Warranty costs for heavy equipment now exceed 3% of revenue as aging products return with complex failure modes executives struggle to predict.

AI-driven warranty management reduces No Fault Found returns by 35-50%, cuts claims processing time by 60%, and lowers warranty reserve accruals by 15-25% through automated entitlement verification, fraud detection, and root cause analysis of equipment failures.

Heavy machinery with 15-30 year lifecycles generates warranty claims years after sale. Finance teams struggle to forecast reserves as failure modes evolve with aging equipment and changing operating conditions.

Industrial equipment returns often arrive with no detectable defect. Manual inspection struggles to identify intermittent failures or operator error, forcing manufacturers to refurbish or replace units unnecessarily.

Entitlement verification for decades-old equipment requires manual lookup across fragmented systems. Claims wait days for approval as staff search legacy databases for serial numbers, install dates, and service history.

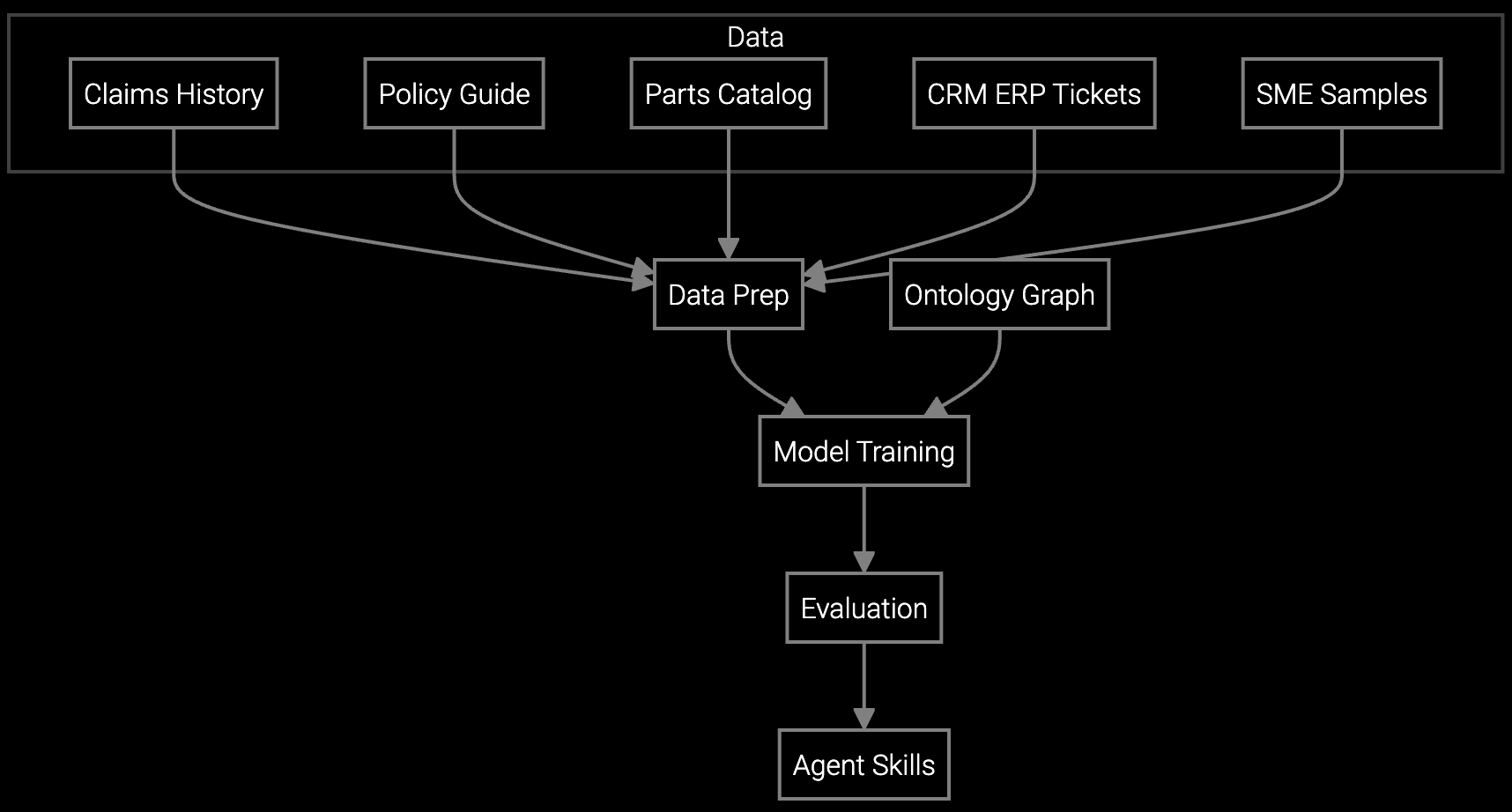

Bruviti's platform ingests machine telemetry, service records, and failure data across the installed base to predict warranty claims before they occur. The AI identifies patterns linking operating conditions to failure modes, enabling finance teams to model warranty reserves with 15-25% greater accuracy than actuarial methods alone.

Automated root cause analysis reduces No Fault Found returns by comparing returned equipment behavior to normal operating signatures. The system flags claims likely caused by misuse or environmental factors, preventing unnecessary refurbishment costs. Entitlement verification runs in seconds rather than days by unifying serial number lookups across legacy systems, eliminating the manual search bottleneck.

