Every hour of lithography tool downtime costs $1M+—yet 40% of fab delays trace to missing chamber kits and consumables.

AI-driven parts inventory optimization reduces semiconductor fab carrying costs by 25-35% while improving fill rates to 98%+. Predictive demand forecasting eliminates stockouts that delay $1M+/hour equipment repairs and cuts emergency expediting by 60%.

Missing chamber kits, RF generators, or vacuum components force tool downtime to stretch from 4 hours to 48+ hours while parts ship overnight. When lithography or etch tools sit idle, every hour bleeds margin.

Fear of stockouts drives over-ordering. Fabs carry $50M-$100M in spare parts inventory, much of it obsolete or slow-moving. High-value consumables age out before use, converting working capital into write-offs.

When critical tools go down without parts on-site, overnight airfreight and rush orders become routine. A $2,000 chamber component becomes a $12,000 emergency line item—multiplied across hundreds of unplanned failures annually.

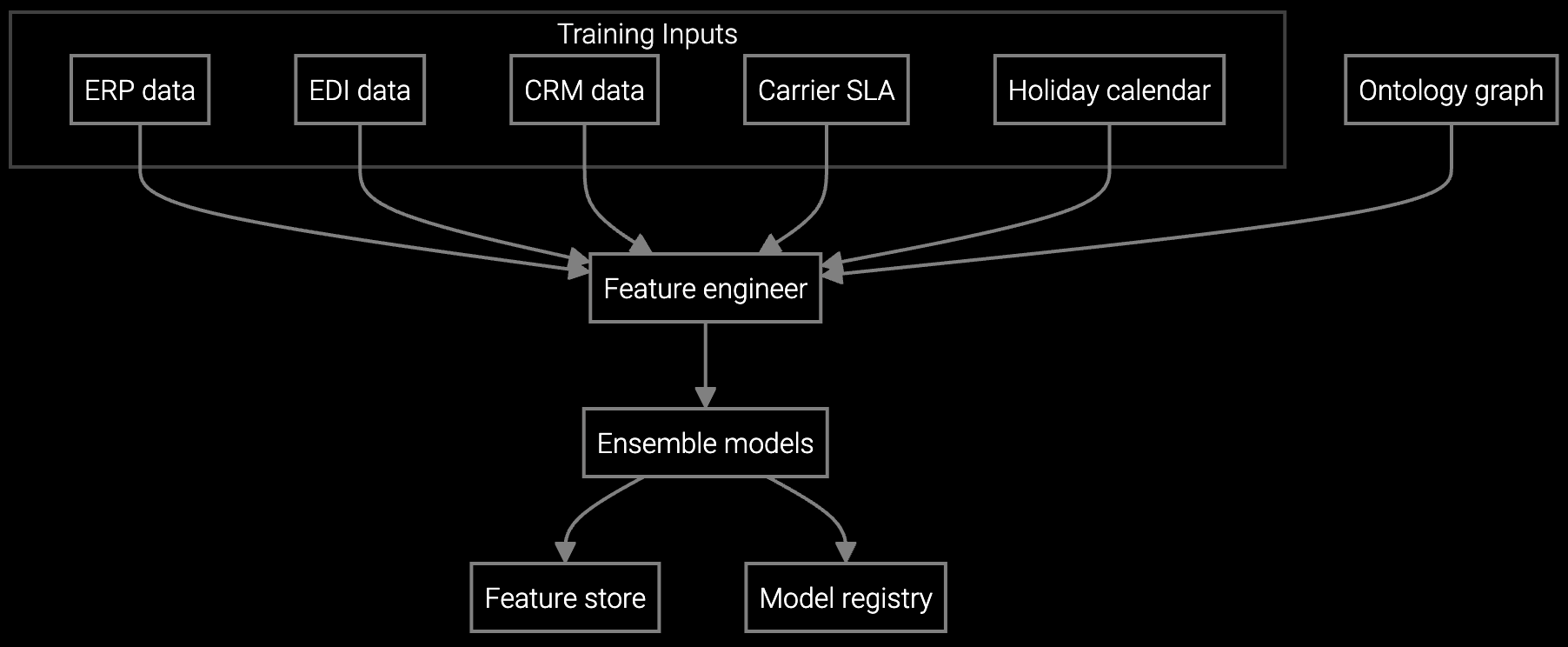

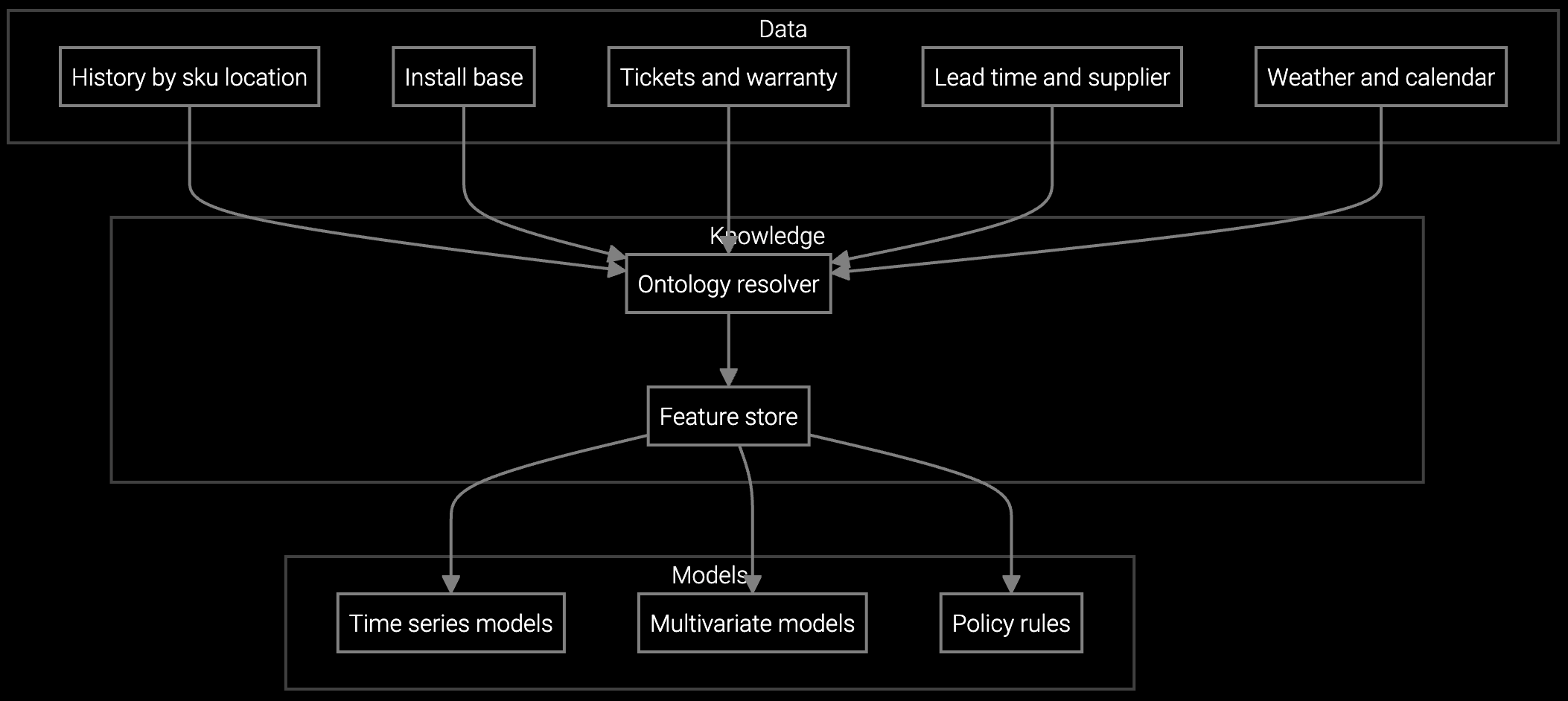

Bruviti's platform analyzes telemetry from lithography, etch, deposition, and metrology tools to predict component failures before they trigger downtime. By correlating RF hours, process recipe drift, plasma strike counts, and chamber pressure anomalies with historical parts consumption, the system forecasts which consumables will fail and when—enabling proactive replenishment without over-stocking.

The financial impact compounds across three levers. First, predictive demand forecasting cuts total inventory carrying costs by right-sizing stock levels to actual consumption patterns, not safety-stock guesses. Second, eliminating stockouts prevents million-dollar-per-hour tool downtime from stretching into multi-day outages. Third, proactive ordering replaces emergency expediting, converting 6-8x cost multipliers into standard lead-time pricing. For a typical fab, this translates to $8M-$15M in annual savings while improving equipment availability from 92% to 97%+.

Forecasts chamber kit and consumable demand by tool type and fab location, optimizing stock levels across 200+ SKUs while reducing carrying costs by 30%+.

Projects parts consumption for EUV source components, RF generators, and vacuum pumps based on tool telemetry, recipe intensity, and preventive maintenance schedules.

