Legacy systems can't track today's 5nm-generation equipment, leaving service teams blind to configuration drift and EOL exposure.

Semiconductor OEMs face critical decisions: build custom asset tracking systems or adopt platforms. Strategy depends on equipment complexity, fab scale, and lifecycle needs. Hybrid approaches balance control with speed.

When asset records don't match actual tool configurations, maintenance windows extend and recipe consistency suffers. Legacy systems can't track recipe versioning across EUV and DUV lithography tools.

Without visibility into installed base lifecycle status, OEMs miss optimal timing for chamber kit upgrades and process tool retrofits. Reactive approaches delay customer fab efficiency gains.

When asset records lack contract linkage, renewal opportunities disappear. Service teams can't proactively reach out before preventive maintenance agreements expire.

Build approaches offer full control but require years of development and continuous maintenance as equipment generations evolve. Custom systems become technical debt when process tools advance from 7nm to 3nm nodes.

The platform brings pre-built asset tracking and lifecycle management that deploys in weeks, not years. Bruviti integrates with existing fab systems while exposing APIs for custom workflow automation, letting you extend without rebuilding core infrastructure.

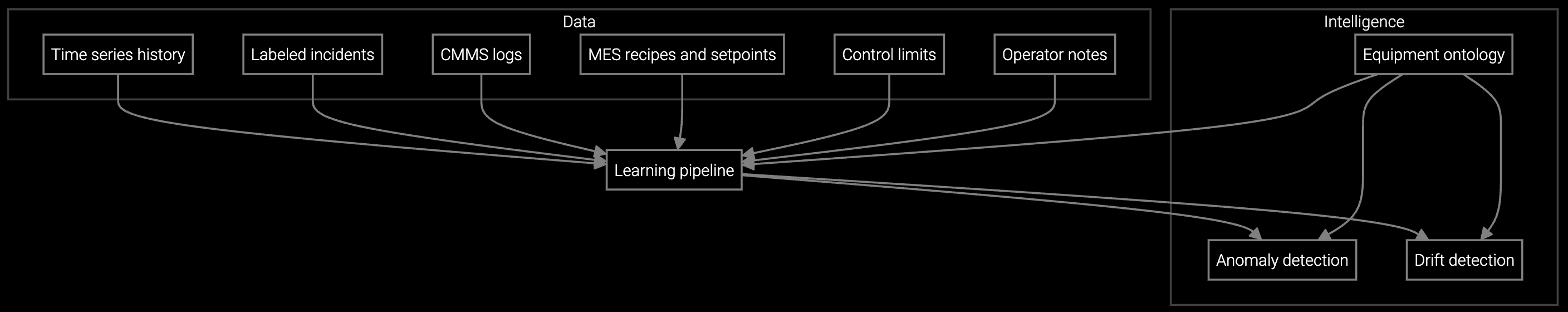

Monitors lithography tool sensor streams to detect recipe parameter drift before it impacts wafer yield.

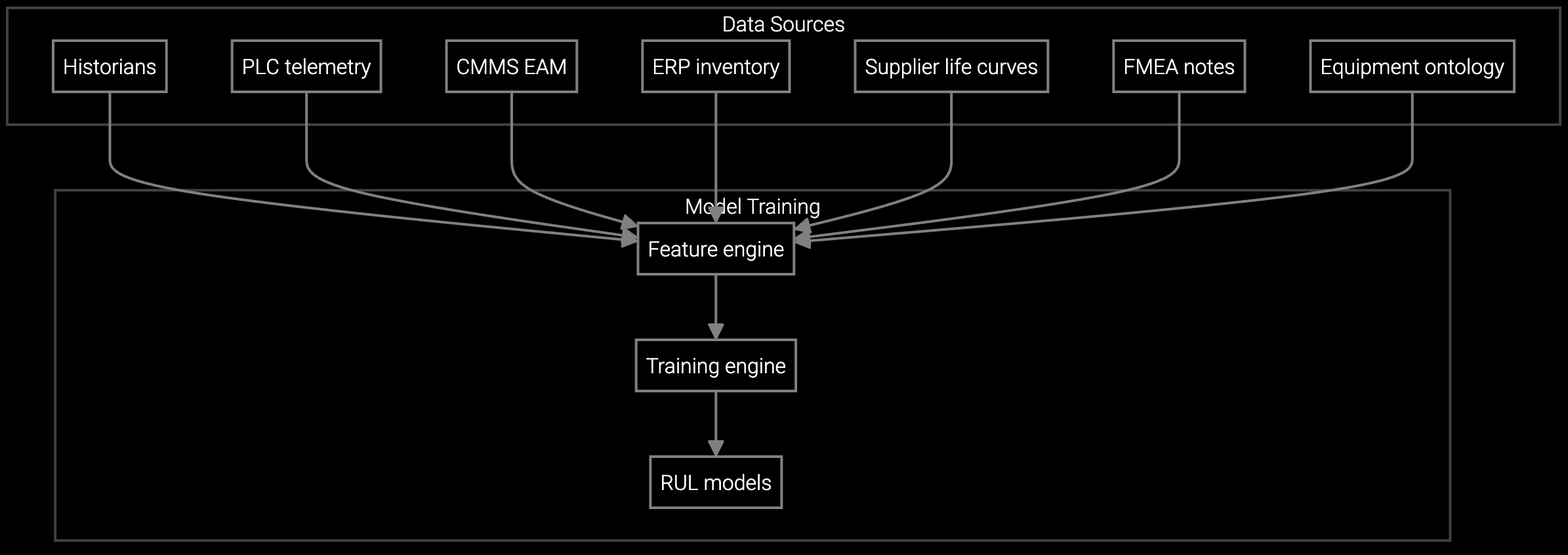

Schedules chamber cleaning and parts replacement based on actual equipment usage patterns, not fixed intervals.

Estimates when critical components like RF generators and vacuum pumps will reach end of life, enabling planned maintenance windows.

Semiconductor process tools generate dense telemetry streams from recipe execution, chamber conditions, and consumable status. The platform ingests this data to build real-time asset profiles that track configuration state, usage patterns, and maintenance history.

For EUV lithography systems running sub-5nm processes, the platform correlates reticle changes, light source maintenance, and environmental conditions to predict when preventive maintenance windows should open. Etch and deposition tools benefit from automated tracking of chamber kit lifecycles and gas flow calibration drift.

Platform deployment typically completes in 6-8 weeks from contract to production go-live, including integration with existing fab systems. Custom builds require 12-18 months for initial functionality, plus ongoing development costs as equipment generations evolve.

Yes. The system tracks multi-layered configurations including reticle versions, light source calibrations, environmental controls, and recipe parameters. It reconciles intended configurations against actual telemetry data to detect drift before it impacts yield.

The platform connects via standard SECS/GEM interfaces and REST APIs to ingest equipment telemetry, recipe data, and maintenance logs. It does not replace your MES but augments it with AI-powered analytics and lifecycle tracking.

The platform exposes full APIs for data extraction and custom workflow integration. Your data remains accessible for migration, and you can build custom extensions using standard development tools. This contrasts with proprietary systems that trap data in closed formats.

Most semiconductor OEMs see payback in 8-12 months through improved contract renewal rates, reduced configuration-related downtime, and optimized spare parts inventory. The exact timeline depends on installed base size and current asset tracking maturity.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how Bruviti's platform deploys in weeks and scales with your equipment portfolio.

Talk to Our Team