When router downtime costs customers $10K per hour, proving technician effectiveness requires financial precision.

Track first-time fix rate, truck roll cost per visit, and mean time to repair. Network OEMs reduce repeat visits 35-40% and cut truck roll costs $180-220 per avoided dispatch by measuring technician effectiveness against customer uptime SLAs.

Technicians return for second visits when diagnostics miss root cause or parts are wrong. Each repeat visit doubles labor cost and extends customer downtime, eroding margin on service contracts.

Average network equipment field visit costs $285-340 including travel, labor, and overhead. When 40-50% of dispatches resolve issues fixable remotely, margin evaporates on warranty and service contracts.

Network customers demand 4-hour MTTR for critical infrastructure. When technicians lack on-site context or diagnostic support, repair time stretches to 6-8 hours, triggering SLA penalties and contract risk.

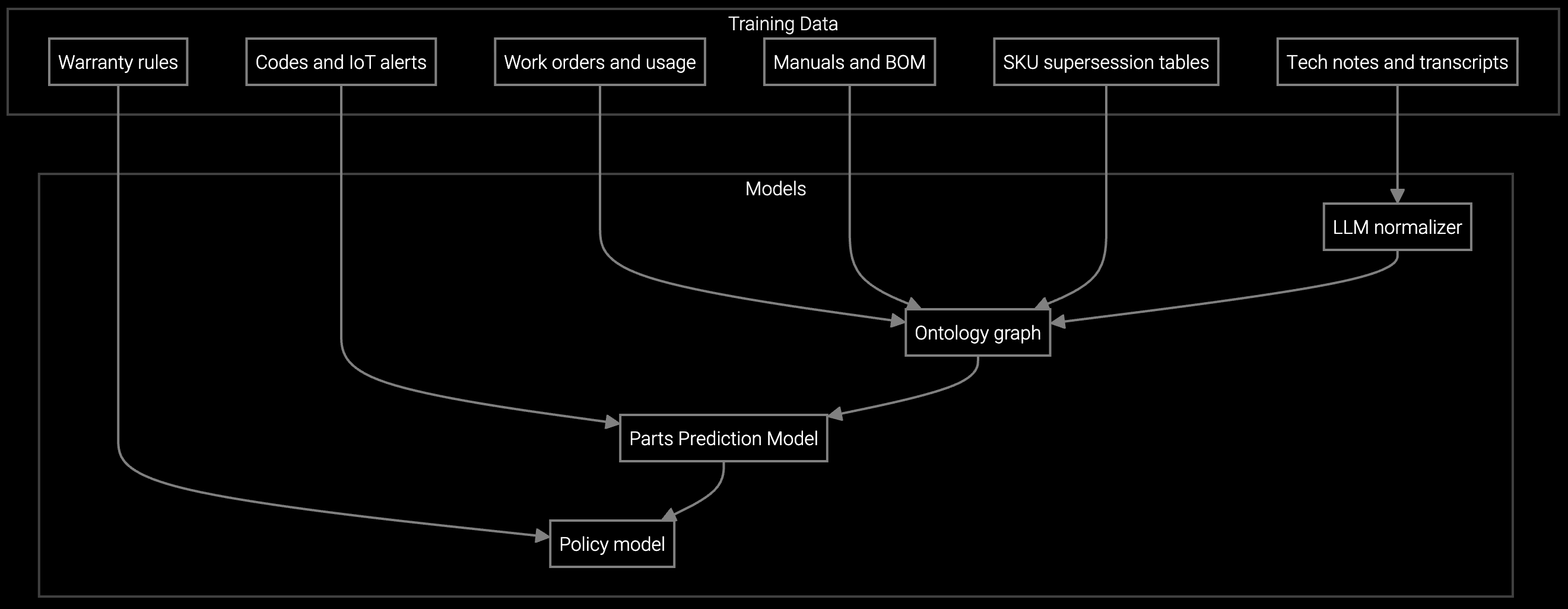

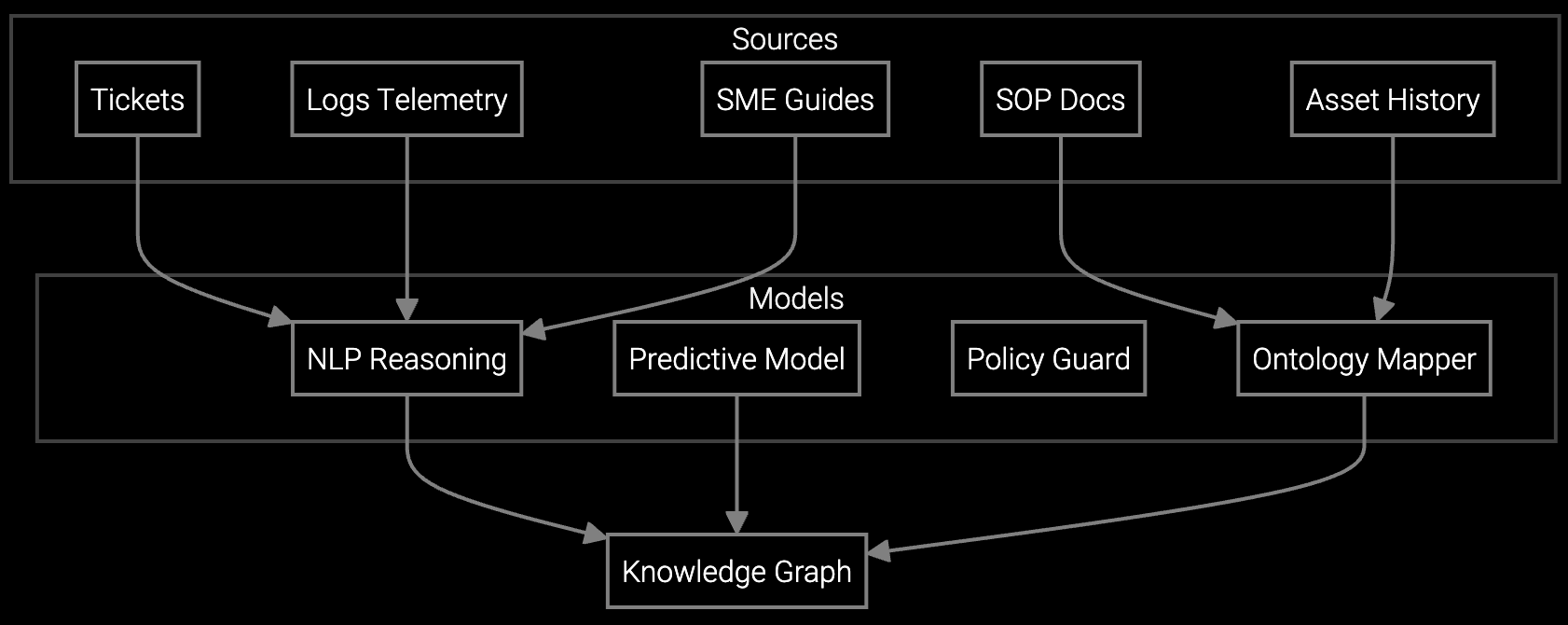

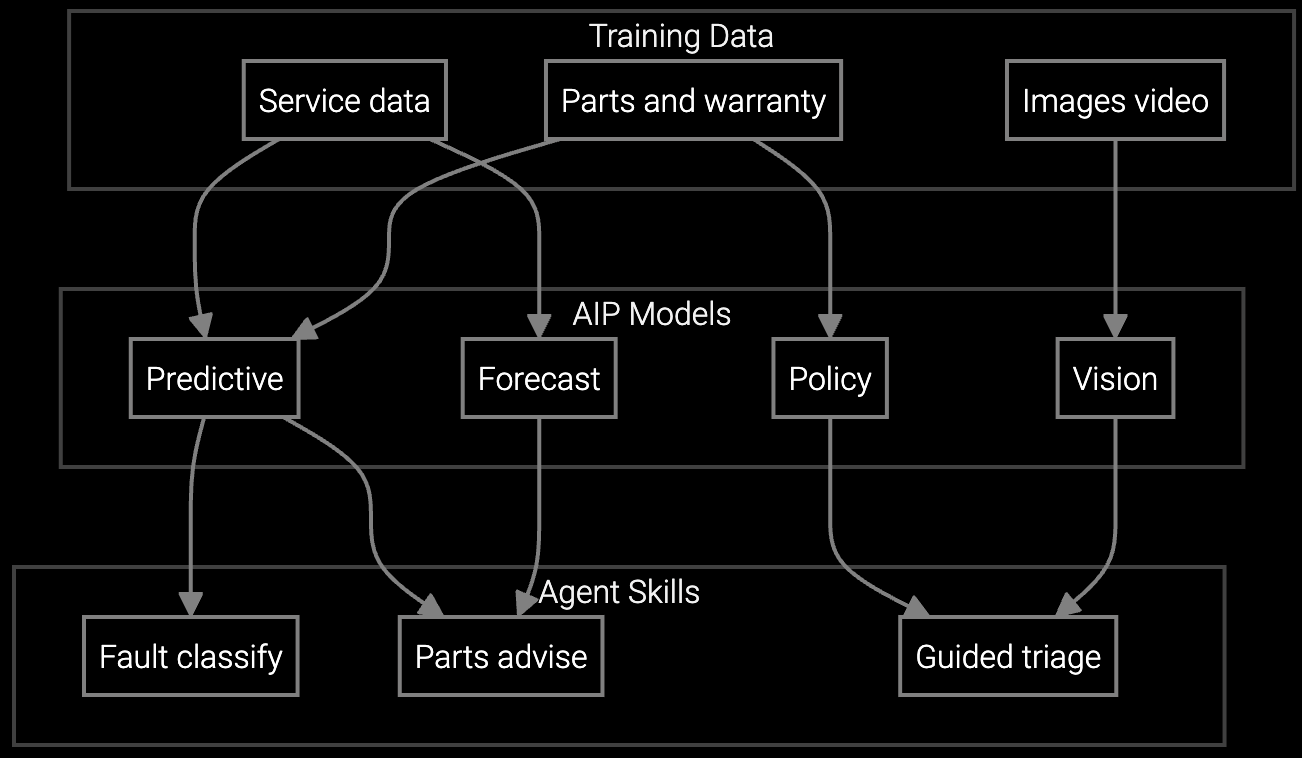

The platform connects technician actions to financial outcomes by instrumenting the work order lifecycle. Pre-dispatch parts prediction reduces missing component delays. On-site diagnostic copilots surface failure patterns from equipment telemetry and historical repairs. Automated job documentation captures resolution paths for future reference without manual paperwork.

Real-time dashboards track first-time fix rate, technician utilization, and cost per resolution against baseline. When a technician arrives with the right part and resolves a router failure in 90 minutes instead of scheduling a return visit, the system attributes the avoided $310 truck roll and 4-hour downtime reduction to specific AI assists. Operators see which diagnostic recommendations shortened MTTR and which parts predictions prevented repeat visits.

