With $50M+ fab inventories and nanometer-precision equipment failures, your parts forecasting approach shapes margin survival.

Semiconductor OEMs face unique parts forecasting challenges due to $50M+ inventory costs and unpredictable failure patterns. The optimal approach combines in-house domain knowledge with specialized AI models that learn equipment-specific failure modes.

Fabs carry massive parts buffers because traditional forecasting cannot predict chamber component failures or recipe-driven consumable consumption patterns. This defensive overstocking directly erodes operating margins.

When critical chamber kits or high-value components are out of stock, expedited logistics costs multiply. At $1M+ per hour downtime, overnight shipments become routine, inflating service costs unpredictably.

Process node transitions and tool upgrades render existing chamber parts obsolete faster than traditional inventory planning anticipates. Each technology shift triggers multi-million dollar writedowns of stranded stock.

The build-versus-buy debate for semiconductor parts forecasting misses the strategic middle ground. Building in-house requires multi-year data science investments and continuous model retraining as equipment portfolios evolve. Buying black-box vendor solutions locks you into systems that cannot incorporate your proprietary process telemetry or adapt to new lithography generations.

Bruviti's platform offers a third path: pre-trained models that understand semiconductor-specific failure modes, delivered through open APIs that integrate with your SAP or Oracle systems. You retain full control over data while leveraging AI that has learned from thousands of fabs. The platform ingests tool sensor data, PM schedules, and recipe parameters to forecast demand by location and time window—then surfaces substitute parts when primary stock runs low. This hybrid approach delivers speed-to-value without vendor lock-in, protecting your competitive differentiation while accelerating margin improvement.

