Retiring technicians take decades of tribal knowledge with them, leaving manufacturers facing rising truck roll costs and falling first-time fix rates.

Industrial OEMs see 15-25% truck roll reduction, 12-18% first-time fix improvement, and $200-400 per visit savings through AI-assisted parts prediction and knowledge capture. Payback typically occurs within 8-14 months.

When technicians arrive without the right parts or diagnostic insight, industrial OEMs pay for multiple truck rolls to the same site. Each additional visit compounds labor, travel, and customer downtime costs.

Senior technicians retiring from the workforce take undocumented expertise about legacy equipment with them. Junior technicians lack access to that tribal knowledge, leading to longer repair times and diagnostic errors.

Extended MTTR from poor first-time fix rates triggers contractual penalties for missed uptime guarantees. Industrial equipment downtime cascades into production losses for customers, creating margin pressure on service contracts.

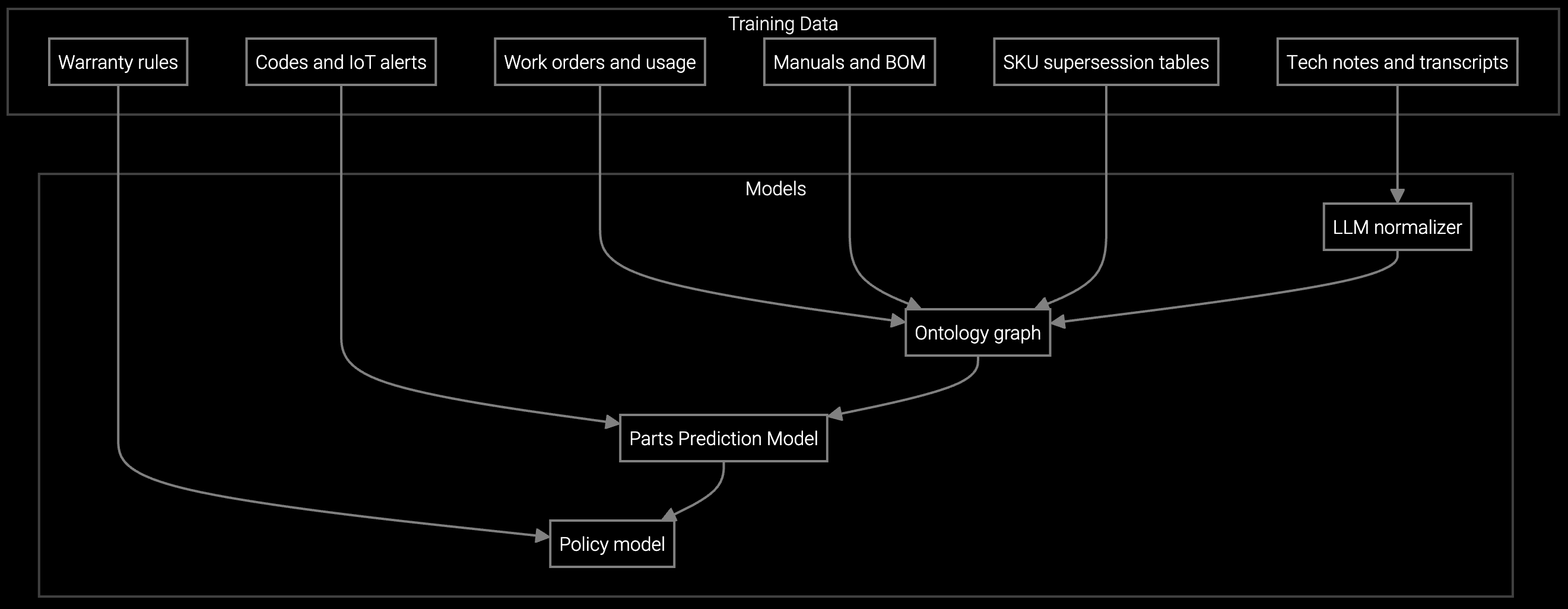

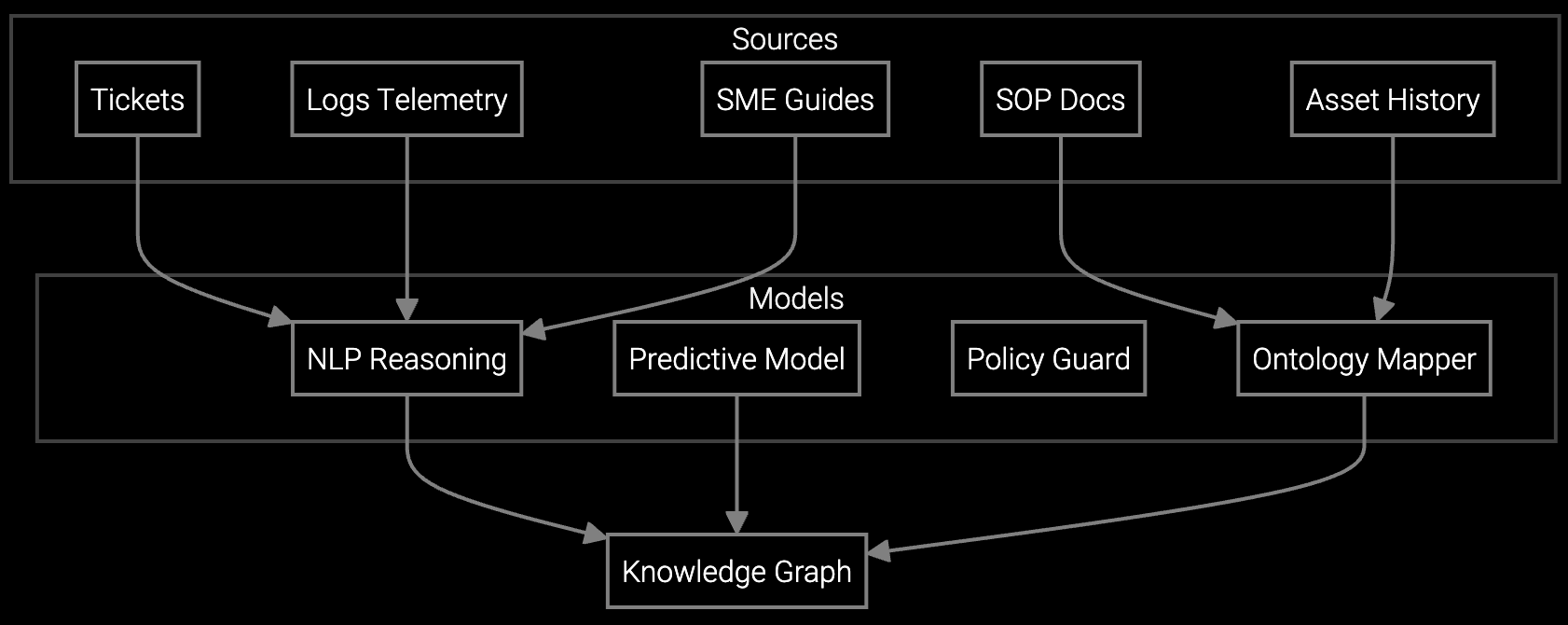

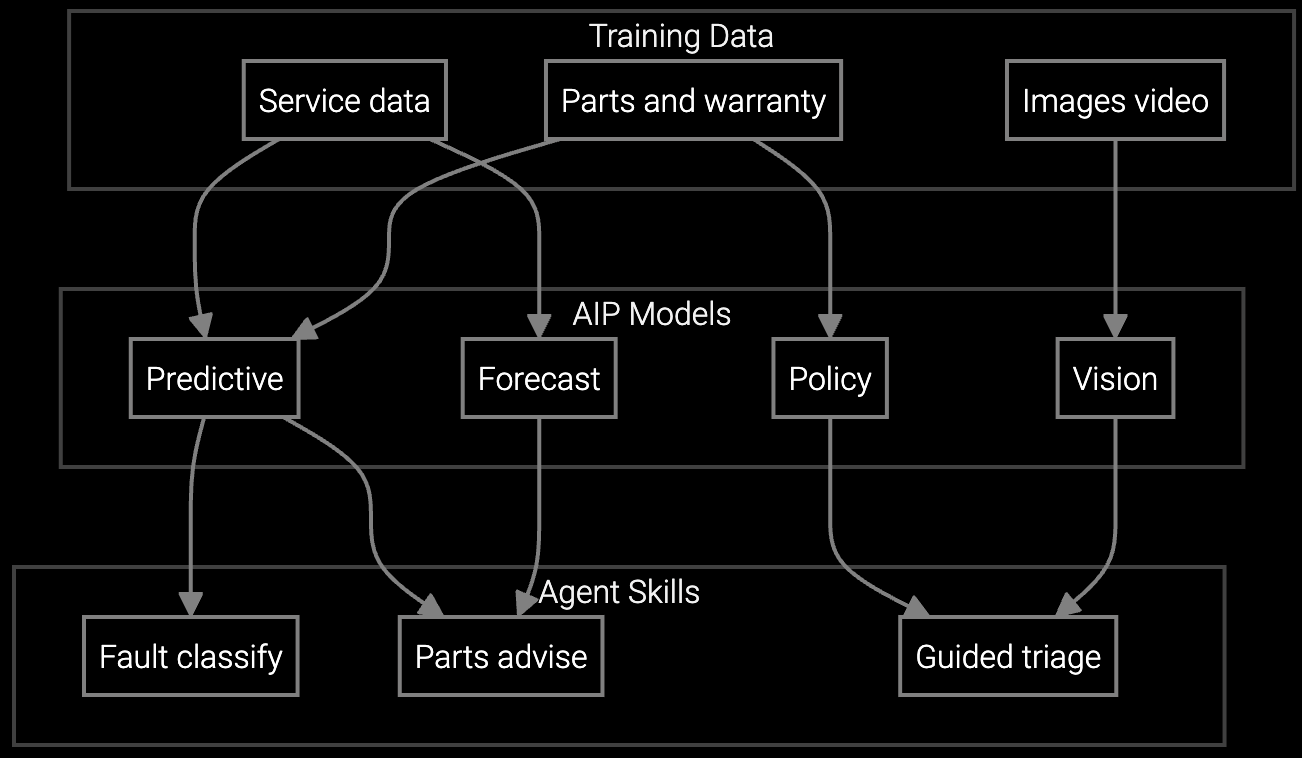

Bruviti's platform integrates with existing FSM systems via Python and TypeScript SDKs, ingesting equipment telemetry, work order history, and parts consumption data. Machine learning models predict which components are likely to fail based on sensor patterns, reducing unnecessary dispatches and pre-staging the right parts before technicians leave.

