When warranty claims can cost millions and NFF returns drain reserves, quantifying the financial impact of automation matters.

AI-driven warranty claims processing reduces NFF rates by 40-60%, cuts claim processing time from days to minutes, and improves fraud detection accuracy to 95%+. These improvements directly reduce warranty reserve accruals and operational costs for semiconductor equipment manufacturers.

Lithography and etch tools returned under warranty show no defects upon inspection. Each unnecessary return consumes refurbishment capacity and inflates warranty reserves without recovering cost.

Manual lookup of warranty status across tool serial numbers, configuration changes, and service contract amendments delays claim approvals. Fab customers demand faster resolution when $1M/hour equipment is down.

Unpredictable claim patterns for chamber consumables and subsystem failures make reserve accruals unreliable. Overestimating reserves ties up capital; underestimating creates financial reporting risk.

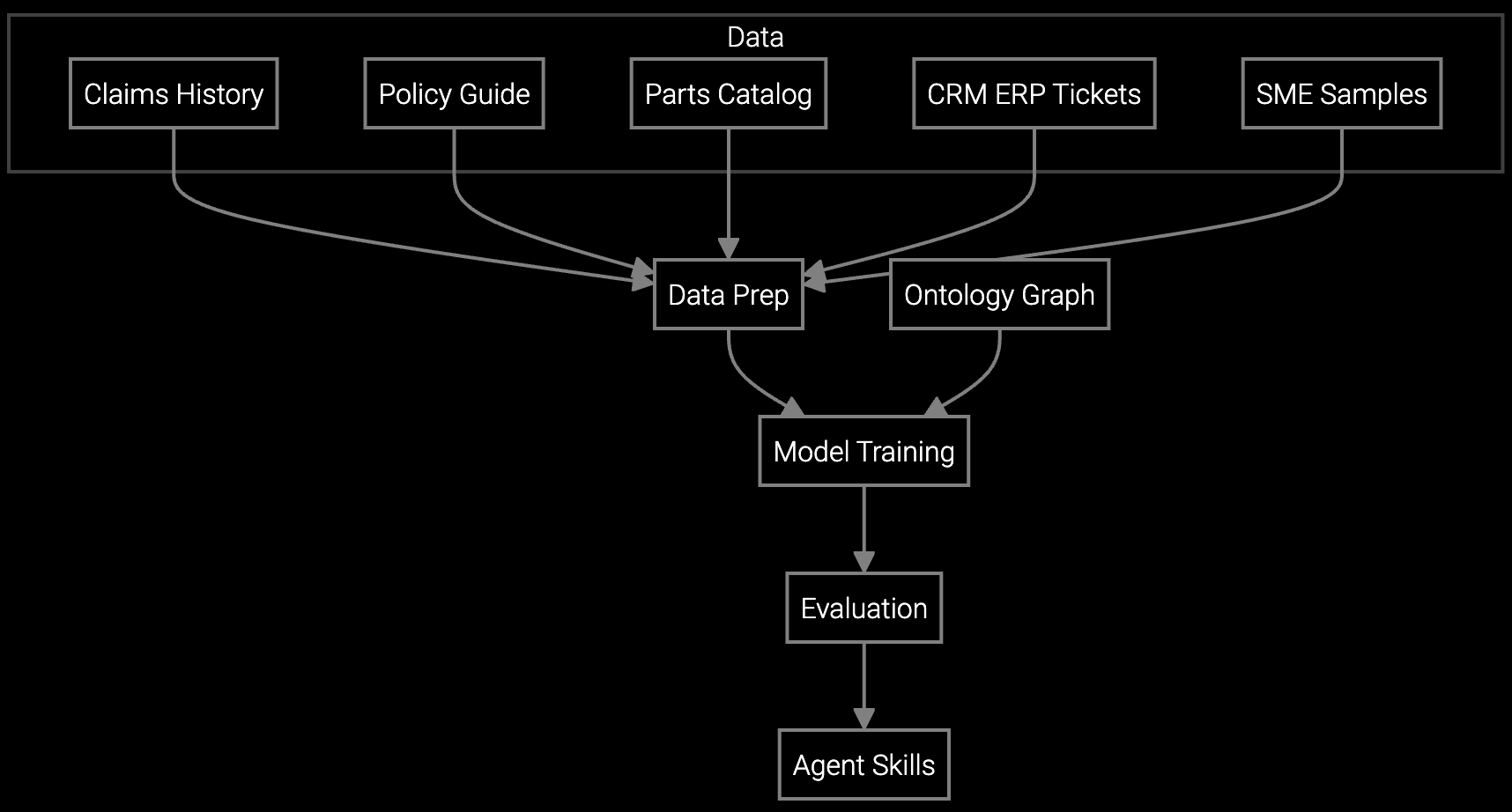

The ROI calculation for AI-driven warranty processing starts with three cost drivers: NFF reduction, processing speed, and fraud detection. Bruviti's platform connects to your ERP, CRM, and telemetry systems via REST APIs to analyze claim patterns against equipment sensor data, service history, and failure mode libraries. This integration enables real-time entitlement verification and automated claim coding without replacing existing workflows.

For semiconductor OEMs, the financial benefit comes from reducing unnecessary refurbishment cycles on high-value tools and improving warranty reserve accuracy. A Python SDK allows your team to customize fraud detection rules and NFF prediction models using your proprietary failure data. You own the trained models and can retrain them as tool configurations evolve, avoiding vendor lock-in while maintaining control over IP-sensitive warranty logic.

