When fab downtime costs exceed $1M per hour, your field service AI strategy becomes a competitive differentiator.

Semiconductor OEMs face a strategic choice: build custom field service AI or deploy proven platforms. Platform approaches deliver faster ROI through pre-trained models on fab-specific failure patterns while preserving API flexibility for custom workflows.

Custom AI development requires 18-24 months to accumulate sufficient failure pattern data across lithography, etch, and deposition tools. During this period, competitors deploying proven platforms gain market share through superior first-time fix rates.

Building in-house requires rare expertise combining semiconductor process knowledge with AI engineering. Competition for this talent drives compensation above $300K annually while delaying deployment timelines.

Each quarter without AI-optimized dispatch costs semiconductor OEMs through preventable repeat visits, missed SLAs, and excess parts inventory. These costs compound while build initiatives remain in development.

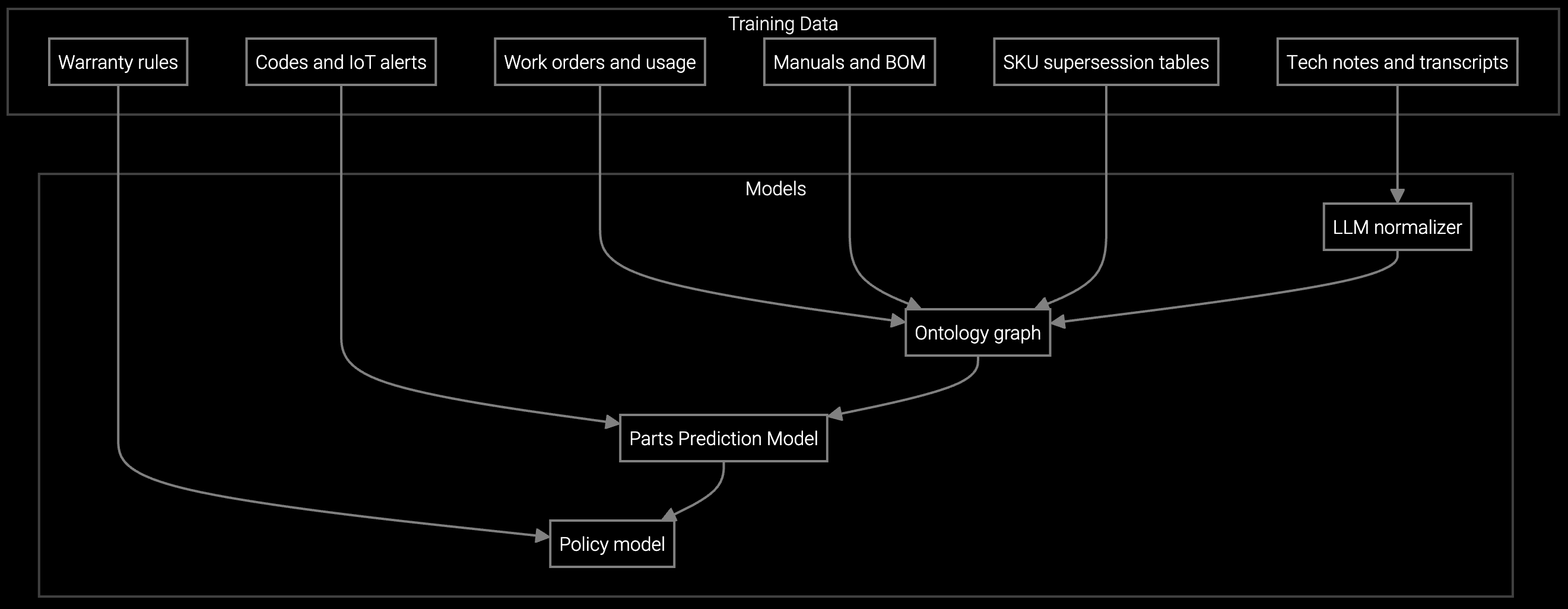

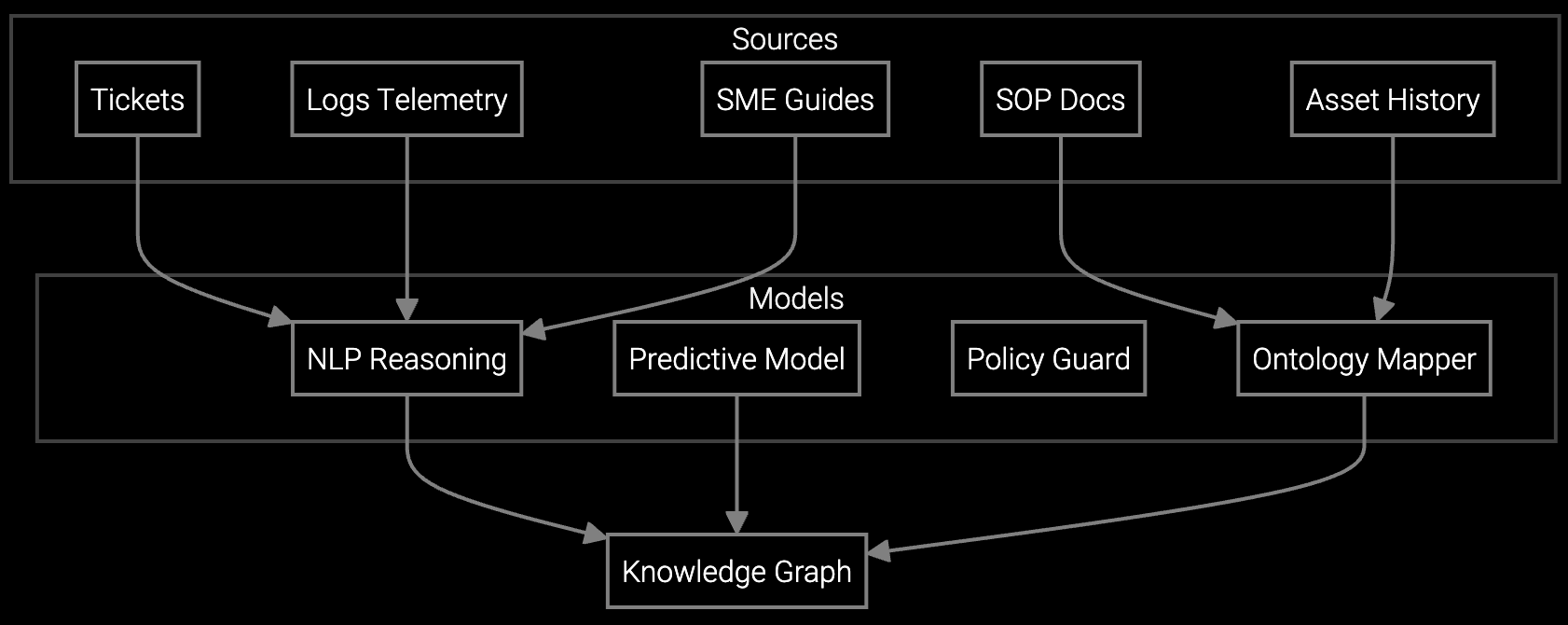

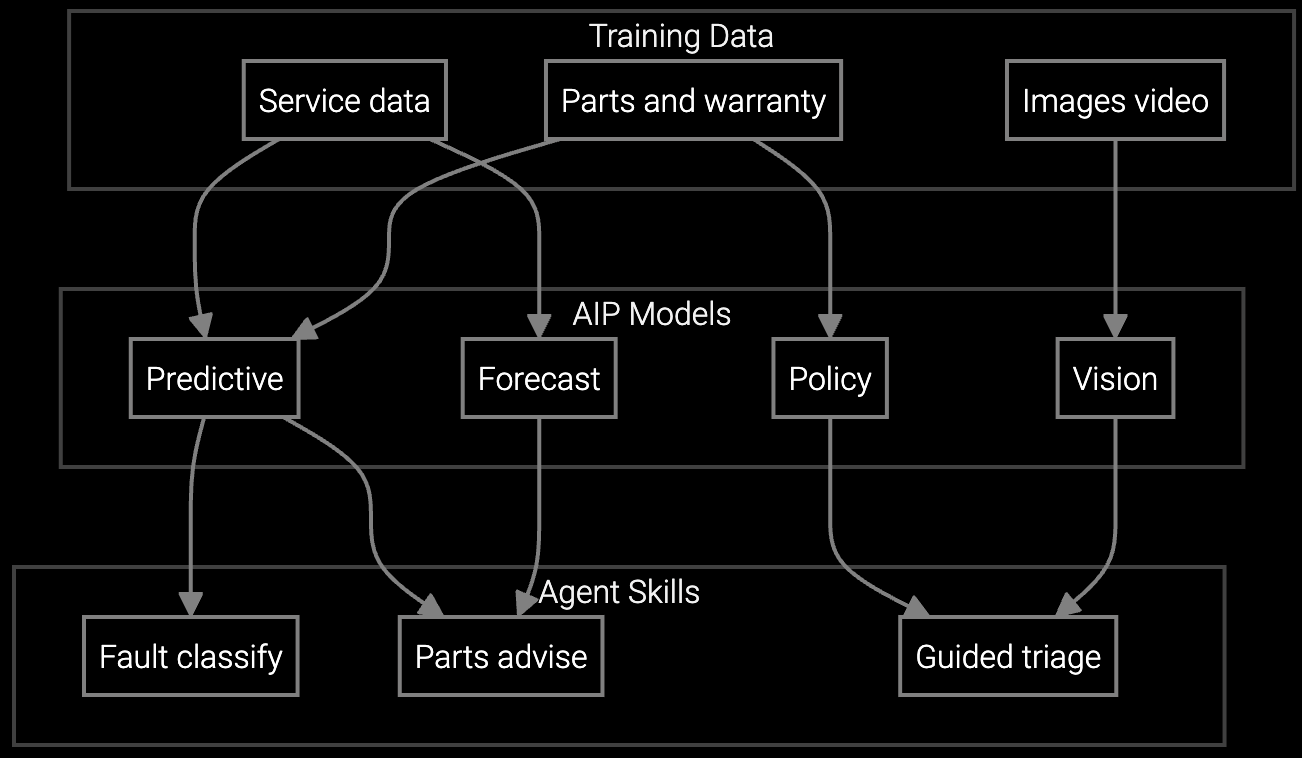

The optimal strategy for semiconductor OEMs combines platform deployment speed with architectural flexibility. Bruviti's approach delivers pre-trained models on chamber component failures, recipe drift patterns, and contamination signatures while exposing APIs for custom FSM integration and proprietary diagnostic workflows.

This hybrid model eliminates the false choice between vendor lock-in and lengthy build cycles. Semiconductor manufacturers deploy proven AI on common failure modes immediately while extending the platform for tool-specific diagnostics unique to their product portfolio. The architecture preserves strategic differentiation where it matters while accelerating time to value on commodity service processes.