Analyzes router error logs and failure history to predict required line cards, power supplies, and optics before dispatch, reducing missing parts delays for network equipment repairs.

Correlates network device symptoms with historical failure patterns and firmware vulnerabilities to identify root cause faster, shortening MTTR for carrier-grade infrastructure.

Mobile copilot provides real-time guidance on network equipment diagnostics, configuration rollback procedures, and firmware recovery steps at customer NOC locations.

Network OEMs face unique field service economics driven by customer uptime requirements. A failed core router serving enterprise data centers costs the customer $8,000-12,000 per hour in downtime. Service contracts promise 4-hour MTTR with financial penalties for delays. When technicians arrive without the failed line card or power supply, the resulting repeat visit doubles OEM labor cost while exposing the customer to extended outage risk.

Carrier-grade equipment deployed in remote cell tower sites or headend facilities adds travel time and parts logistics complexity. A technician dispatched 90 miles to a microwave backhaul site discovers the failed unit requires a different optical module than predicted. The return trip consumes another day and $450 in labor and travel costs. Measuring first-time fix rate and truck roll cost per resolution quantifies where AI-assisted diagnostics and parts prediction deliver ROI.

Track current first-time fix rate, average truck roll cost including travel and labor, mean time to repair by equipment type, and total dispatches per month. Segment by customer SLA tier to identify where MTTR delays trigger penalties. Baseline establishes the cost avoidance opportunity for AI-assisted diagnostics and parts prediction.