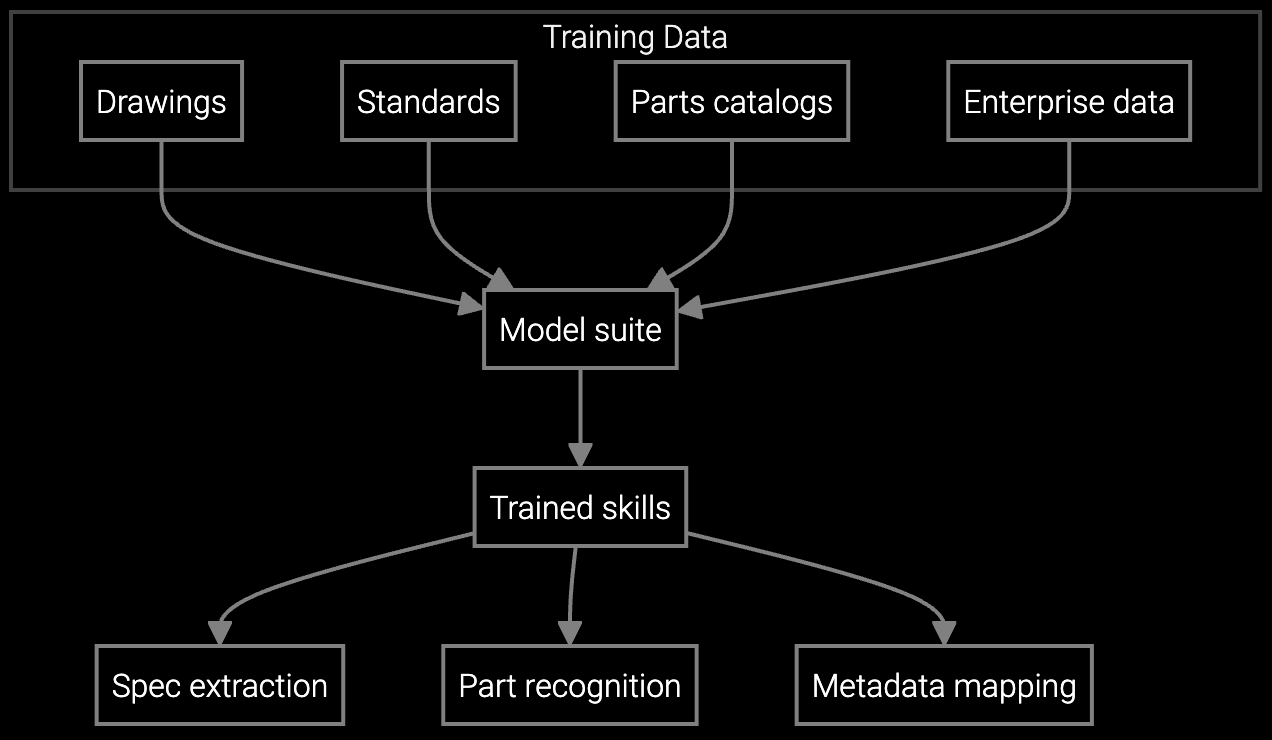

AI reads technical drawings and schematics for lithography optics, chamber assemblies, and robotics to identify part numbers instantly, accelerating service quoting by 75%.

Semiconductor equipment operates at nanometer precision under extreme conditions—plasma etching at 400°C, EUV light at 13.5nm wavelengths, vacuum chambers at 10⁻⁹ torr. Consumables like chamber liners, electrostatic chucks, and RF match networks degrade predictably based on wafer throughput, recipe power levels, and process gas chemistry. Yet most fabs still order parts reactively, stockpiling high-cost components "just in case" or scrambling for overnight shipments when critical tools fail.

The financial stakes dwarf other industries. A single ASML EUV scanner costs $150M and generates $1M+ revenue per hour at full utilization. When a light source module or reticle stage fails without a replacement part on-site, every additional hour of downtime destroys margin equivalent to 5-10 wafer lots. Multiply this across 50+ critical tools per fab, and inventory inefficiency becomes a board-level P&L issue—not an operational nuisance.

Most fabs achieve payback within 6-9 months. ROI accelerates when the platform prevents even one extended lithography tool outage, which can cost $10M+ in lost wafer production. By month 12, cumulative savings from reduced carrying costs, eliminated expediting, and improved equipment availability typically exceed $8M-$15M for a 40K wafer-starts-per-month fab.

The platform analyzes tool telemetry—RF hours, plasma strike counts, chamber pressure trends—to predict component failures with 85-90% accuracy, 30-60 days in advance. This eliminates the need for large safety-stock buffers. Fabs right-size inventory to actual consumption patterns rather than worst-case scenarios, cutting carrying costs by 25-35% while maintaining 98%+ fill rates.

Yes. Bruviti's platform connects to ERP systems via standard APIs to ingest parts master data, stock levels, and order history. It also ingests tool telemetry from equipment data feeds. Predicted demand forecasts and replenishment recommendations flow back into the ERP as suggested purchase orders or MRP adjustments, requiring no process re-engineering.

Track four KPIs monthly: (1) inventory carrying cost as percentage of total parts value, targeting 25-35% reduction; (2) fill rate for critical tool parts, targeting 98%+; (3) emergency expediting costs, targeting 60%+ reduction; (4) unplanned tool downtime attributed to parts delays, targeting sub-1% of total scheduled production time. These metrics directly tie inventory efficiency to margin protection.

The platform flags parts at risk of obsolescence by analyzing supplier lead-time trends, end-of-life announcements, and historical consumption decay curves. For legacy tools with aging supplier bases, it recommends proactive last-time buys or identifies substitute parts with compatible specifications. This prevents catastrophic stockouts when OEMs discontinue support for 10-15 year old lithography or metrology equipment still generating revenue.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how Bruviti's AI platform delivers measurable ROI in semiconductor fab environments.

Schedule ROI Assessment