With warranty reserves consuming 3-5% of revenue and NFF rates at 35%, CFOs demand measurable returns before approving platform investments.

Semiconductor manufacturers typically reduce warranty reserves 18-24% and cut NFF rates from 35% to under 12% within 12 months. AI validates claims against fab telemetry and process data, eliminating fraudulent submissions while accelerating legitimate claims processing from days to hours.

Without predictive models, semiconductor OEMs over-reserve by 20-30% to cover unpredictable failure patterns. CFOs face quarterly pressure to justify these accruals while boards demand margin improvement.

Manual validation cannot cross-reference fab telemetry at scale. Claims processors lack process engineering context, approving returns that inspection later reveals as customer-induced damage or improper recipe execution.

Engineers manually review telemetry logs, chamber histories, and maintenance records for each claim. The 5-7 day validation cycle delays credit issuance, straining customer relationships and extending DSO.

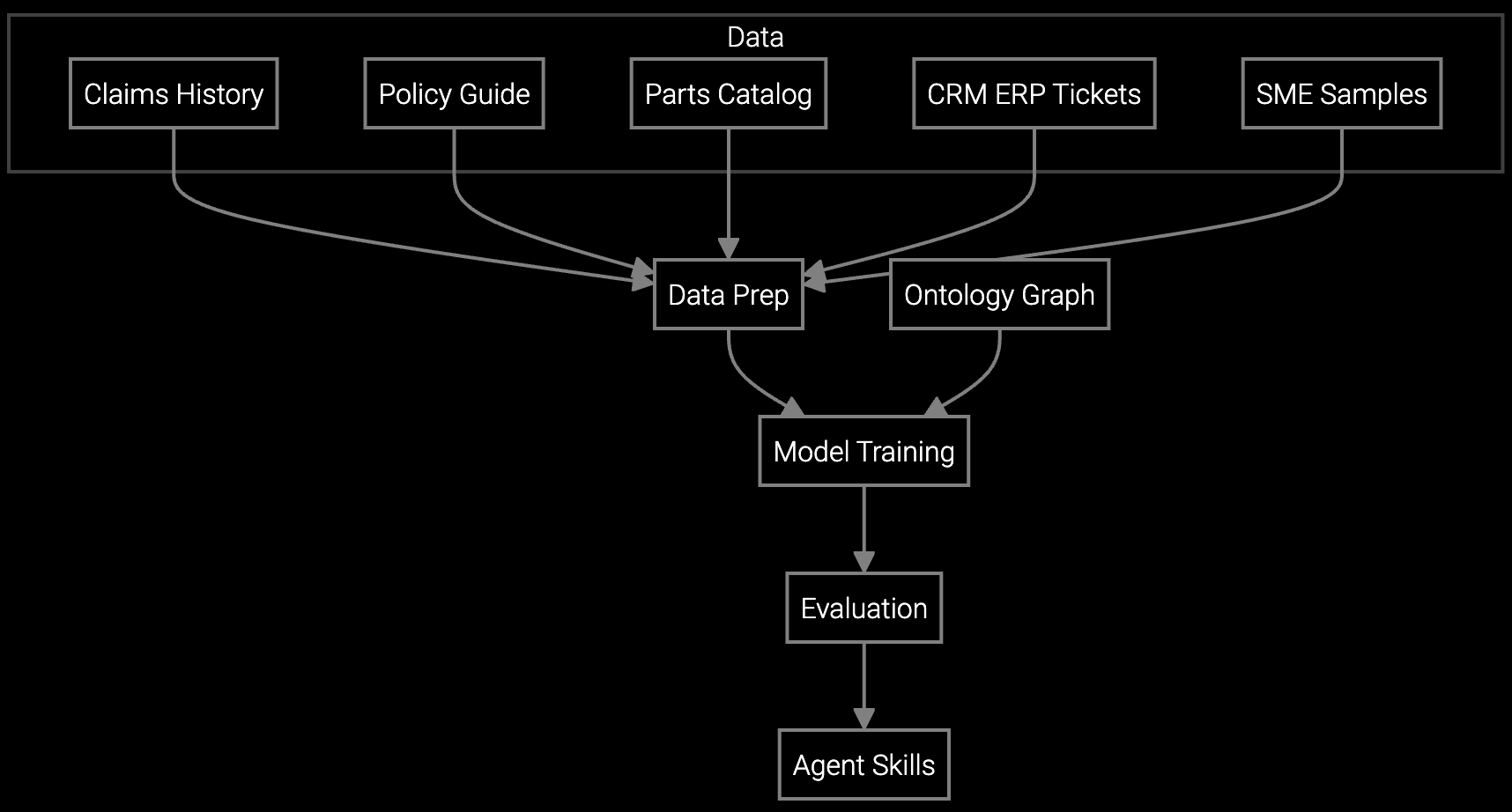

Bruviti's platform ingests fab sensor data, chamber logs, and process recipes to validate claims against actual equipment behavior. The AI cross-references customer-reported failures with telemetry patterns, identifying legitimate defects while flagging claims inconsistent with process parameters or maintenance history.

For semiconductor manufacturers, the measurable impact centers on three cost pools: warranty reserve accuracy improves as AI predicts failure rates by tool type and process node; NFF elimination recovers refurbishment labor and logistics spend; and automated validation reallocates process engineering time from paperwork to yield improvement initiatives. CFOs gain board-ready ROI calculations tied directly to operating margin expansion.

