Five-nines uptime demands make every truck roll costly—yet most OEMs lack visibility into where service dollars disappear.

Network equipment OEMs reduce field service costs by 35-45% through AI-driven parts prediction, dispatch optimization, and first-time fix improvements. Key ROI drivers: eliminating repeat truck rolls ($800-1200 each), reducing technician idle time, and capturing retiring expert knowledge.

Technicians arrive at NOCs and data centers without correct firmware versions or replacement line cards. Second visits erode margin and trigger SLA penalties when network downtime extends.

Senior network engineers who diagnosed DWDM failures and routing protocol issues are retiring. Junior technicians lack the pattern recognition that prevents escalations and reduces MTTR.

Work orders route to wrong technician skill sets. Carrier-grade specialists dispatched to enterprise PoE issues. Firmware experts sent to hardware failures. Utilization drops when skills mismatch.

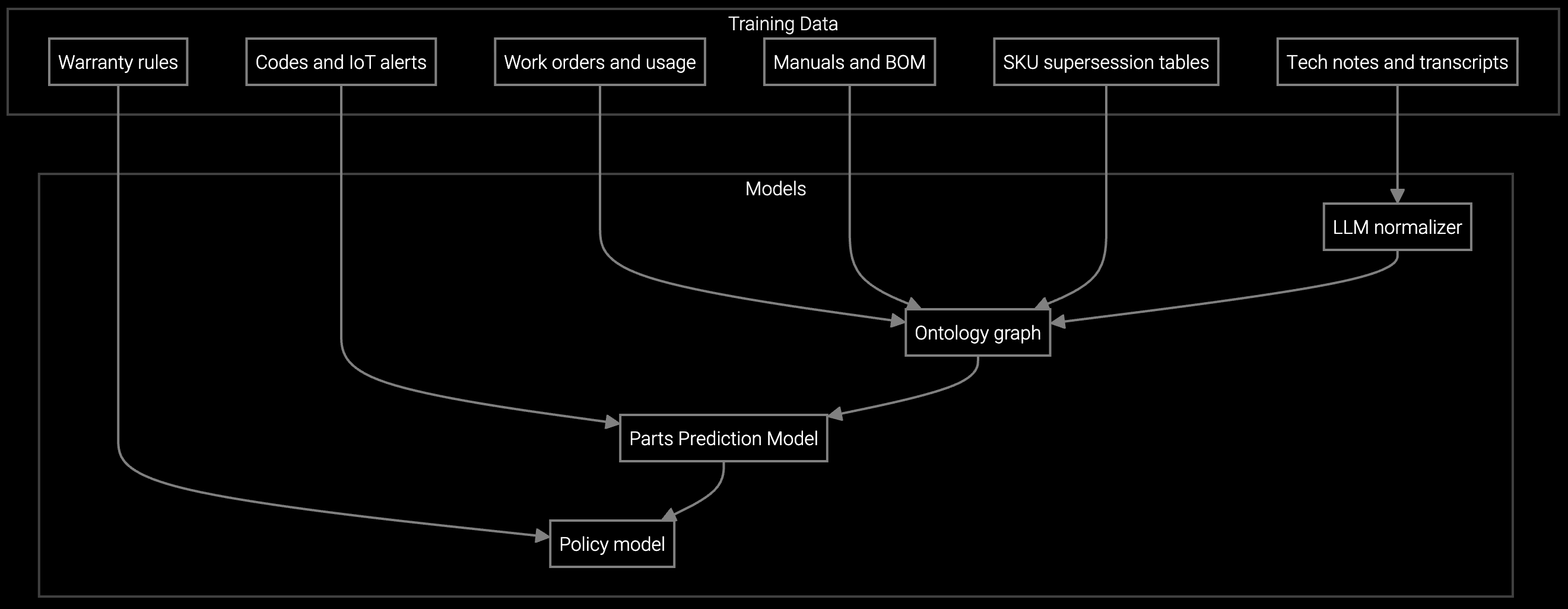

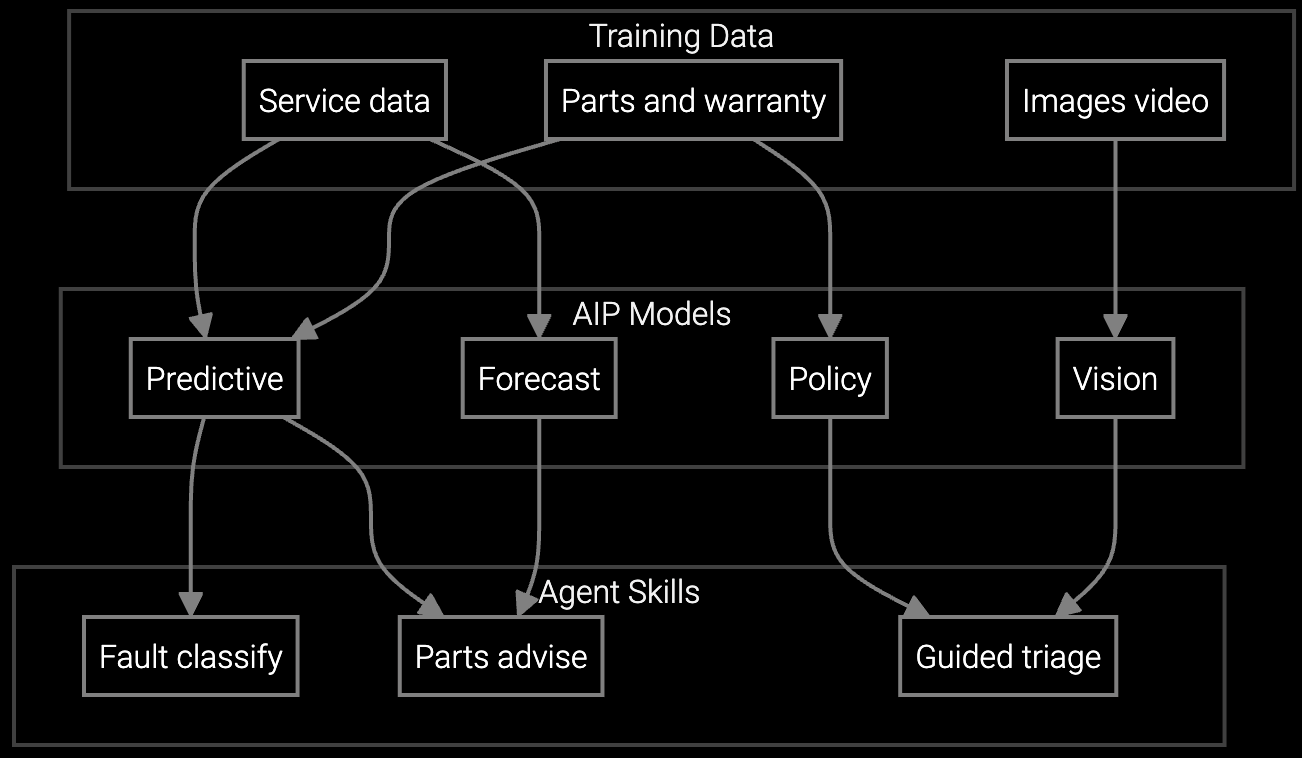

The platform analyzes syslog patterns, SNMP trap sequences, and historical failure data to predict which router modules or firewall components will fail before they trigger customer-impacting events. For network OEMs serving enterprise and carrier customers, this shifts economics from reactive truck rolls to predictive parts staging.

