Data center OEMs process millions in warranty claims annually—without clear visibility into which costs are avoidable.

AI-driven warranty analytics reduce data center hardware warranty reserves by 15-25% through automated entitlement verification, NFF detection, and fraud prevention. Typical payback occurs in 6-9 months via faster claims processing and reduced invalid returns.

Data center OEMs set aside warranty reserves based on historical failure rates, but unpredictable claim spikes—driven by undetected fraud and NFF returns—force reserve increases that directly impact margin guidance and investor confidence.

Power supplies, memory modules, and BMCs returned under warranty often test functional upon inspection. Each NFF unit incurs reverse logistics, inspection labor, and restocking costs—while the original customer issue remains unresolved, triggering repeat claims.

Manual entitlement verification against serial numbers, purchase dates, and extended warranty contracts delays RMA approvals by days. Hyperscale customers under strict SLAs escalate, forcing expedited shipping and rush processing that doubles per-claim costs.

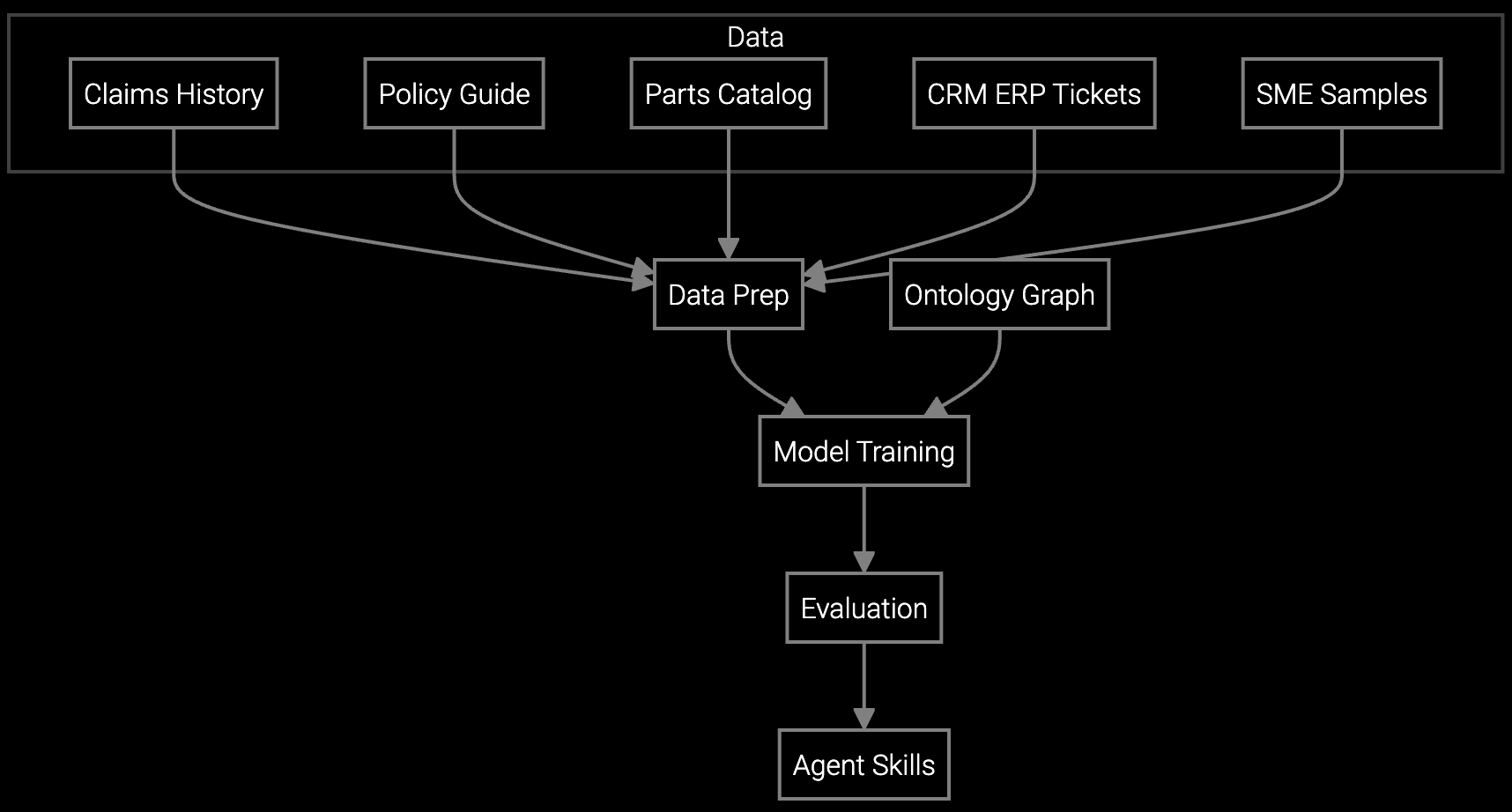

The financial return comes from replacing manual claim inspection with automated pattern recognition. The platform ingests warranty claims data (serial numbers, failure codes, customer descriptions), BMC telemetry logs, and historical RMA outcomes to train classification models. These models flag high-risk claims for review, auto-approve low-risk requests, and surface NFF patterns before units ship back to customers.

For builders, the architecture matters: RESTful APIs let you pipe claims data from your existing warranty management system (Oracle Warranty, SAP Service Cloud, or custom-built) into the analytics layer without rip-and-replace. Python SDKs allow your team to define custom fraud detection rules, adjust NFF thresholds per product line, and export model predictions back into your workflow automation. You control the logic—no vendor lock-in to black-box decisioning.