Deploy immediately on chamber kit failures, showerhead replacements, and O-ring degradation patterns specific to EUV and plasma etch tools, eliminating the need to build custom models.

Capture retiring process engineer expertise on recipe optimization and contamination sources before it walks out the door, converting tribal knowledge into strategic IP.

Equip technicians with mobile AI guidance on tool-specific diagnostics while customizing workflows for proprietary equipment through platform APIs.

Semiconductor tool diversity creates a paradox: OEMs need AI models for dozens of equipment types, but each individual fab runs limited variety. Platform providers aggregate learning across customer installations, training superior models on lithography failures, deposition chamber wear, and metrology drift faster than any single OEM can achieve internally.

The competitive advantage lies not in predicting generic pump failures, but in optimizing dispatch for your specific tool portfolio and integrating with proprietary recipe management systems. Platforms handle commodity predictions while you focus development resources on differentiating workflows that directly impact customer yield and uptime commitments.

Building production-grade AI for semiconductor field service requires 18-24 months minimum. This timeline accounts for data collection across sufficient failure cycles, model training on rare but critical events like chamber arcing, and validation against actual technician outcomes across diverse fab environments. Platform deployment reduces this to 90 days.

Analysis of semiconductor field service workflows shows approximately 75% of AI use cases are commodity functions like parts prediction, technician routing, and knowledge retrieval. The remaining 25% involving proprietary tool diagnostics and custom recipe optimization delivers competitive differentiation. Strategic platforms handle the commodity 75% while enabling customization where it matters.

API-first platforms eliminate lock-in by exposing all AI capabilities through standard interfaces. Semiconductor OEMs maintain data ownership, can build custom models on the platform infrastructure, and preserve the ability to migrate. The key evaluation criterion is whether the vendor provides full API access to predictions, model retraining, and workflow orchestration.

Phased deployment begins with 2-3 high-volume tool families representing 40% of service calls. Initial 90-day implementation establishes API connections to FSM systems, ingests historical failure data, and validates predictions against technician outcomes. Subsequent phases expand to additional tool types quarterly while customizing models for proprietary equipment through platform extension capabilities.

Semiconductor OEMs track three primary metrics over six-month horizons: first-time fix rate improvement, truck roll reduction percentage, and SLA penalty avoidance. Leading deployments demonstrate 12-18 percentage point gains in first-time fix, 20-30% reduction in repeat visits, and 2-4% improvement in service margin contribution. These outcomes justify platform costs within 9-12 months while custom builds remain in development.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

Explore how platform approaches accelerate deployment while preserving strategic flexibility for semiconductor equipment manufacturers.

Schedule Strategic Consultation