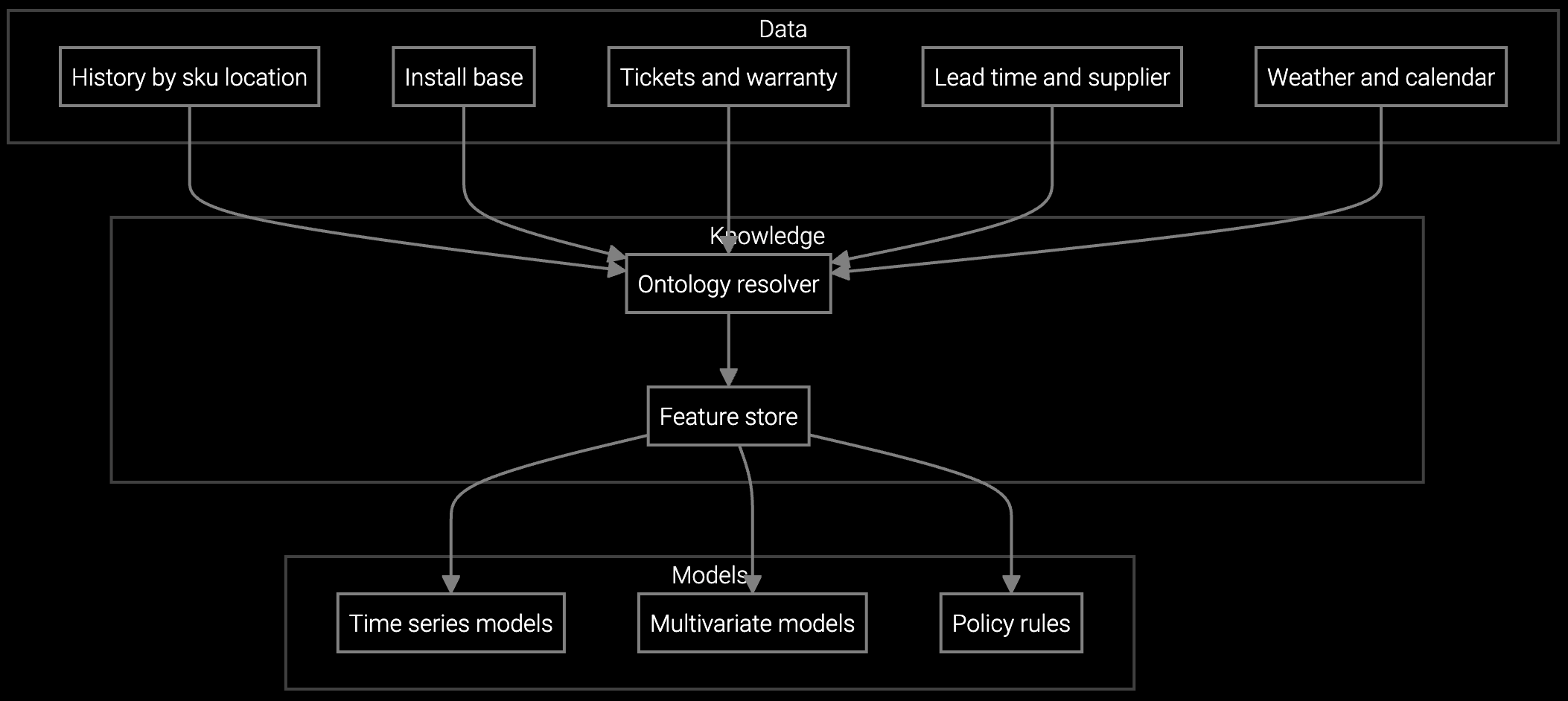

Predict chamber kit consumption and consumable usage based on tool age, process recipes, and wafer throughput patterns across your installed base.

Optimize stock allocation across regional warehouses by forecasting demand spikes tied to preventive maintenance cycles and equipment upgrade schedules.

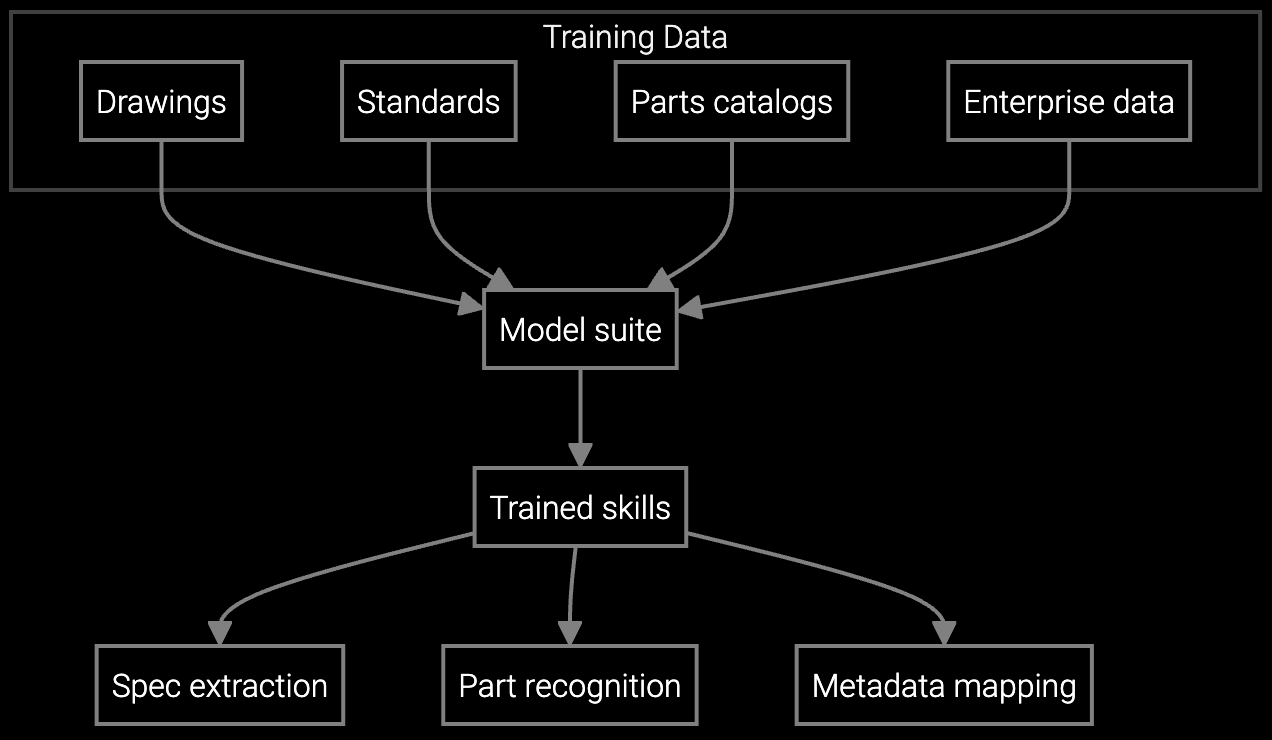

Accelerate quoting and ordering by instantly identifying part numbers from engineering schematics and chamber assembly drawings.

Semiconductor tools operate with sub-5nm precision, and failure modes are tightly coupled to process parameters. A slight recipe adjustment in an etch chamber alters consumable wear rates; a new lithography mask set changes cleaning frequency. Traditional forecasting treats parts as commodities with stable demand curves. Semiconductor inventory requires models that understand these physics-driven dependencies.