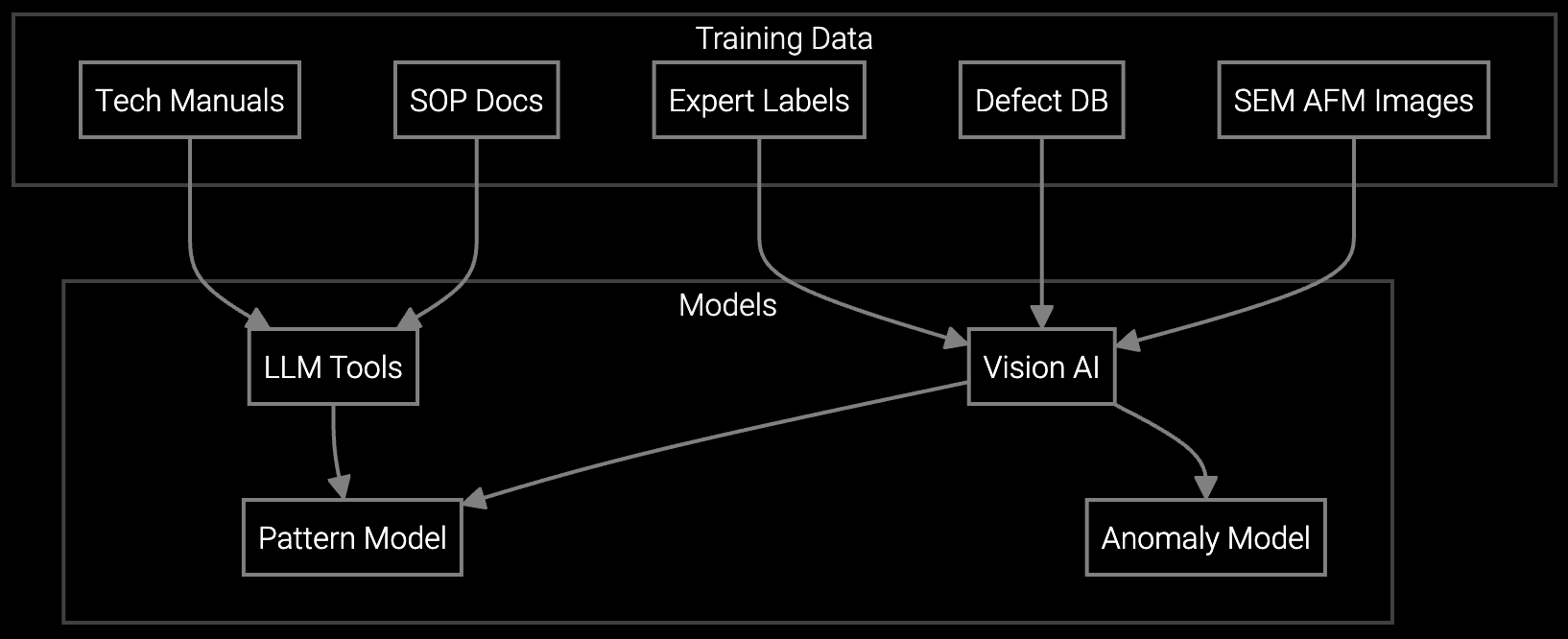

AI analyzes microscopic images of server memory modules and storage drives to identify defects, classify failure modes, and validate warranty claims for data center components.

Automatically classifies warranty claims by failure type, assigns cost codes, and routes to the correct refurbishment queue—reducing manual coding time by 80% for high-volume data center RMAs.

Data center OEMs face unique warranty economics: hyperscale customers order thousands of identical server configurations, creating concentrated failure risk if a component batch proves defective. A single bad lot of power supplies can trigger 5,000+ warranty claims in 90 days, overwhelming manual claim reviewers and spiking reserve accruals mid-quarter.

NFF returns carry especially high costs because data center operators replace entire server nodes at the first sign of instability—power fluctuation, memory error, thermal anomaly. Many of these units test functional upon return because the root cause was environmental (cooling failure, power sag) or configuration drift (firmware mismatch, BIOS setting). AI models trained on BMC telemetry can correlate failure symptoms with environmental data, flagging likely NFF cases before the unit ships back and guiding the customer toward the actual fix.

For OEMs processing 50,000+ warranty claims annually, payback typically occurs in 6-9 months. Savings come from three sources: reduced claims processing labor (60-75% time savings), avoided NFF reverse logistics costs ($240-$480 per unit), and lower warranty reserve accruals (15-20% reduction). Larger OEMs with higher claim volumes and more volatile reserve swings see faster payback—some achieve ROI in under 6 months.

Bruviti provides RESTful APIs that accept warranty claim records (serial number, failure code, customer ID, claim date) in JSON format. Your team writes a lightweight integration layer—typically 200-400 lines of Python or Node.js—that pulls new claims from your system of record, sends them to the analytics API, and