Warranty reserve erosion hits 4-7% of revenue when NFF returns and fraudulent claims go undetected at scale.

AI warranty systems reduce NFF returns by 35-45%, cut claims processing time by 60%, and improve fraud detection rates to 92%. Integration via API delivers ROI within 6-9 months for industrial OEMs.

NFF claims for CNC machines, pumps, and turbines consume refurbishment capacity and erode margins. Each unnecessary return costs the full reverse logistics cycle plus inspection labor with zero warranty recovery.

Legacy warranty databases require manual cross-checks against equipment serial numbers, install dates, and service history. Slow validation delays RMA approval and frustrates customers waiting on critical machinery repairs.

Warranty fraud patterns hide in high claim volumes—misreported failure modes, serial number manipulation, or out-of-scope damage claims. Without systematic detection, warranty reserves balloon unpredictably.

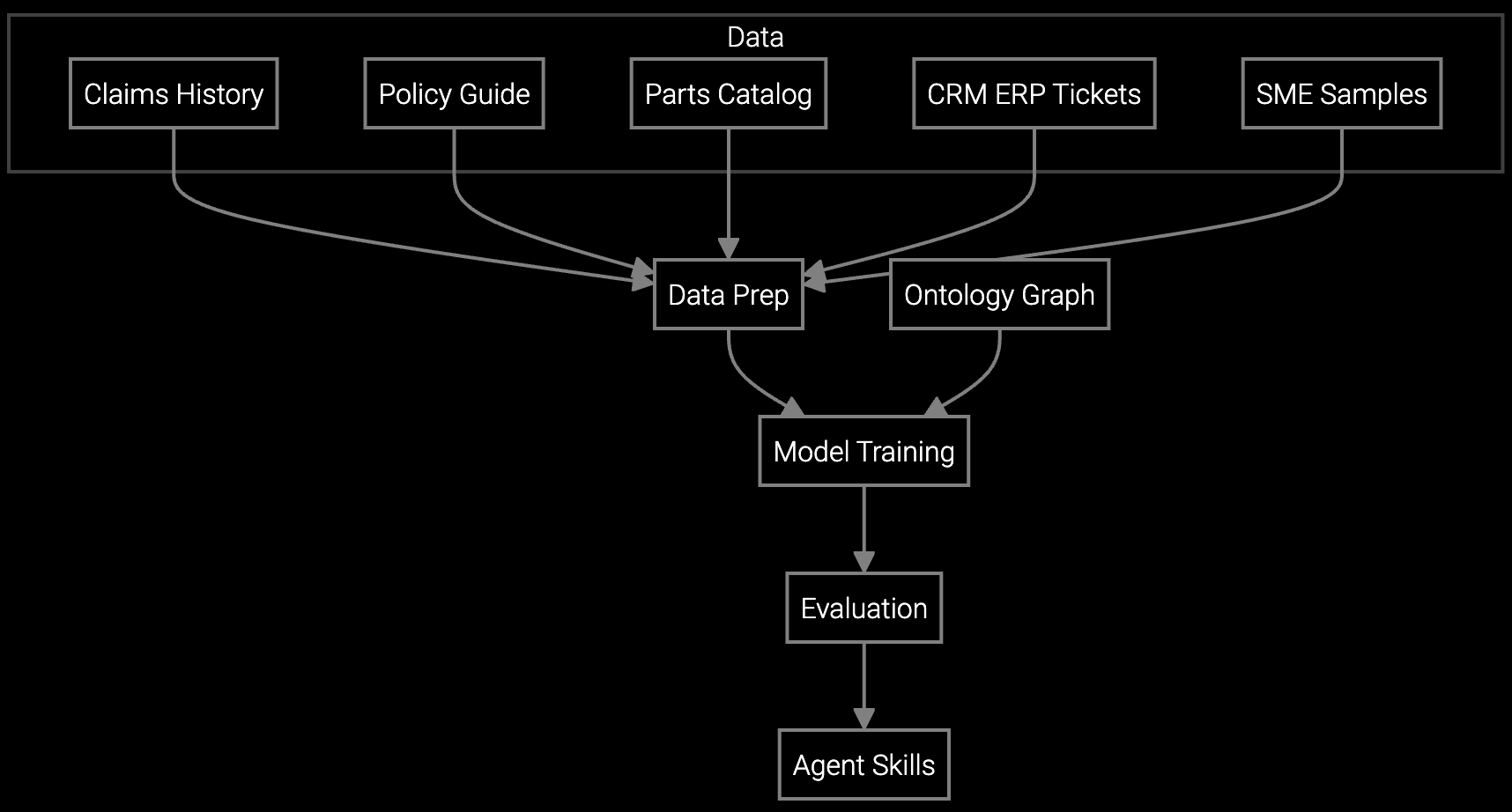

The ROI logic is straightforward: warranty costs concentrate in three areas—NFF processing waste, manual validation bottlenecks, and undetected fraud. AI models trained on historical claims data, sensor telemetry, and failure patterns eliminate these losses by automating entitlement checks, predicting false positives before return shipping, and flagging anomalies that indicate fraud.

For developers integrating warranty intelligence, the platform provides REST APIs for claims submission, Python SDKs for custom fraud detection rules, and webhook-based notifications for entitlement validation. You own the integration logic and retain full data sovereignty—the AI layer augments your existing warranty system without replacing it. Deployment typically happens in staging within 2-4 weeks, with production rollout completing in 6-8 weeks for phased launch across product lines.

Automatically classify and code warranty claims for industrial machinery, reducing manual review time and improving accuracy across thousands of monthly submissions.

