With fab downtime costing $1M+ per hour, the strategic choice between custom-built and platform approaches determines your competitive position.

Semiconductor equipment manufacturers face a strategic choice: build custom asset tracking systems requiring 18+ months and dedicated ML teams, or deploy proven platforms that integrate within weeks. Hybrid approaches combine vendor speed with API extensibility, eliminating the false choice between control and time-to-value.

Custom-built asset intelligence systems require 18-24 months to production, during which competitors gain share. Your fab customers demand proactive service visibility today, not after the next product cycle.

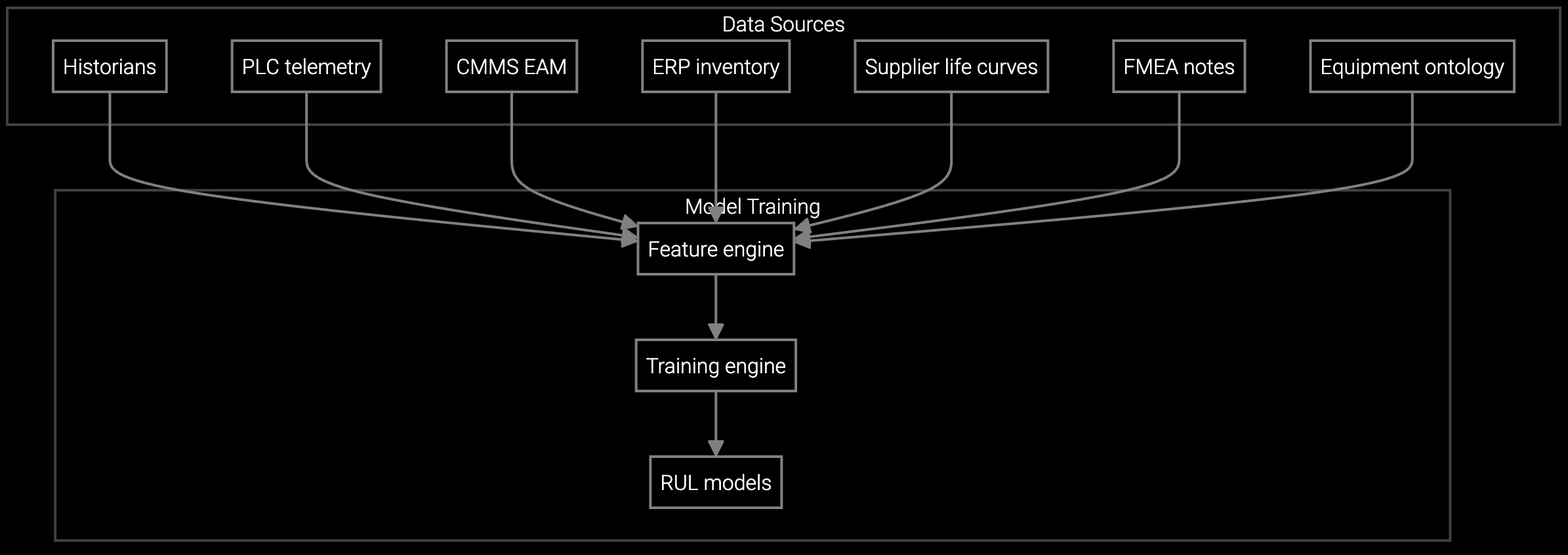

Building in-house requires dedicated ML engineers, data scientists, and DevOps teams—not just initial development but ongoing maintenance as fab telemetry formats evolve across EUV, etch, and deposition tool generations.

Proprietary systems lock you into architectural decisions made before new fab equipment types emerge. When 2nm processes arrive, rigid custom platforms can't pivot—forcing expensive rewrites or competitive disadvantage.