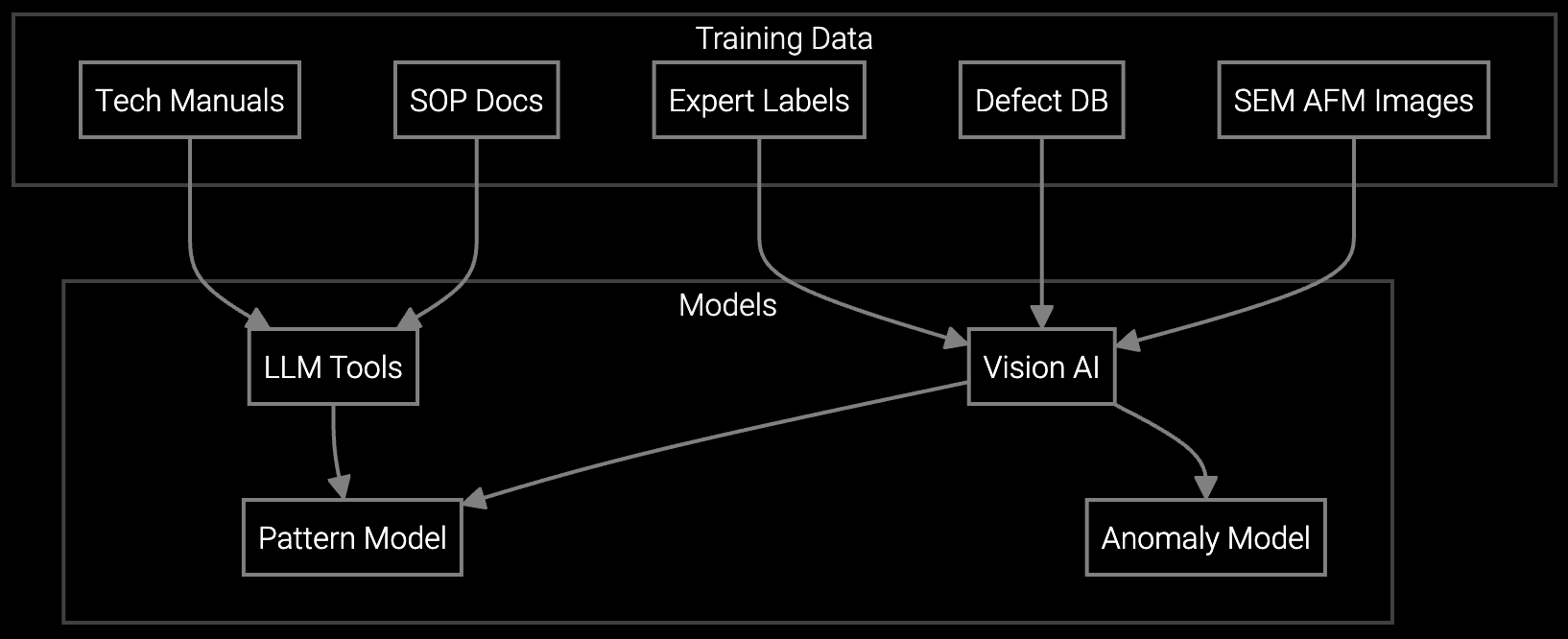

AI analyzes SEM and AFM microscopy images to identify sub-nanometer defects, classify failure modes, and validate warranty claims for semiconductor fabrication equipment with objective visual evidence.

Automatically classifies warranty claims by failure mode, equipment type, and root cause for semiconductor tools, reducing manual coding time and improving warranty reserve forecasting accuracy.

Semiconductor capital equipment carries warranty obligations worth millions per tool, with complex entitlement rules tied to process recipes, chamber configurations, and PM schedules. A single lithography system can generate dozens of component-level claims annually, each requiring verification against installation date, usage hours, and consumable replacement logs.

For semiconductor OEMs, warranty analytics must account for equipment interdependencies within a fab. When a CVD tool fails during a critical production run, warranty processing speed directly affects customer yield recovery timelines. AI-driven claim validation reduces the time between failure notification and credit approval, strengthening customer relationships while controlling cost exposure.

ROI calculation combines NFF reduction savings, claim processing cost savings, and fraud prevention value. For a semiconductor OEM processing 5,000 claims annually with a 50% NFF rate, reducing NFF by 40% saves $2-4M in refurbishment costs. Cutting processing time from 5 days to 4 hours saves approximately $500K in labor annually. Add fraud detection preventing $1-2M in invalid claims, and total annual benefit reaches $3.5-6.5M against typical implementation costs of $400-800K.

Bruviti's platform requires API connections to your ERP for warranty entitlement data, CRM for customer service history, and equipment telemetry systems for sensor data. For semiconductor tools, SECS/GEM interfaces provide real-time process parameters. A Python SDK enables custom data transformations if your systems use proprietary formats. Most integrations complete within 4-6 weeks using REST APIs with OAuth authentication.

Yes. Bruviti provides a Python SDK and TypeScript API for training custom fraud detection models on your historical claims data. You define rules based on claim frequency patterns, failure mode consistency, and equipment usage thresholds specific to your warranty terms. The models run in your environment, and you retain ownership of all training data and model weights.

Most semiconductor OEMs observe a 20-30% NFF reduction within the first 90 days as the platform learns failure patterns from historical claims. Full 40-60% reduction typically occurs by month six once the system has processed enough new claims to refine prediction accuracy. Speed of improvement depends on claim volume; OEMs processing 500+ claims monthly see faster learning curves.

Improved claim classification and NFF prediction directly enhance warranty reserve modeling. Semiconductor OEMs typically reduce year-over-year warranty cost variance from 12-18% to under 8% within the first year. The platform's analytics API provides monthly forecast updates based on claim trends, enabling CFOs to adjust reserves proactively rather than reactively correcting accruals during quarterly close.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Work with Bruviti's team to build a financial model using your actual claim data and NFF rates.

Schedule ROI Analysis