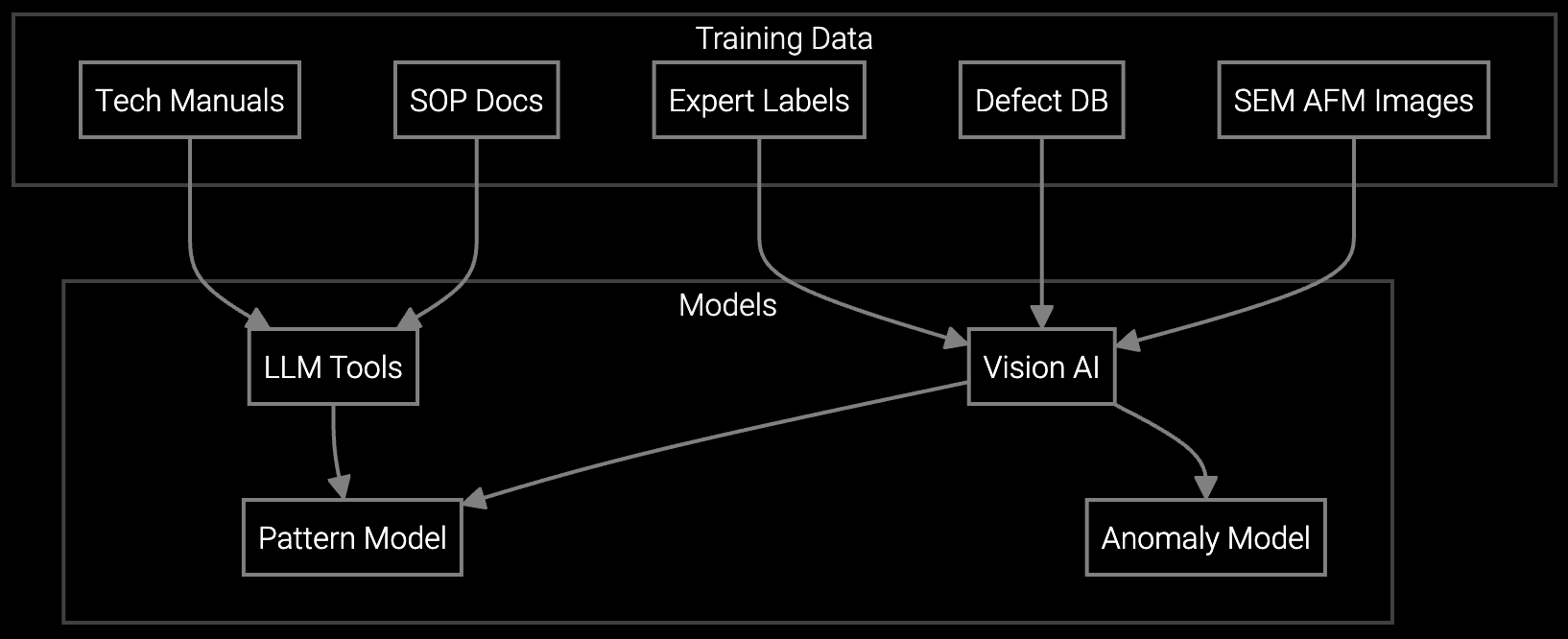

AI analyzes microscopic images from returned turbine blades and pump components to validate defect claims and eliminate guesswork in warranty adjudication.

Industrial machinery warranties span 10-30 year lifecycles, creating extended cost exposure for OEMs. A single turbine warranty might cover 20+ years of operation, accumulating claims from vibration sensor drift, bearing wear, and thermal cycling. Manual validation processes can't scale to this complexity without ballooning labor costs.

AI models trained on decades of CNC failure modes, pump cavitation patterns, and compressor seal degradation provide faster, more consistent entitlement decisions than rotating teams of warranty analysts. The platform ingests equipment serial data, maintenance logs, and condition monitoring telemetry to verify claim legitimacy before approving return shipping—eliminating the most expensive NFF category (unnecessary reverse logistics).

ROI accelerates when NFF reduction and fraud detection savings exceed implementation and API integration costs. For industrial OEMs processing 5,000+ annual returns, eliminating 35-45% of NFF waste saves $2M+ yearly while integration costs typically run $150K-$250K. Payback happens within 6-9 months as monthly savings compound.

NFF reduction directly lowers warranty reserve accruals by reducing total claim volume and eliminating high-cost false positives. Each prevented NFF return saves reverse logistics ($400-$800), refurbishment labor ($200-$500), and restocking costs ($150-$300). For OEMs with 2,000 annual NFF claims, a 40% reduction saves $1.5M-$3.2M annually.

Typical integration involves connecting REST APIs to your existing warranty database for claims submission, configuring webhooks for entitlement validation responses, and mapping product SKUs to AI model endpoints. Most teams complete staging deployment in 2-4 weeks using provided Python SDKs, then phase production rollout across product lines over 4-6 weeks.

The platform operates as a headless API layer—your warranty claims data stays in your database, and you control all data residency decisions. API calls send minimal context (claim attributes, telemetry snapshots) for AI inference, and responses return to your system for storage. No vendor lock-in on data architecture or retention policies.

Track three board-ready metrics: NFF rate reduction (target 30-40% drop), average claims processing time (target 50-60% improvement), and fraud detection rate (target 85-92% accuracy). These map directly to P&L impact—lower warranty reserves, reduced labor costs, and margin protection from fraud prevention.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how Bruviti's API-first warranty intelligence reduces NFF costs and improves fraud detection for your product lines.

Get ROI Analysis