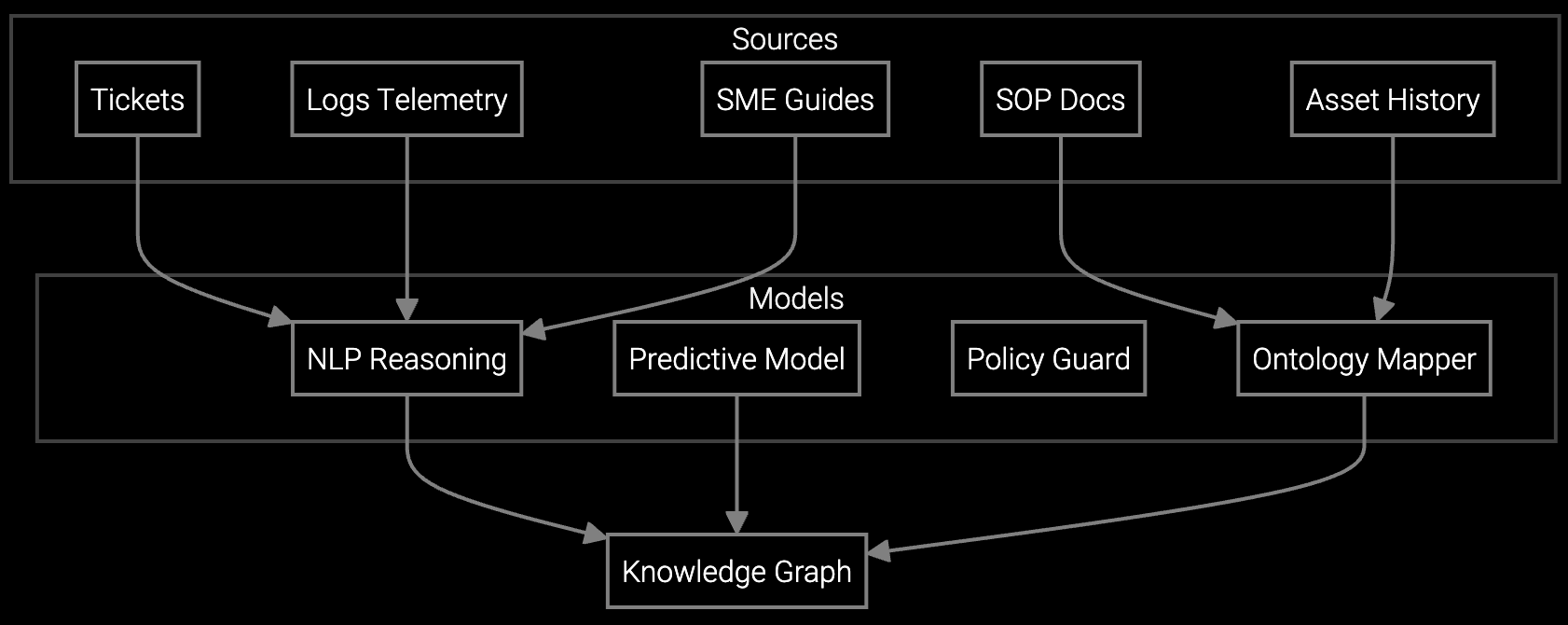

Bruviti captures diagnostic logic from retiring engineers—the pattern recognition that identifies BGP flapping root causes or DWDM optical degradation signatures. The AI absorbs this tribal knowledge and delivers it to junior technicians on-site via mobile devices, collapsing MTTR while protecting first-time fix rates as workforce demographics shift.

Pre-stage correct line cards, optics, and power supplies before dispatching to carrier NOCs or enterprise data centers—reducing second trips for missing components.

Correlate network telemetry with historical patterns captured from senior engineers—identifying firmware conflicts or configuration drift that junior technicians would escalate.

Mobile copilot provides real-time guidance on DWDM troubleshooting procedures, BGP reconfiguration steps, and optical power readings—on-site at remote cell towers or data centers.

Network equipment operates under 99.999% uptime SLAs where every minute of downtime triggers penalties. Traditional field service models dispatch technicians reactively after failures impact customer networks. AI shifts this to predictive intervention—analyzing error log patterns from routers and switches to identify degrading optical transceivers or failing power supplies before they cause outages.

For carrier-grade equipment deployed in remote cell towers or central offices, truck roll costs compound with travel time. Parts prediction ensures technicians carry the correct replacement modules on first dispatch, collapsing MTTR from multi-day parts ordering cycles to same-visit resolution. This directly protects margin on service contracts where SLA compliance determines profitability.

Most network OEMs achieve payback within 8-14 months by tracking three metrics: eliminated repeat truck rolls, reduced warranty reserve accruals from predictive RMA avoidance, and improved technician utilization. The fastest ROI comes from high-volume enterprise product lines where truck roll frequency is highest.

Track the percentage of work orders closed on initial dispatch without follow-up visits within 30 days. Baseline this metric pre-deployment using your FSM system data, then measure quarterly. Network OEMs typically see 18-24 point improvements within six months as parts prediction and mobile decision support reach technicians.

The platform observes how expert technicians diagnose carrier-grade routing issues and DWDM failures by analyzing their device interaction patterns, configuration change sequences, and diagnostic command progressions. This captured logic becomes decision trees accessible to junior technicians on-site, preserving institutional knowledge that would otherwise disappear at retirement.

Syslog streams, SNMP trap sequences, and device telemetry provide the richest signals for failure prediction. Combine these with historical work order outcomes and parts consumption data from your FSM system. Network OEMs with 24+ months of telemetry history achieve the fastest model accuracy and earliest ROI realization.

Reframe the business case around margin protection on service contracts and competitive differentiation. Network customers increasingly expect predictive maintenance as table stakes for five-nines uptime commitments. OEMs who reduce MTTR through AI gain pricing power on renewals while competitors absorb SLA penalties from reactive service models.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

See how network equipment OEMs quantify margin improvement from predictive dispatch and first-time fix optimization.

Schedule ROI Analysis