Network OEMs typically see measurable first-time fix rate gains within 60-90 days of deployment as technicians adopt on-site diagnostic copilots and parts predictions improve. The financial impact appears in quarterly service cost reports as repeat visit volume drops and SLA penalty exposure declines. Contract renewals reflect the improved service delivery economics within 6-12 months.

Focus on high-complexity network devices with multiple failure modes—core routers, optical transport systems, and carrier switches. These products generate rich telemetry, have diverse parts inventories, and command high service contract values. When a $180K DWDM system requires on-site repair, AI that prevents a second truck roll or shortens MTTR by 2 hours delivers immediate margin protection.

The platform tags each work order with AI assists used—parts prediction, diagnostic recommendation, knowledge retrieval. When a technician completes a repair on first visit, the system attributes the avoided repeat dispatch cost to the pre-dispatch parts prediction. When MTTR drops from 6 hours to 3.5 hours, the dashboard links the time savings to specific on-site diagnostic steps surfaced by the copilot.

Present first-time fix rate improvement as a percentage and dollar value of avoided repeat visits. Show MTTR reduction in hours and corresponding SLA penalty avoidance. Calculate total truck roll cost savings from remote resolutions enabled by better diagnostics. For network equipment OEMs, reducing repeat visits from 28% to 12% and cutting MTTR by 35% typically yields $1.8-2.4M annual savings per 100 technicians.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

See how network OEMs measure first-time fix improvements and truck roll avoidance with Bruviti.

Schedule Demo