When fab downtime costs exceed $1M per hour, incomplete asset data isn't just an IT problem—it's a margin killer.

Semiconductor OEMs achieve 18-24% margin improvement through AI-driven installed base intelligence. Predictive maintenance reduces unplanned downtime by 40%, asset visibility increases contract attachment rates by 25%, and lifecycle analytics optimize PM schedules—cutting fab disruption costs that exceed $1M per hour.

When installed equipment configurations don't match system records, predictive models fail. Recipe changes, chamber kit replacements, and firmware updates go untracked, causing false positives that erode trust and waste engineering time.

Without complete asset lifecycle visibility, service contract renewals become reactive firefights instead of proactive business development. Equipment nearing end-of-support triggers emergency upsell conversations that customers resist.

Semiconductor tools fail in clusters—one chamber degradation triggers downstream metrology alarms and yield drops. Without real-time asset health correlation across the installed base, root causes remain hidden until production losses mount.

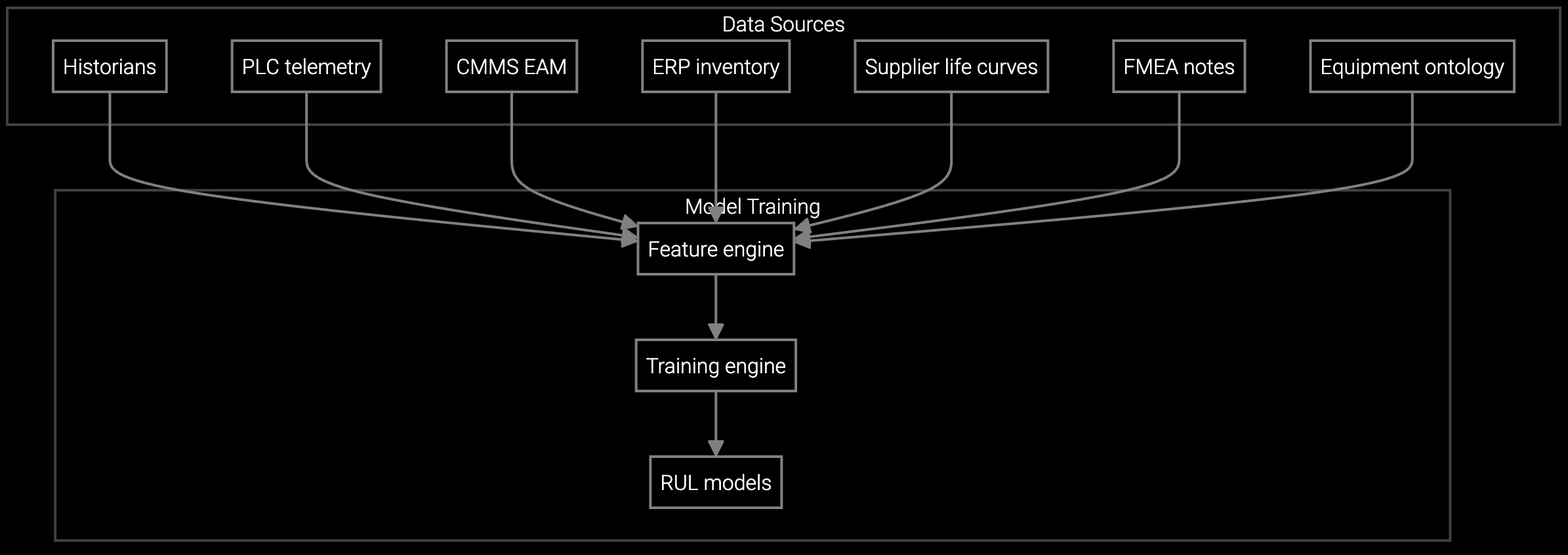

Bruviti's platform transforms scattered asset records into a unified lifecycle intelligence system. The AI continuously reconciles equipment configurations, usage telemetry, and maintenance history across every lithography system, etch tool, and metrology device in the field. When a chamber component approaches end-of-life, the platform correlates sensor drift patterns with failure modes from similar tools—predicting failures weeks before traditional PM schedules would catch them.