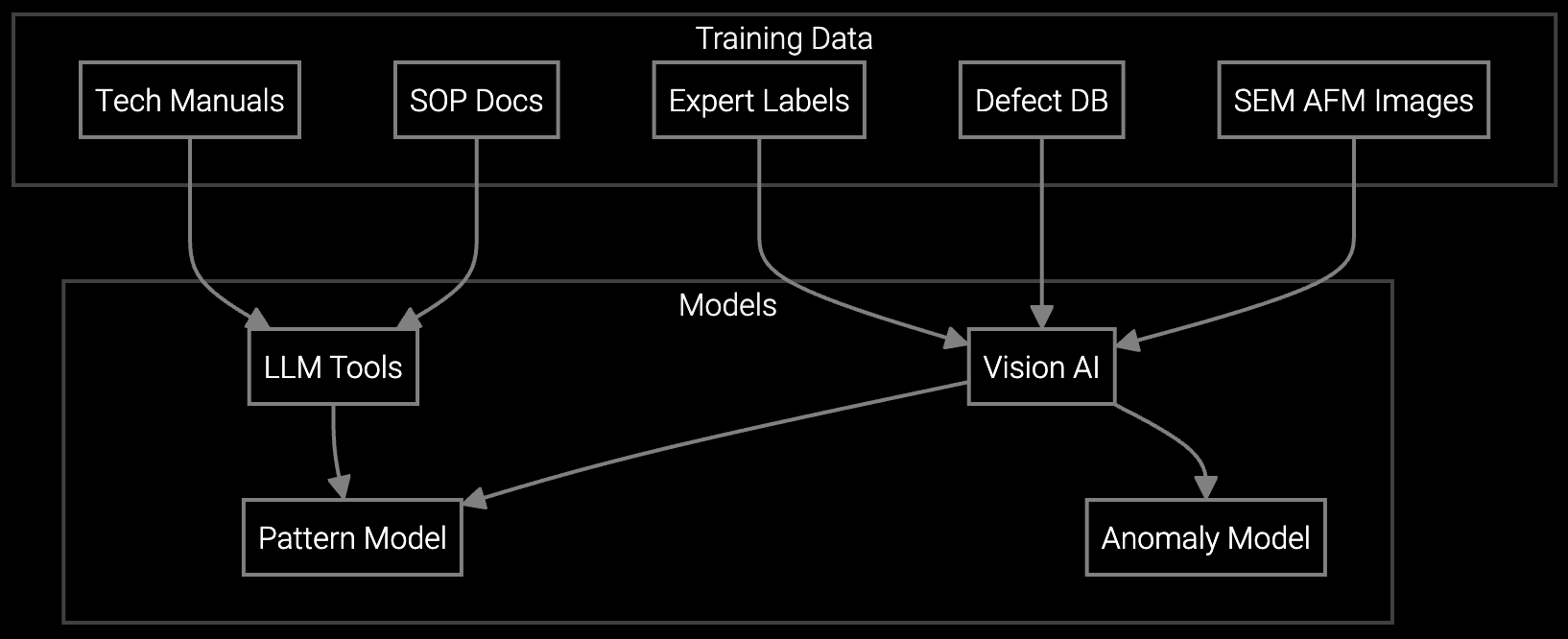

AI analyzes nanoscale microscopy images from failed wafers to classify defect modes, correlate with process recipes, and validate warranty claims against physical evidence.

Automated classification of warranty claims by failure mode, tool type, and process node enables accurate reserve forecasting and identifies systemic quality issues before they escalate.

Lithography tools cost $150M+ per unit with sub-5nm precision requirements. A single invalid warranty claim for EUV optics replacement costs $8-12M in unnecessary parts and refurbishment labor. AI validation against exposure telemetry and dose uniformity data prevents these million-dollar errors at scale.

Fab downtime costs $1M+ per hour, making accurate entitlement verification critical. The platform cross-references PM schedules, consumable replacement logs, and recipe drift patterns to distinguish manufacturing defects from customer-induced failures. This precision protects margin while preserving customer relationships through faster legitimate claim resolution.

Most manufacturers achieve breakeven within 6-8 months as NFF reduction and reserve accuracy improvements compound. The first quarter typically shows 8-12% NFF reduction, accelerating to 20-25% by month 12 as the AI learns tool-specific failure signatures across more process nodes.

Focus on warranty reserves as percentage of revenue, NFF rate by tool type, claims processing cycle time, and refurbishment labor hours per claim. Leading semiconductor manufacturers add DSO impact and process engineering time reallocation to quantify the full P&L effect.

Bruviti's platform ingests telemetry via standard FDC interfaces and can operate alongside legacy warranty systems without requiring full replacement. Most deployments start with read-only access to fab sensor data and PM logs, adding write-back capabilities for automated claim approvals once accuracy is validated.

The platform correlates claimed failure symptoms with pre-failure telemetry patterns, recipe parameter drift, and maintenance history. If chamber temperature deviation or improper cleaning cycles preceded the failure, the AI flags potential customer-induced issues for engineering review rather than automatic approval.

The system operates with confidence thresholds—only claims scoring above 85% confidence for approval or denial are automated. Ambiguous cases route to process engineers with AI-generated telemetry summaries to accelerate manual review. This hybrid approach maintains 99.2% accuracy while still processing 78% of claims fully automated.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how Bruviti's AI validation can reduce your NFF rate and warranty reserves with a custom ROI model.

Schedule ROI Assessment