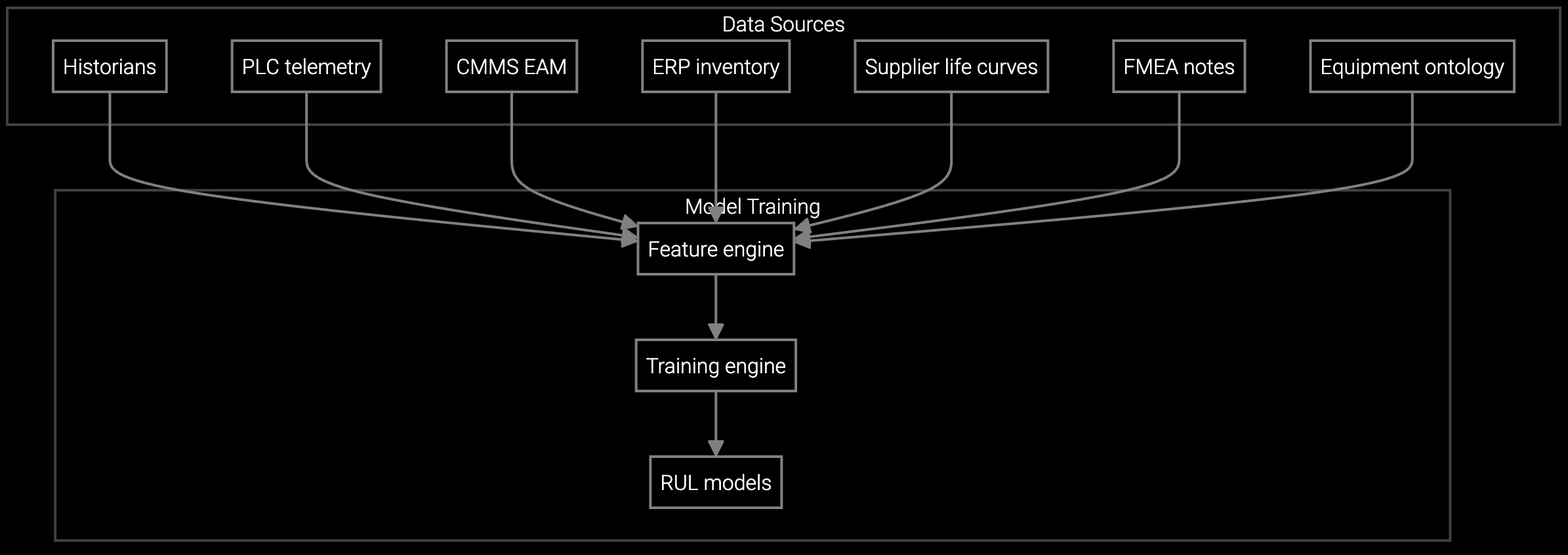

Bruviti's platform continuously monitors SNMP telemetry, syslog streams, and registration data to maintain current asset records without manual intervention. When an operator searches for a device, the system instantly surfaces firmware versions, installed modules, contract status, and historical incidents—all synchronized from the equipment itself. Configuration changes detected through telemetry automatically update the asset record, eliminating the lag between field reality and system data.

For lifecycle management, the platform flags firmware compliance status, EOL/EOS timelines, and upgrade eligibility across the entire installed base. Operators see alerts for devices approaching end-of-support or running vulnerable firmware versions, enabling proactive customer outreach before network issues occur. Contract attachment happens automatically when serial numbers appear in registration or telemetry feeds, closing the gap between deployed equipment and entitlement records.

Monitor SNMP trap patterns and error log trends across routers and switches to identify failing power supplies, optics, or fan assemblies before they cause network outages.

Estimate when line cards and chassis components will fail based on temperature patterns, packet throughput, and historical replacement data for proactive spare parts planning.

Automatically schedule firmware updates and hardware refreshes during planned maintenance windows based on traffic patterns and customer SLA requirements.

Network equipment customers demand five-nines uptime, making predictive visibility into router and switch health directly tied to retention. Asset tracking ROI appears fastest in firmware vulnerability response—when a CVE drops, automated asset queries identify affected devices in minutes versus the hours or days manual searches require. Operators spend their time coordinating customer communications instead of hunting serial numbers.

Contract attachment improvements drive upsell conversion. When entitlement records link automatically to deployed chassis and line cards, upgrade recommendations reach customers with accurate eligibility and pricing data. EOL/EOS notifications arrive months in advance, giving customers time to budget hardware refreshes during planned maintenance windows rather than emergency replacements during outages.

Most operators see time savings within the first firmware compliance audit after deployment—typically 30-45 days. Contract attachment rate improvements take 60-90 days to measure as registration data flows in and entitlement links populate. The clearest early indicator is reduction in manual asset lookup time, which operators notice immediately in daily workflow.

Start with time per asset lookup, contract attachment percentage, and firmware compliance audit duration. Also track the lag between configuration changes in the field and system record updates. After implementation, measure the same metrics at 30, 60, and 90 days to quantify improvement. Customer SLA compliance and escalation rates provide secondary indicators of improved asset visibility.

No. Value starts with whatever data you currently receive—SNMP traps, registration records, warranty claims, or RMA submissions. The system fills gaps over time as more data sources connect. Even partial telemetry coverage delivers ROI by eliminating manual lookups for that subset of equipment.

Drift detection prevents wasted effort on outdated asset data. When operators base firmware updates, spare parts recommendations, or EOL notifications on incorrect configuration records, they create rework and customer frustration. Automated drift detection ensures lifecycle actions target the right equipment with the right specifications, improving first-contact resolution and reducing repeated outreach.

Payback depends on installed base size and current manual lookup volume. For OEMs with 10,000+ deployed devices and high firmware update frequency, payback typically occurs within 6-9 months through reduced operator time and improved contract attachment. Larger installed bases with frequent CVE response needs see payback in 3-6 months.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Connect your telemetry feeds and see automated asset lookups in action during a 30-minute demo.

Schedule Demo