Retiring technicians take decades of tribal knowledge with them—choose your preservation strategy now or face mounting first-time fix failures.

Industrial equipment OEMs face a strategic choice: build custom field service AI or deploy proven solutions. Buy-and-extend platforms deliver faster ROI while preserving technical flexibility, combining pre-trained models with open APIs to reduce time-to-value from 18+ months to 90 days without vendor lock-in.

Building custom AI requires 18-24 months for data pipelines, model training, and FSM integration. Competitors deploying faster solutions capture market advantage while internal teams struggle with infrastructure.

Senior technicians retiring with 20-30 years of equipment knowledge. Delaying AI deployment accelerates tribal knowledge loss, reducing first-time fix rates as inexperienced technicians lack diagnostic expertise.

Truck roll costs escalate with repeat visits and inefficient dispatch. Every quarter without predictive parts intelligence and AI-assisted diagnostics compounds service margins, exposing profitability to commodity pricing pressure.

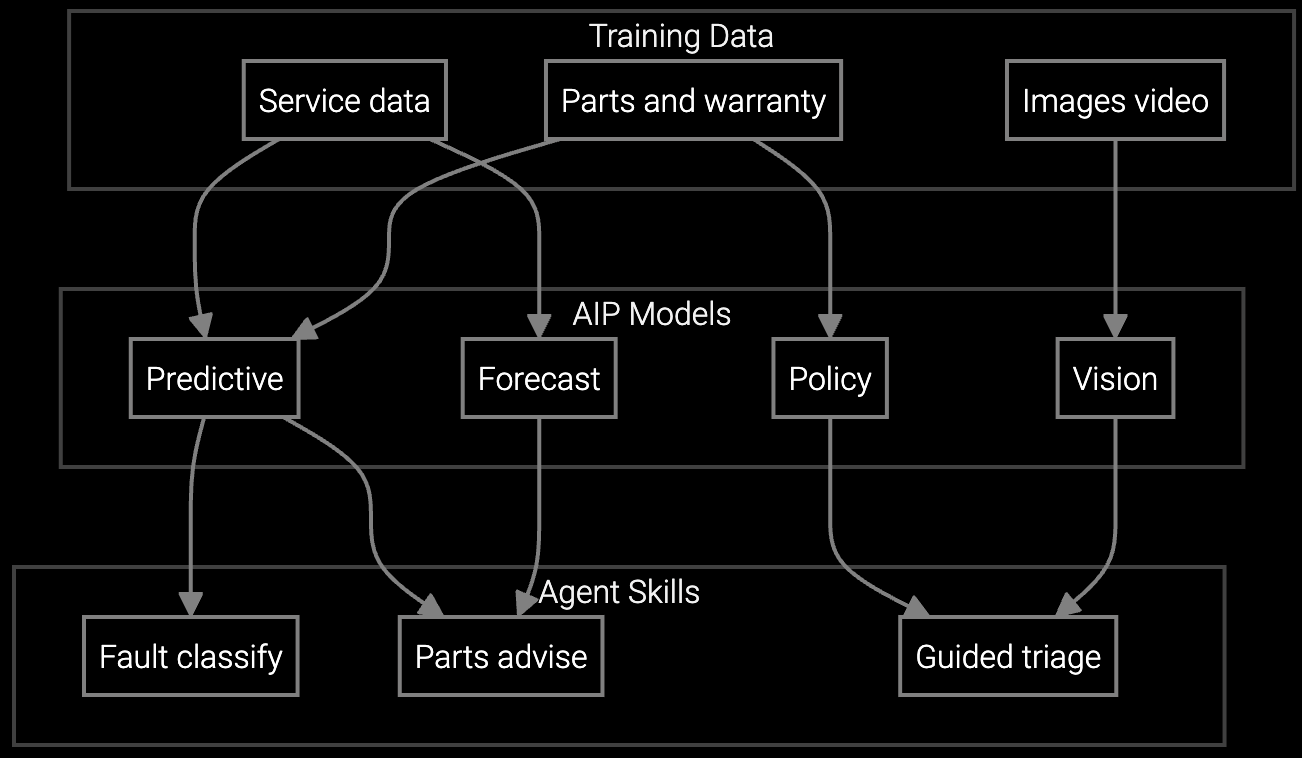

The strategic inflection point for industrial OEMs is recognizing that field service AI is not a "build or buy" binary—it's a build-and-extend decision. Pure build approaches delay value while internal teams replicate capabilities already proven at scale. Pure buy approaches risk vendor lock-in and customization constraints. The hybrid model deploys pre-trained foundation models for immediate impact while preserving API-level extensibility for competitive differentiation.