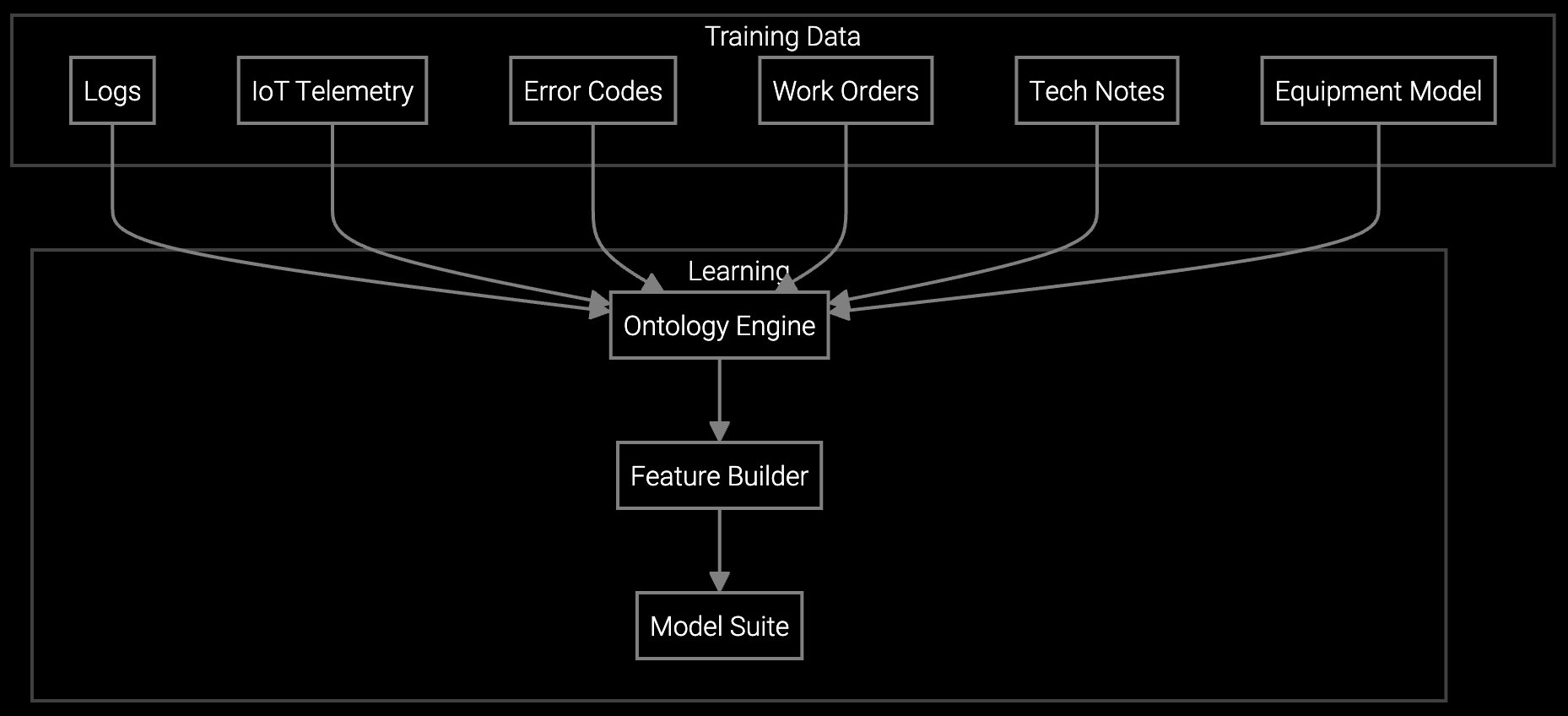

The platform eliminates the false choice between speed and customization. Deploy pre-trained models for chamber anomaly detection and recipe drift analysis within weeks, not quarters. Then extend with custom logic for your unique equipment configurations—without forking the codebase or losing vendor support.

API-first architecture means your data science team builds on proven infrastructure rather than reinventing telemetry ingestion, model versioning, and production monitoring. When new fab equipment categories emerge, platform updates flow automatically while your custom extensions remain intact. You maintain strategic control over differentiation while outsourcing commodity AI infrastructure.

Virtual models of lithography and etch tools track real-time performance deviations, enabling proactive chamber maintenance before yield-impacting failures occur at your fab customers' sites.

Estimates when critical chamber components and consumables will reach end-of-life based on actual process usage patterns, enabling planned maintenance windows that avoid unscheduled fab downtime.

Identifies recurring failure trends across your installed base of deposition and metrology tools, surfacing design improvements that reduce field failure rates and strengthen competitive positioning.

Your customers—TSMC, Intel, Samsung fabs—demand proactive service visibility as a purchasing criterion. When evaluating lithography or etch tool vendors, fabs now ask: "Can you predict chamber failures before they impact our yield?" Equipment OEMs that answer "yes, and we'll prove it in your fab within 60 days" win deals. Those that answer "we're building it" lose to competitors already delivering.

Fab customers also demand integration with their existing MES and FDC systems. Platform approaches with pre-built connectors to Applied Materials AutoMod, KLA FabGuard, and ASML systems accelerate proof-of-value. Custom-built solutions require 6+ months just to establish data pipelines—time your competitors use to demonstrate ROI.

API-first platforms let you deploy core asset tracking and anomaly detection in weeks, then layer custom logic for proprietary process recipes or unique tool configurations without modifying the base system. This preserves vendor support while maintaining competitive differentiation. Teams typically deploy standard capabilities first to demonstrate value, then add custom extensions based on fab customer feedback.

Building requires $3-4M annually for ML engineers, data scientists, and DevOps—plus 18-24 months before production deployment. Platform approaches cost $200-500K annually depending on installed base size, with 6-8 week deployment. Over three years, build approaches cost $10M+ with delayed ROI, while platforms deliver $1.5-2M total cost with immediate value capture. The strategic cost is opportunity—margin protected during competitors' build phase.

Evaluate platforms on three criteria: API completeness for data extraction, open data formats that preserve portability, and absence of proprietary model training formats. Platforms that expose full API access to your asset data, telemetry streams, and prediction outputs enable migration if needed. Avoid platforms that encrypt training data or require proprietary tools for model customization—these create switching costs equivalent to custom builds.

Start with a single tool type at one customer fab—typically highest-value equipment like EUV lithography where downtime costs are most visible. Deploy asset tracking and anomaly detection only, proving value before expanding to predictive maintenance. After demonstrating uptime improvement over 90 days, expand to additional tool types and customer sites. This staged approach builds internal confidence and customer references while limiting initial investment.

Proven platforms include telemetry adapters for major equipment vendors—Applied Materials, Lam Research, Tokyo Electron, ASML—that update automatically as new tool generations ship. When 2nm process tools arrive with new sensor formats, vendor-maintained connectors handle ingestion without custom development. This contrasts with custom-built systems where your team must reverse-engineer each new telemetry format, creating ongoing maintenance burden and deployment delays.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Connect to your actual telemetry feeds and prove value in 30 days—no custom build required.

Schedule Strategic Assessment