writes predictions (fraud risk score, NFF likelihood, recommended action) back into custom fields. For Oracle Warranty Management Cloud, the integration uses Oracle Integration Cloud connectors; for SAP Service Cloud, it uses OData APIs. Total integration effort runs 3-5 developer-weeks for standard deployments.

Three data types drive model accuracy: historical warranty claims (failure codes, customer descriptions, RMA outcomes), BMC telemetry logs (temperature readings, power events, error logs captured via IPMI), and refurbishment inspection results (tested functional vs. defective, root cause classification). A minimum of 12 months of historical data covering 10,000+ claims provides sufficient training volume. Data should include both NFF and legitimate failure cases to establish baseline patterns.

Yes. The Python SDK exposes model configuration endpoints where you define segment-specific rules. For example, you might flag claims from resellers (not direct customers) for additional review, or apply stricter thresholds to high-value storage systems versus commodity server nodes. Rule changes deploy via API calls without retraining the underlying model. You can also export prediction data to your own analytics environment (Snowflake, Databricks) for custom reporting or to feed internal BI dashboards.

Track two metrics quarterly: warranty reserve-to-actual variance (compare accrued reserve at quarter-start to actual claims paid by quarter-end) and NFF rate by product line (percentage of returned units testing functional). Before AI deployment, most data center OEMs see 18-25% reserve variance and 30-40% NFF rates. After 6-9 months, variance typically drops to 8-12% and NFF rates fall to 15-22%. Finance teams use these metrics to justify lower reserve ratios, which directly improves reported gross margin and free cash flow.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how Bruviti's API-first platform integrates with your existing warranty systems to deliver measurable ROI in 6-9 months.

Schedule Technical Demo