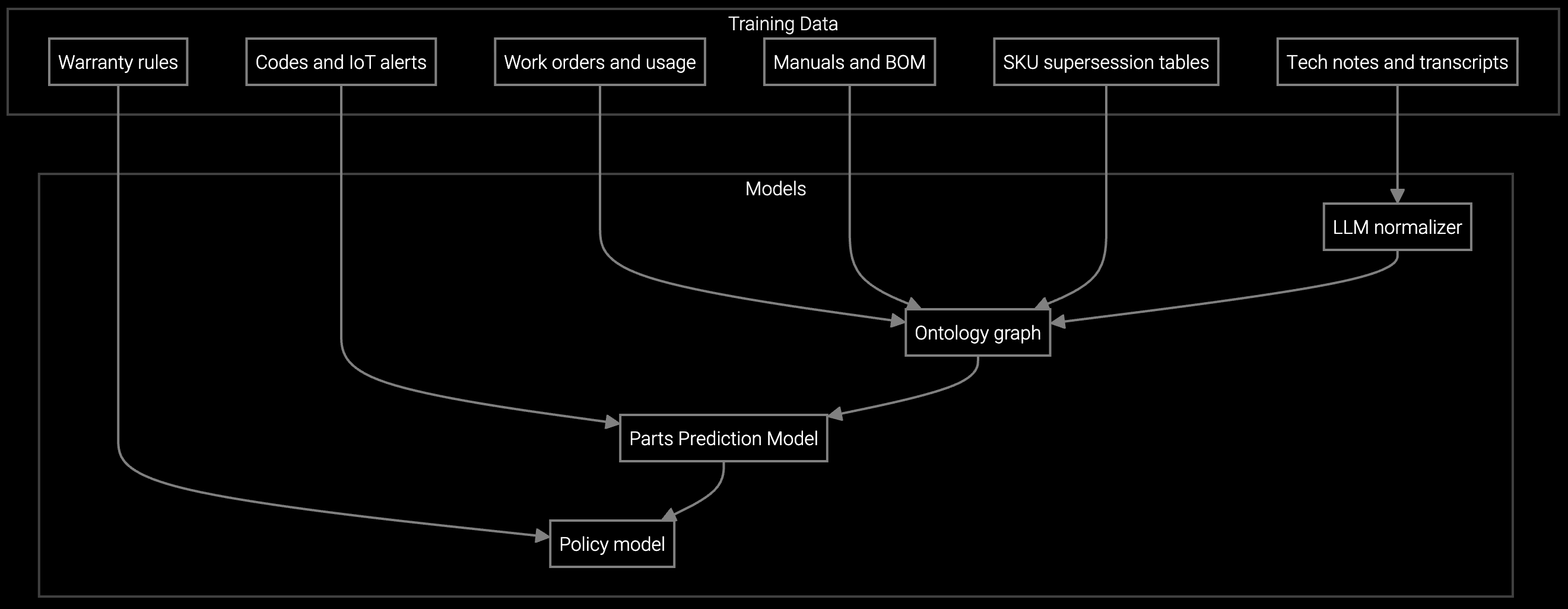

Bruviti's platform architecture addresses this strategic tension directly. Pre-trained models for parts prediction, root cause analysis, and technician decision support deliver 90-day deployment timelines. Open APIs enable custom model integration, proprietary data source connections, and FSM system orchestration without replacing existing infrastructure. This eliminates the "rip and replace" risk that stalls board approval while accelerating time-to-margin-improvement.

Predicts required replacement parts for CNC machines and heavy equipment before dispatch, reducing repeat visits and improving first-time fix rates for industrial service operations.

