Connected appliances generate millions of data points daily, but most OEMs lack the infrastructure to turn telemetry into actionable asset intelligence.

Appliance OEMs face a build-or-buy decision for asset tracking systems. Building offers customization but requires sustained engineering effort. Buying accelerates deployment but risks vendor lock-in. API-first platforms provide flexibility without reinventing telemetry ingestion and predictive models.

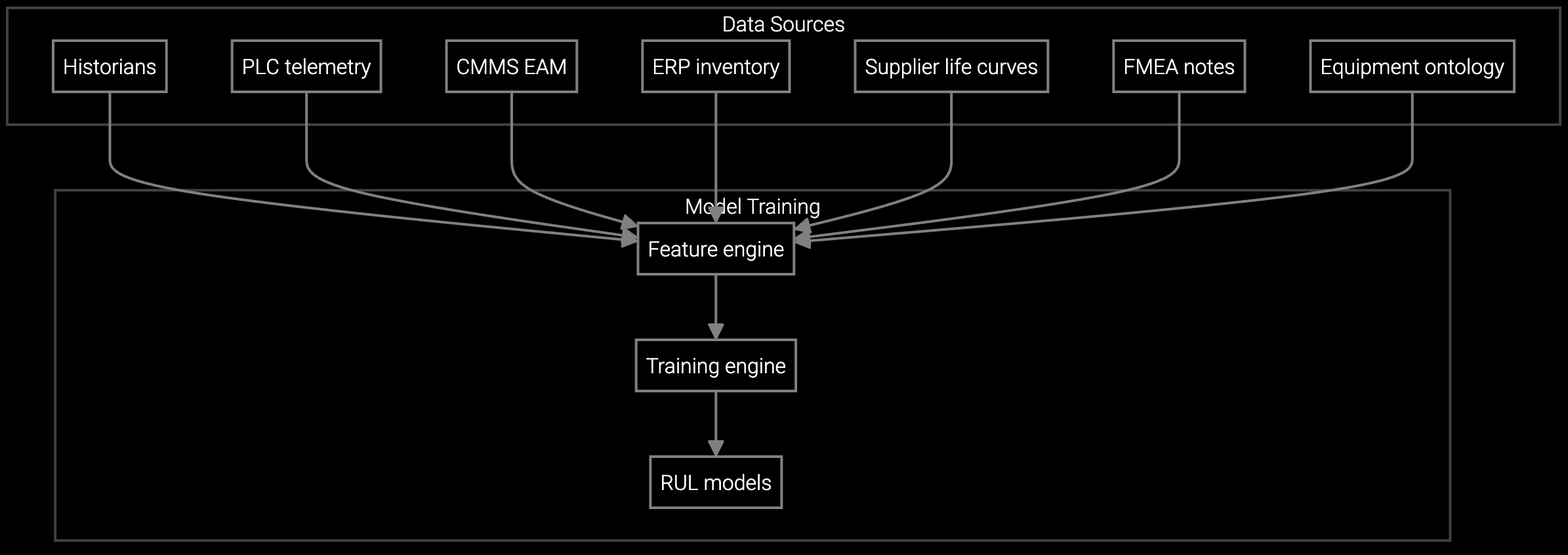

Building an in-house asset tracking system diverts data engineers from product development. Foundation models for remaining useful life prediction and anomaly detection require months of training cycles and ongoing retraining as product lines evolve.

Appliances in the field accumulate firmware updates, parts replacements, and environmental variations that create discrepancies between registered configurations and actual installed state. Manual reconciliation across millions of units is infeasible.

Decades of product lines mean asset data lives in disparate ERPs, warranty databases, and IoT platforms. Monolithic solutions require migrating historical records or accepting incomplete visibility into older equipment still generating revenue.

Bruviti's platform bridges the build-versus-buy dilemma with an API-first architecture that integrates with existing data lakes and ERPs. Python SDKs allow data engineers to define custom lifecycle rules, configuration baselines, and predictive maintenance thresholds without abandoning in-house tools. Pre-trained models for anomaly detection and remaining useful life estimation accelerate deployment while preserving the option to fine-tune on proprietary telemetry.

The headless design decouples data ingestion from analytics, enabling incremental rollout across product lines. Connected HVAC units can feed real-time telemetry while legacy water heaters rely on service event records, all normalized into a unified asset registry. This eliminates the migration risk of monolithic platforms and supports gradual expansion as IoT connectivity reaches older equipment.

Analyze IoT streams from refrigerators and HVAC units to flag anomalies before failures reach end customers.

Estimate compressor lifespan and water heater element degradation based on usage patterns and environmental conditions.

Schedule filter replacements and descaling based on actual equipment condition rather than arbitrary time intervals.

Appliance manufacturers increasingly compete on service differentiation rather than hardware specs. Connected refrigerators and smart HVAC systems generate telemetry that reveals usage patterns, failure precursors, and upsell opportunities, but only if asset tracking infrastructure can digest real-time data streams alongside decades of legacy service records.

The strategic window is narrowing. Competitors deploying predictive maintenance gain customer loyalty through proactive filter reminders and pre-failure alerts, while those relying on reactive break-fix models face rising warranty reserves and NPS erosion. An API-first approach allows phased deployment starting with high-value connected products while preserving visibility into legacy equipment that still drives 40% of aftermarket revenue.

API-first platforms typically integrate with SAP, Oracle, and major IoT hubs within 4-6 weeks. Python SDKs allow data engineers to map proprietary telemetry schemas without vendor professional services. Legacy systems can connect via batch file imports if real-time APIs are unavailable.

Headless architectures avoid forced migration by ingesting data where it lives. Historical service records remain in legacy databases while new telemetry flows into modern pipelines. The asset registry creates a unified view without requiring bulk data transfers or system cutover.

Yes. Pre-trained models for common failure modes accelerate initial deployment, while Python SDKs enable fine-tuning on proprietary telemetry. Data engineers retain full control over training datasets, feature engineering, and model retraining schedules without vendor dependencies.

Automated baseline comparison detects discrepancies between registered configurations and actual installed components. When firmware updates or part swaps occur, the system flags mismatches and prompts reconciliation workflows. This reduces manual audits by 60% compared to periodic inventory sweeps.

Open APIs ensure data portability. Asset registries export to standard formats, and predictive models trained on your telemetry remain accessible via Python libraries. Unlike monolithic platforms, API-first architectures don't trap data or force workflow lock-in.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Speak with our technical team about API capabilities, SDK documentation, and integration timelines.

Schedule Technical Review