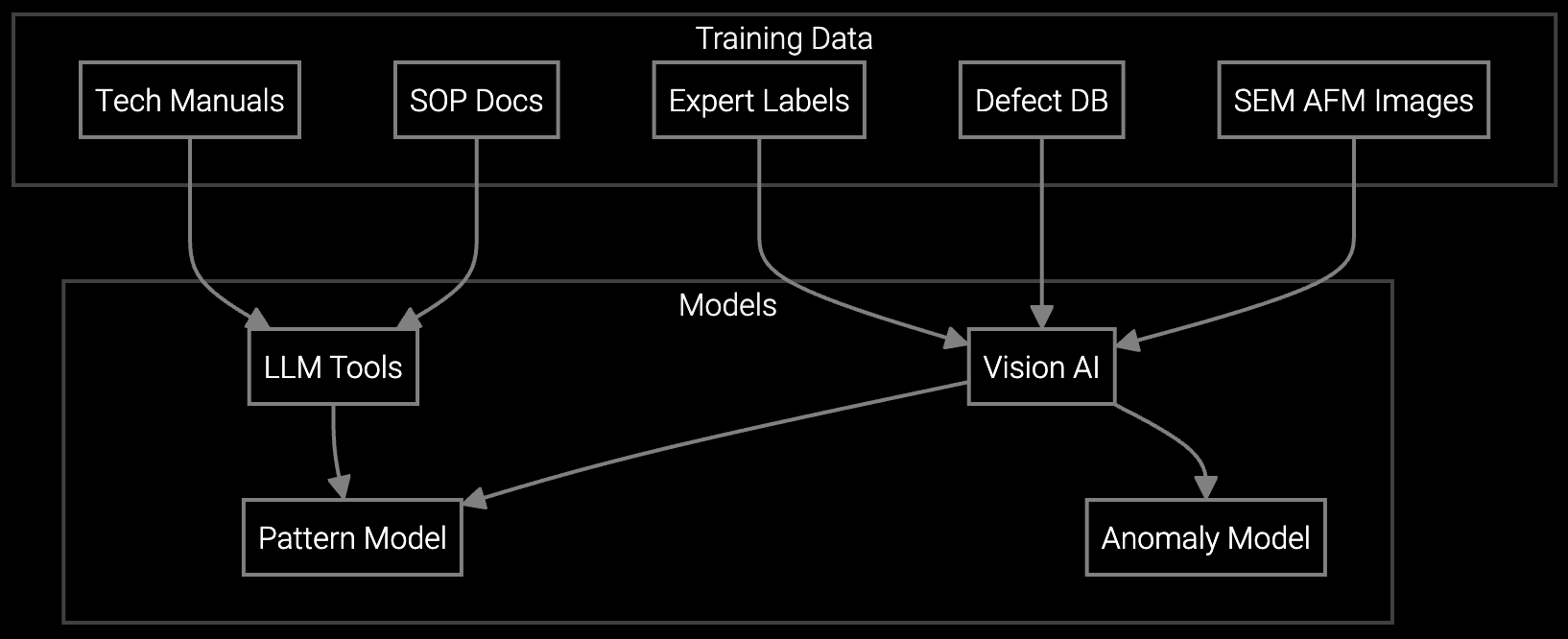

AI analyzes microscopic images of returned industrial components to identify manufacturing defects, material degradation, and wear patterns—validating warranty claims with objective evidence rather than manual inspection.

Automatically classifies warranty claims across machinery lines by failure mode, component type, and root cause—enabling executives to track warranty cost drivers and adjust product design or supplier contracts.

Industrial equipment OEMs carry warranty obligations spanning decades. A CNC machine sold in 2010 may file a claim in 2025 for a bearing failure linked to operating conditions the OEM never anticipated. Finance teams model reserves using historical averages, but these miss emerging failure modes as equipment ages beyond design life.

The largest cost driver is often invisible: No Fault Found returns. When a customer reports intermittent hydraulic pressure loss or erratic PLC behavior, the unit ships back to the depot. Manual inspection finds no defect. The OEM refurbishes or replaces the unit anyway to maintain customer relationships, absorbing $5K-$50K in unnecessary costs per return.

Track three metrics: NFF rate reduction (target 35-50% improvement), claims processing cycle time (target 60% reduction), and warranty reserve forecast accuracy (target 15-25% improvement). Each translates directly to working capital freed or administrative cost saved. For a manufacturer with $100M annual warranty spend, these improvements unlock $5-10M in measurable value within 18 months.

The platform ingests sensor telemetry from industrial equipment, service ticket history, parts replacement records, and warranty claim narratives. For machinery lacking connectivity, technician notes and failure code logs provide sufficient signal. The AI correlates operating hours, environmental conditions, and maintenance patterns to predict which units will file claims.

Initial NFF reduction appears within 90 days as the system flags questionable returns. Reserve forecast accuracy improves over 12-18 months as the AI observes seasonal failure patterns and equipment aging curves. Finance teams gain confidence to adjust accruals downward after two full quarterly cycles demonstrate consistent prediction accuracy.

Yes. The platform learns from service history even when equipment lacks modern sensors. For CNC machines or industrial pumps sold in the 1990s, technician notes and failure codes provide training data. The AI identifies patterns linking installation environment, maintenance intervals, and failure modes—enabling warranty cost prediction for equipment regardless of vintage.

Present a three-part business case: quantified NFF cost savings, working capital freed from reduced reserves, and competitive positioning as warranty costs erode peers' margins. For OEMs with $100M warranty spend, conservative estimates show $3-5M annual benefit against typical implementation costs of $500K-$1M, delivering 3-5x ROI within two years.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how AI-driven warranty management translates to margin protection in your product portfolio.

Schedule ROI Analysis