The knowledge capture engine extracts diagnostic logic from historical repairs and technician notes, converting tribal knowledge into reusable decision trees. Mobile APIs deliver on-site guidance to field teams, improving first-time fix rates without requiring technicians to memorize decades of equipment variations.

Predicts which replacement components technicians need for CNC machines, compressors, and automation systems before dispatch, cutting repeat visits by 20%.

Correlates vibration, temperature, and pressure anomalies with historical failure patterns from 20+ years of industrial equipment repairs.

Mobile SDK provides real-time diagnostic guidance and repair procedures for legacy machinery, reducing MTTR by 18% for junior technicians.

Industrial OEMs face truck roll costs of $600-1,500 per dispatch when serving geographically distributed equipment. Machinery with 20-30 year lifecycles generates long-tail service obligations where parts obsolescence and documentation gaps drive up MTTR. Senior technicians with decades of experience retiring create knowledge voids that increase training costs and reduce first-time fix rates.

Preventable repeat visits compound these costs. When technicians diagnose incorrectly or arrive without the needed component, the second truck roll costs nearly as much as the first while extending customer downtime. SLA penalties for missed uptime commitments can reach 2-5% of contract value, directly impacting service margin.

Bruviti provides REST APIs and Python/TypeScript SDKs that integrate with ServiceMax, SAP, Oracle, and custom FSM platforms. Most implementations connect via API in 4-6 weeks with minimal custom code. Data sovereignty remains with the OEM, avoiding vendor lock-in concerns common with SaaS-only platforms.

Track the percentage of work orders closed on the first technician visit before and after AI deployment. Industrial OEMs typically see baseline FTF rates of 65-75% improve to 78-88% within 6 months. The key metric is whether the issue was resolved without a return visit within 30 days.

Minimum viable training data is 500-1,000 work orders per equipment family spanning 2-3 years. For legacy machinery with sparse data, the platform uses transfer learning from similar equipment types and incorporates technician tribal knowledge via structured interviews to bootstrap model accuracy.

The platform provides versioned model APIs allowing developers to retrain on updated datasets without disrupting production FSM integrations. Industrial OEMs typically retrain quarterly for high-volume equipment and semi-annually for legacy systems. Python notebooks are included for custom model tuning.

Building in-house requires 12-18 months and $800K-1.5M for data engineering, model development, and mobile app integration. Bruviti reduces time to value to 3-4 months with lower upfront cost since foundation models and SDKs are pre-built. The trade-off is less customization depth for highly specialized equipment.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

Review cost models, integration architecture, and payback timeline with our technical team.

Schedule Technical Review