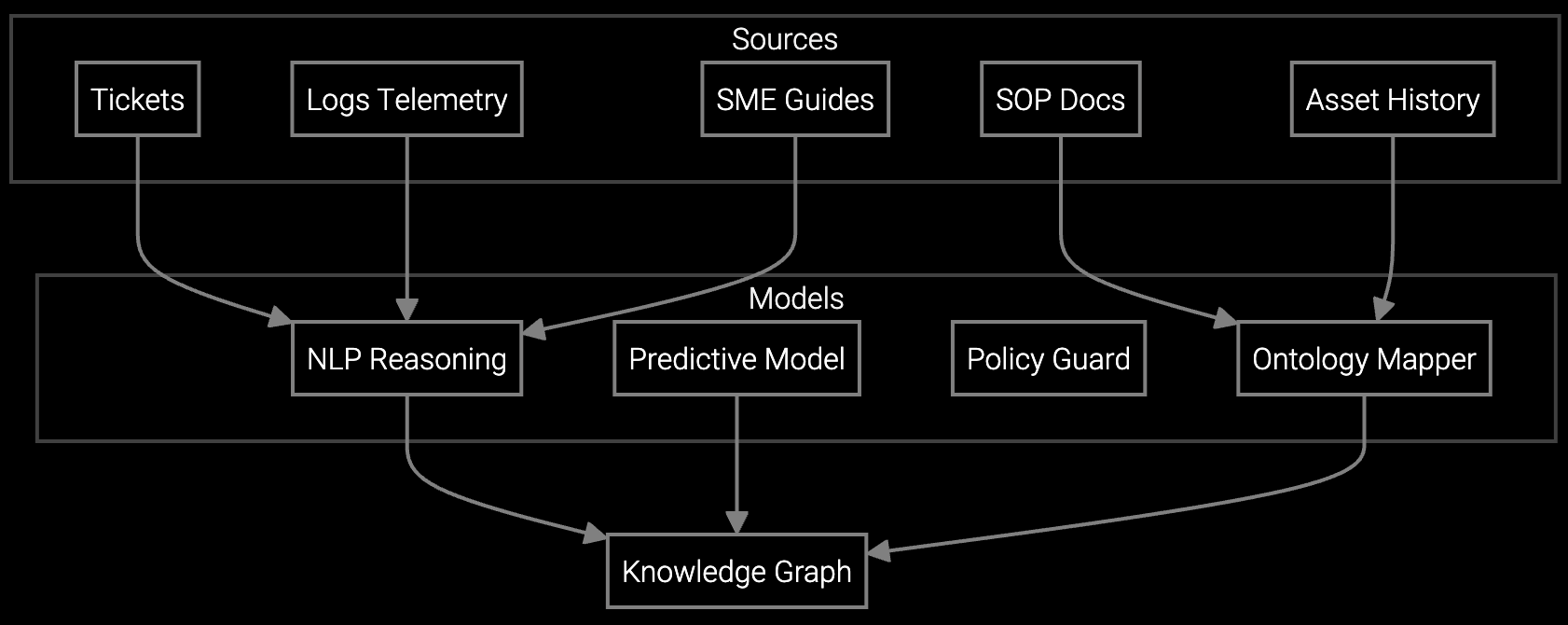

Correlates vibration patterns, temperature anomalies, and historical failure data to identify root causes faster, preserving retiring technician expertise in AI models for long-lifecycle equipment.

Mobile copilot delivers real-time repair guidance for industrial machinery, providing diagnostic recommendations and step-by-step procedures based on equipment model and failure symptoms.

Industrial equipment OEMs face unique AI deployment challenges stemming from 10-30 year equipment lifecycles and geographically distributed installed bases. Legacy machinery lacks modern telemetry, forcing AI systems to ingest heterogeneous data from PLCs, SCADA systems, and manual technician logs. The retiring workforce crisis compounds urgency—senior technicians with decades of pump, compressor, and turbine expertise are leaving faster than knowledge can be documented.

The buy-and-extend approach addresses these constraints by starting with high-volume equipment families where tribal knowledge loss poses immediate margin risk. Deploy parts prediction first on CNC machines or industrial robots with consistent failure patterns, capturing ROI within one warranty cycle. Extend to root cause analysis for complex systems like power generation equipment once foundational data pipelines prove value. This phased strategy builds board confidence while accelerating knowledge preservation before critical retirements.

Industrial OEMs typically see measurable ROI within 6-9 months of deployment when starting with high-volume equipment families. First-time fix rate improvements and reduced truck roll costs appear in the first warranty cycle, with full margin impact visible after two cycles as AI models ingest broader failure pattern data. This contrasts with 24+ month build timelines that delay value realization.

API-first architectures eliminate traditional lock-in by exposing all platform capabilities through documented interfaces. OEMs retain the ability to integrate proprietary models, connect custom data sources, and orchestrate multi-vendor systems without replacing core infrastructure. The platform becomes a composable layer rather than a monolithic replacement, preserving strategic flexibility while accelerating deployment.

Knowledge preservation requires capturing diagnostic patterns and repair decisions during normal workflow rather than post-retirement interviews. AI platforms that ingest technician notes, parts selections, and repair outcomes automatically train models on implicit expertise. Deploy decision support tools that prompt senior technicians to document reasoning while assisting junior staff, creating a feedback loop that embeds tribal knowledge into production systems before retirements accelerate.

Treating field service AI as an IT project rather than a margin protection strategy. Successful deployments start with high-impact equipment families where service costs threaten profitability, not comprehensive data infrastructure buildouts. Board-level commitment emerges when AI demonstrably reduces truck rolls and improves first-time fix rates within two quarters, not when technical teams present theoretical capabilities. Start narrow, prove value, then scale.

Integration follows a "surround and extend" pattern rather than replacement. AI platforms connect to existing FSM systems via APIs, enriching work orders with parts predictions and diagnostic recommendations without changing technician workflows. Dispatch systems continue routing jobs normally while AI layers provide intelligence that improves outcomes. This approach minimizes change management risk while delivering measurable impact, building confidence for deeper integration later.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

Discuss your build-versus-buy decision with experts who've deployed across industrial equipment OEMs.

Schedule Strategic Consultation