Incomplete asset data costs appliance OEMs millions annually in warranty overruns, missed renewals, and compliance failures.

Complete asset visibility reduces warranty exposure by 12-18% through better configuration management, increases contract renewals by 25% through proactive lifecycle tracking, and cuts compliance costs by 30% through automated EOL/EOS monitoring.

Without accurate configuration records, appliance manufacturers overestimate warranty risk. Incomplete asset data forces conservative reserve calculations that lock up working capital unnecessarily.

Service contract renewals depend on proactive outreach before expiration. Missing serial numbers and configuration drift make it impossible to identify renewal opportunities or upsell candidates systematically.

End-of-life refrigerants and legacy HVAC components create regulatory risk. Without complete asset tracking, manufacturers can't proactively notify customers of compliance deadlines or EOL parts availability.

Bruviti's platform unifies fragmented asset data from product registrations, connected device telemetry, and service history into a single source of truth. The AI continuously reconciles configuration drift by comparing actual deployed states against system records, flagging discrepancies that create warranty risk or compliance gaps.

For executives focused on margin protection, the platform directly impacts three P&L line items: warranty exposure drop through better failure prediction based on complete configuration data; service contract revenue increases through automated renewal identification and upsell targeting; and compliance costs fall through proactive EOL/EOS tracking that prevents penalties and emergency parts procurement.

Estimate when HVAC compressors or refrigeration components will fail based on usage patterns and environmental conditions, enabling planned maintenance windows that minimize customer disruption and maximize contract renewal opportunities.

Schedule maintenance for connected appliances based on actual component condition rather than fixed intervals, reducing unnecessary service visits while catching failures before they trigger warranty claims or SLA penalties.

Analyze IoT telemetry from connected appliances to identify anomalies indicating impending failures, enabling proactive parts ordering and customer outreach that transforms service from reactive cost center to revenue opportunity.

Appliance manufacturers face unique asset tracking complexity: decades-long product lifecycles, millions of deployed units across consumer and commercial segments, and warranty costs that directly impact thin margins. Connected refrigerators generate real-time health data, but legacy HVAC systems installed 15 years ago exist only in incomplete service records.

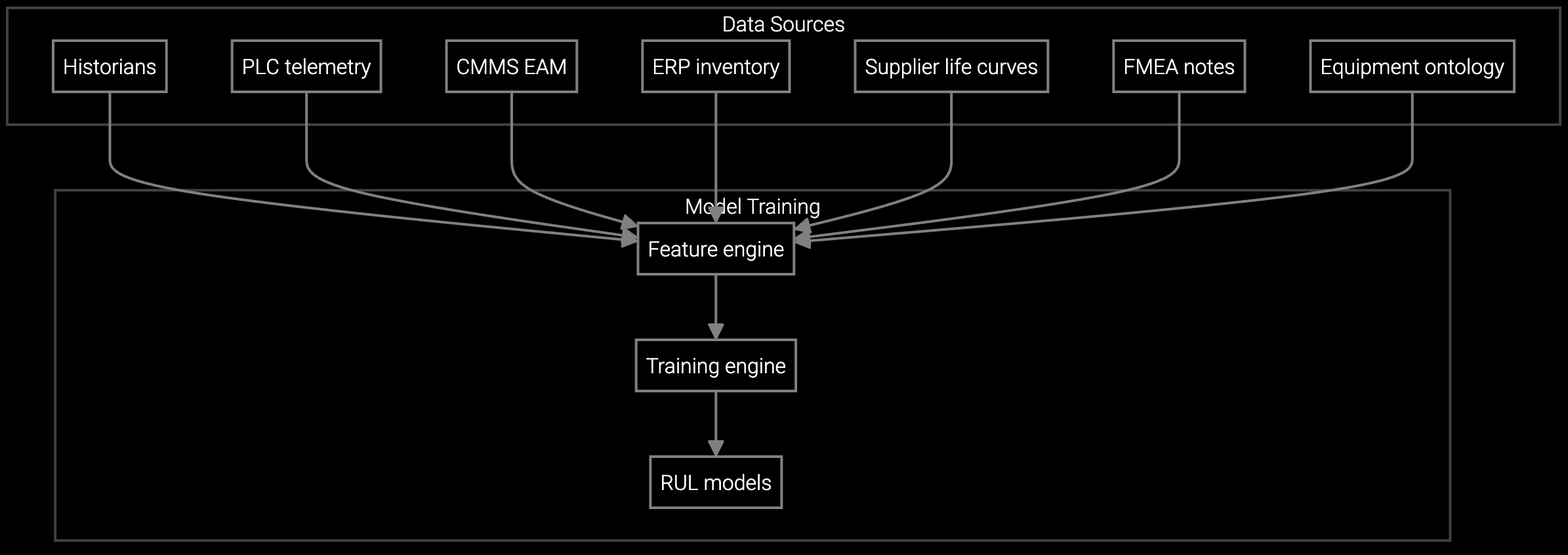

The platform reconciles this fragmented reality by ingesting product registration data, connected device telemetry from IoT-enabled appliances, and service history from legacy systems into a unified asset registry. For HVAC systems nearing end-of-life with refrigerant compliance deadlines, the AI flags units requiring proactive customer notification. For connected refrigerators showing compressor wear patterns, it predicts remaining useful life and triggers preemptive service contract outreach before warranty expiration.

Warranty reserve reduction begins within 6-12 months as configuration accuracy improves. Finance teams can adjust actuarial models quarterly based on demonstrated failure prediction improvements, with full 12-18% reserve reduction typically achieved within 18 months of deployment.

Mid-size appliance OEMs see payback within 14-18 months from combined warranty reserve reduction, contract renewal lift, and compliance cost savings. The largest ROI driver varies by business mix: HVAC-heavy portfolios see faster compliance savings; connected appliance leaders achieve quicker contract renewal gains.

Track contract attachment rate improvement by comparing pre-platform baseline renewal rates against post-deployment performance, segmented by product line and contract type. Most manufacturers see 20-30% lift within 12 months as proactive outreach replaces reactive renewal processes.

Yes. The platform uses AI to infer missing configurations from partial service records, connected device data, and product registration patterns. This automated backfill approach costs 60-70% less than manual data cleansing while achieving 85%+ accuracy for warranty risk modeling and renewal targeting.

ROI scales proportionally with installed base size and warranty cost as percentage of revenue. Enterprise manufacturers with 5M+ deployed units see absolute dollar savings 10-15x larger than mid-market OEMs, while percentage improvements remain consistent across segments at 12-18% warranty reserve reduction and 25% contract renewal lift.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Get a custom financial analysis showing warranty reserve reduction, contract revenue lift, and compliance cost savings for your installed base.

Request ROI Analysis