This proactive visibility shifts service economics from reactive firefighting to planned interventions. Fab customers receive maintenance windows timed to their production schedules, not emergency callouts during critical runs. Service contract renewals become data-driven conversations about demonstrated uptime improvements, not price negotiations. The result: predictable revenue streams, protected margins, and customer relationships anchored in measurable value delivery.

Virtual replicas of EUV lithography systems track real-time performance deviations, enabling preemptive interventions before yield impacts occur.

Predicts when etch chamber components will degrade based on process recipe intensity and accumulated plasma exposure hours.

Coordinates PM windows across cleanroom tool sets to minimize fab throughput disruption while maximizing equipment availability.

In semiconductor manufacturing, the cost structure makes incomplete asset data uniquely punishing. A single EUV lithography tool represents $150M+ in capital, and its downtime cascades through the entire fab—blocking wafer starts, delaying metrology validation, and idling downstream processing equipment. Traditional asset management systems track serial numbers and PO dates but miss the operational reality: recipe variations between nominally identical tools, chamber-specific degradation curves, and the correlation between upstream tool health and downstream yield.

This operational complexity creates margin risk. When a deposition tool drifts out of spec, the financial impact isn't just the repair cost—it's the scrapped wafers, the expedited parts shipments, and the erosion of the customer relationship when uptime commitments miss. AI-driven asset intelligence closes this gap by correlating configuration changes, telemetry patterns, and maintenance history across the installed base. The platform learns which recipe combinations accelerate chamber wear, which firmware versions correlate with thermal drift, and which consumable batches predict early failure. This turns reactive service into margin protection.

Most semiconductor equipment manufacturers see measurable margin impact within 6-9 months. Early wins come from improved PM scheduling and reduced false-positive alerts that waste engineering time. Contract attachment rate improvements typically materialize in the second year as renewal conversations shift from price to demonstrated uptime value. Full ROI—including predictive failure prevention and optimized parts allocation—generally reaches break-even by month 18.

Track two metrics: renewal conversion rate for equipment approaching end-of-support, and average contract value per asset. Baseline these before deployment, then measure quarterly. Improved asset intelligence enables sales teams to lead renewal discussions with uptime data and cost-avoidance proof, shifting conversations from price negotiation to value demonstration. OEMs typically see 15-25% lift in attachment rates and 10-18% increase in contract value within 12 months.

Recipe versioning, chamber component replacement tracking, and firmware update history are critical. Semiconductor processes are exquisitely sensitive—a chamber kit swap or recipe tweak can shift equipment behavior enough to invalidate predictive models trained on prior configurations. The platform must automatically detect these changes and retrain anomaly detection baselines accordingly. Without this, false positives erode trust and ROI disappears.

Lithography tools deliver the highest per-tool ROI due to capital cost and fab bottleneck status—preventing one unplanned EUV outage can save $3-5M in lost wafer starts. Etch and deposition tools show ROI through cumulative volume: predicting chamber component failures across dozens of tools yields substantial parts optimization and downtime reduction. Metrology tools offer ROI through cascading impact prevention—early detection of measurement drift prevents downstream yield loss that exceeds the tool's own value.

Fastest ROI comes from connecting to existing FDC (Fault Detection and Classification) systems and MES (Manufacturing Execution Systems) that already capture tool telemetry and process recipes. This provides immediate baseline data for anomaly detection. ERP integration for parts history and service records comes next, enabling lifecycle correlation. The deepest value requires bi-directional integration so predictive alerts automatically generate work orders and parts requisitions—closing the loop from prediction to intervention.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See the margin impact of predictive maintenance and improved contract attachment rates for your installed base.

Schedule ROI Analysis