Incomplete asset data costs industrial OEMs millions in missed renewals, unplanned downtime, and reactive service delivery.

Industrial equipment OEMs achieve 15-25% margin improvement through AI-powered asset tracking. Automated configuration management eliminates manual audits, improves contract attachment rates 40-60%, and enables predictive maintenance programs that reduce unplanned downtime costs by $200K-$800K annually.

Without accurate asset records, industrial OEMs lose visibility into contract expiration dates and upgrade candidates. Service contracts lapse because sales teams don't know which pumps, compressors, or CNC machines are approaching end-of-warranty or end-of-life status.

Configuration drift—where actual equipment state differs from recorded state—forces service teams into reactive mode. They can't predict failures or schedule maintenance windows because they lack accurate firmware versions, run hours, and sensor baseline data for turbines, automation systems, and material handling equipment.

Legacy industrial equipment often lacks automated telemetry. Service teams spend weeks conducting manual site audits to reconcile asset records for decades-old machinery. This labor-intensive process diverts engineering resources from higher-value work and delays proactive service initiatives.

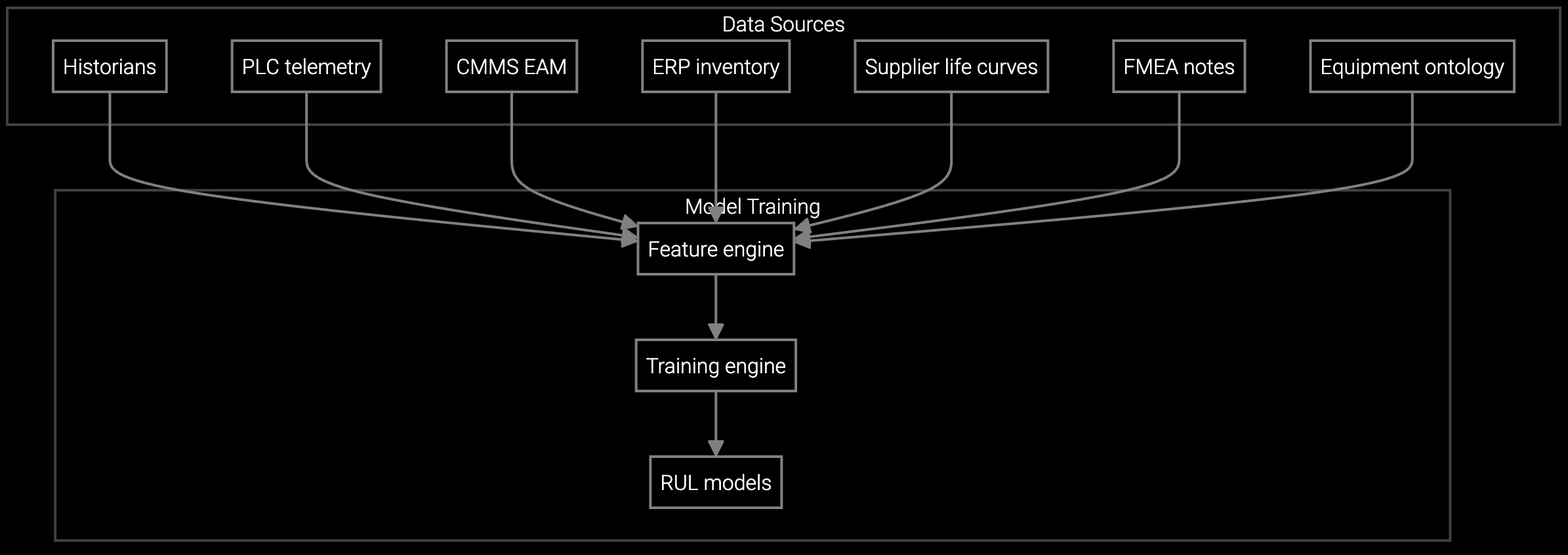

Bruviti's platform ingests PLC, SCADA, and IoT sensor data to build a continuously updated asset registry for industrial equipment. The system detects configuration drift automatically—comparing recorded firmware versions, component replacements, and operating parameters against actual field state—and flags discrepancies before they trigger service failures.

This eliminates the manual audit cycle that consumes thousands of engineering hours quarterly. The platform correlates asset data with contract entitlements and predictive failure models, enabling proactive outreach 60-90 days before warranty expiration or predicted component failure. For equipment with 10-30 year lifecycles, this visibility transforms service from a cost center into a margin-protective revenue stream.

Virtual models of pumps, compressors, and turbines track real-time performance against baseline parameters, enabling proactive maintenance scheduling before failures disrupt production lines.

Estimates when critical components will fail based on usage patterns, vibration data, and thermal profiles—enabling planned maintenance windows that minimize production downtime for industrial customers.

Schedules maintenance based on actual equipment condition rather than fixed intervals, reducing unnecessary service visits while catching issues before they escalate into costly failures.

Industrial equipment OEMs face unique asset tracking challenges driven by 10-30 year product lifecycles. A CNC machine installed in 1998 may still be operating but lack modern telemetry capabilities. Manual site audits reconcile asset records for legacy pumps, compressors, and automation systems—but this process is too slow and labor-intensive to enable proactive service strategies.

Configuration drift accelerates as equipment ages. Customers replace components without notifying the OEM. Firmware updates happen inconsistently across geographically distributed installations. The result: service teams operate with outdated asset data, forcing reactive troubleshooting instead of predictive interventions that protect customer uptime and OEM margins.

Industrial OEMs achieve savings in three areas: eliminating 70-85% of manual audit labor (1,500-3,000 engineering hours quarterly), improving contract attachment rates by 40-60% to drive $2-5M in recurring revenue, and reducing unplanned downtime costs by $200K-$800K annually through predictive maintenance programs enabled by accurate asset baselines.

Most industrial OEMs demonstrate measurable impact within 12 months by tracking contract attachment rate improvements and unplanned downtime reduction. Start with your highest-revenue equipment lines where downtime carries $50K-$200K penalties—this creates visible margin impact quickly and builds confidence for broader rollout across the product portfolio.

The platform accommodates hybrid tracking models. For equipment with PLC or SCADA connectivity, asset data updates automatically. For decades-old machinery lacking sensors, the system supports manual data entry workflows and scheduled audit reminders—still reducing audit cycles from quarterly to semi-annual or annual while maintaining accurate records for contract renewal programs.

Configuration drift—where actual equipment state differs from recorded state—forces reactive service delivery that costs 3-5x more than proactive maintenance. When firmware versions, component replacements, and operating parameters aren't tracked accurately, service teams can't predict failures or schedule maintenance windows. This drives unplanned downtime costs of $300K-$1.2M annually for mid-market industrial OEMs.

Focus on three executive-level metrics: contract attachment rate (target 40-60% improvement within 18 months), mean time between failures for tracked vs. untracked equipment cohorts (should show 15-25% improvement), and engineering hours spent on manual audits (target 70-85% reduction). These metrics directly link asset tracking accuracy to margin protection and revenue growth.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Discuss your installed base challenges with our team and model the margin impact of automated asset tracking for your equipment portfolio.

Schedule ROI Assessment