Incomplete asset data costs network OEMs millions in lost renewals and preventable failures every year.

Network equipment OEMs achieve 18-22% improvement in contract renewal rates and reduce service costs by 15-20% through complete asset visibility. AI-powered installed base management eliminates configuration drift, identifies upsell opportunities before end-of-life, and prevents revenue leakage from unattached service contracts.

Missing serial numbers and configuration data prevent proactive service. You can't predict failures or target upgrades when you don't know what's deployed where. Revenue opportunities vanish.

Actual device states diverge from records as firmware updates, patches, and changes accumulate. Troubleshooting slows when engineers can't trust configuration databases. Security vulnerabilities remain unpatched.

Service contracts expire without renewal when visibility is poor. EOL/EOS transitions happen without proactive outreach. High-margin recurring revenue evaporates while competitors step in.

AI-powered installed base management creates a single source of truth for all deployed network equipment. The platform automatically reconciles data from multiple systems—registration databases, telemetry streams, support tickets, and contract systems—eliminating manual reconciliation work that consumes engineering hours.

Bruviti continuously monitors configuration state against records, flagging drift before it causes incidents. When routers or switches report anomalies through SNMP traps or syslog, the system cross-references asset history to identify patterns. This enables proactive outreach before SLA-triggering failures occur. The platform also tracks firmware versions and EOL/EOS timelines, automatically surfacing upgrade and renewal opportunities when devices approach end-of-support.

Analyze SNMP trap streams and router telemetry to detect anomalies before they escalate into customer-impacting network outages.

Estimate when switches and routers will fail based on usage patterns, enabling planned maintenance windows instead of emergency responses.

Schedule firmware updates and hardware refreshes based on actual device condition rather than fixed intervals, reducing unnecessary site visits.

Network equipment operates in 24/7 uptime environments where every minute of downtime costs enterprises thousands of dollars. Unlike consumer equipment, these devices accumulate configuration changes continuously—firmware patches for CVEs, VLAN reconfigurations, routing table updates—making configuration drift inevitable without automated tracking.

The distributed nature of network deployments compounds the problem. Routers and switches live in remote NOCs, edge locations, and carrier facilities where physical access is expensive. When asset records are incomplete or outdated, troubleshooting requires costly truck rolls. Complete installed base visibility transforms reactive break-fix into proactive lifecycle management, directly impacting your service margin and contract renewal rates.

Focus on contract attachment rate (percentage of deployed assets under active service contracts), configuration compliance rate (assets matching recorded state), and renewal conversion rate (contracts renewed vs. expired). Also track asset data completeness (percentage with serial numbers and firmware versions) and time-to-resolution for configuration-related incidents. These directly correlate with service margin and recurring revenue.

Initial gains appear within 90 days as proactive EOL/EOS alerts drive renewal conversations that would otherwise lapse. Service cost reduction from anomaly detection becomes visible in 4-6 months as you prevent enough failures to move the MTTR needle. Full ROI crystallizes at 12-18 months when contract renewal cycles complete and you can measure year-over-year retention lift.

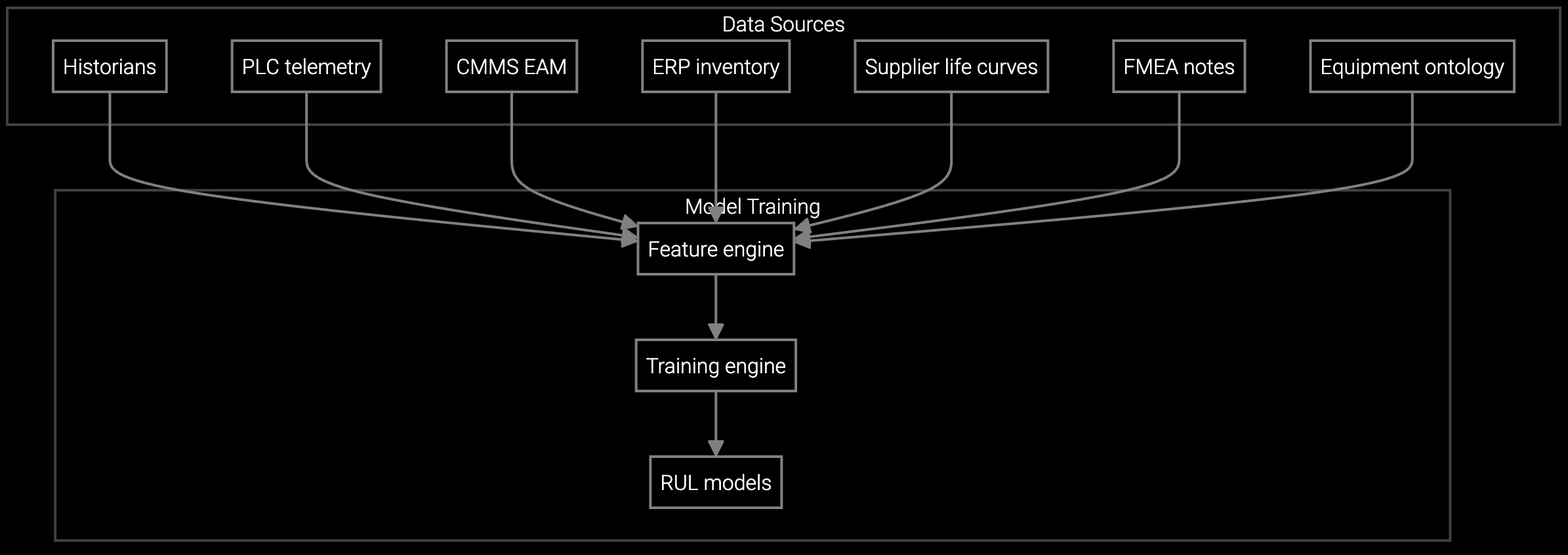

Start with product registration databases and contract management systems for baseline asset records. Add SNMP trap feeds and syslog streams for real-time device status and configuration changes. Integrate support ticket systems to correlate incidents with specific hardware. If you have NOC monitoring tools, those provide telemetry on uptime and performance. The platform reconciles these disparate sources automatically.

The platform continuously compares device-reported configurations (via SNMP, CLI scraping, or API polling) against records in your asset database. When discrepancies appear—firmware versions, interface states, routing tables—the system flags them for review. It learns normal change patterns over time, reducing false positives while catching meaningful drift that could impact troubleshooting or security compliance.

Network equipment OEMs report 18-22% improvement in renewal rates when they reach out proactively before contracts expire, compared to reactive renewal processes. The lift is highest for enterprise accounts with distributed deployments where visibility was previously poor. Timing matters—alerts 90-120 days before EOL give customers time to budget for upgrades or renewals rather than scrambling at expiration.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how complete asset visibility drives contract renewal rates and service margin for network equipment OEMs.

Schedule ROI Analysis