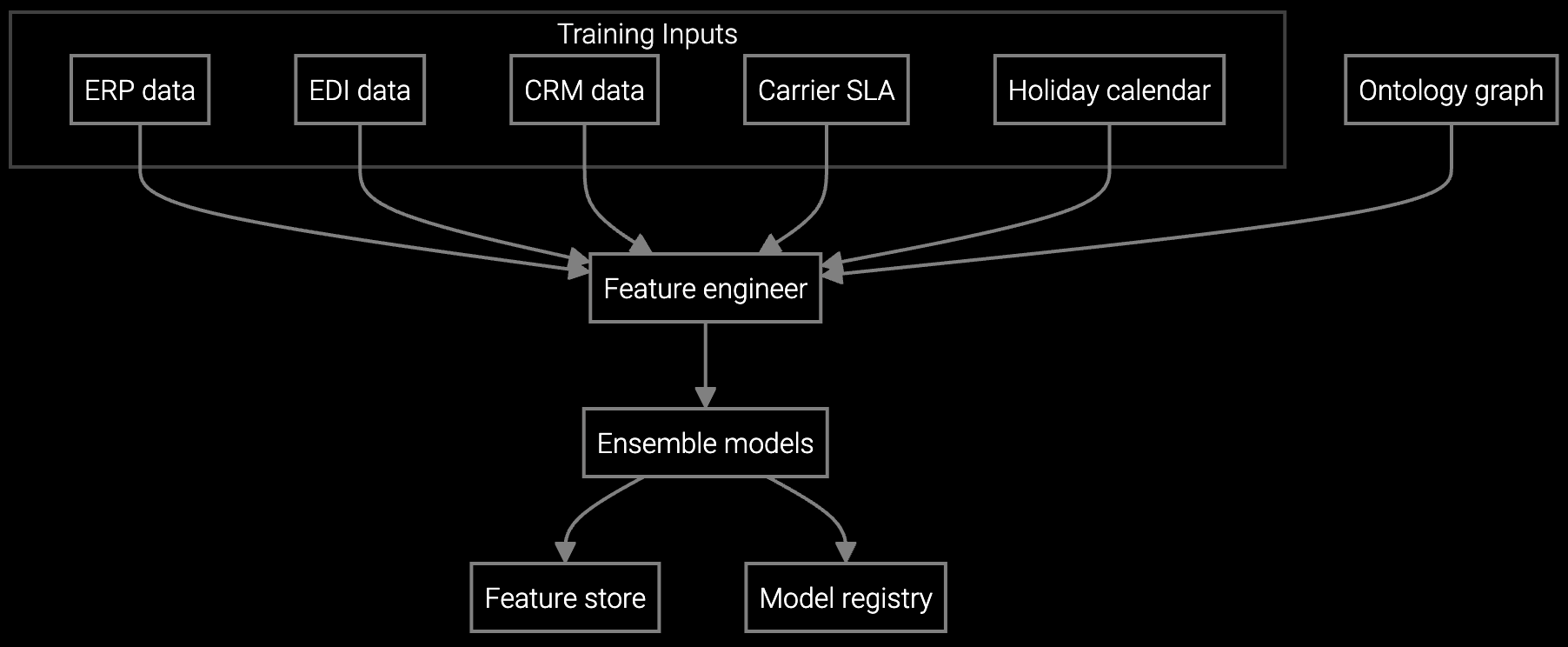

The platform ingests telemetry from lithography systems, deposition tools, and metrology equipment to detect drift patterns that precede component failures. It correlates PM schedules with historical chamber kit consumption, then adjusts forecasts as fabs shift between process nodes. For EUV systems with $150M+ capital costs, even minor forecast accuracy improvements translate to millions in avoided downtime and carrying cost reduction.

Building in-house makes sense only if you have dedicated data science teams and multi-year runway. Most OEMs lack the volume of failure data needed to train accurate models from scratch. Partnering with a platform that already understands semiconductor-specific failure modes accelerates time to value while preserving your ability to customize with proprietary telemetry.

Effective forecasting requires tool sensor data (temperature, pressure, flow rates), preventive maintenance schedules, historical parts consumption records, and process recipe parameters. The AI learns correlations between equipment behavior and component wear, then predicts when specific parts will be needed at each location.

The platform tracks equipment upgrade roadmaps and correlates them with historical obsolescence patterns from previous node transitions. As tools transition from 7nm to 5nm processes, the system flags chamber components likely to become stranded inventory, enabling proactive drawdown strategies that minimize writedowns.

Yes. Bruviti provides REST APIs and pre-built connectors for SAP, Oracle, and major WMS platforms. Demand forecasts sync directly into your procurement workflows, and the system can trigger automatic reorder recommendations when stock falls below safety thresholds based on predicted consumption.

Most semiconductor OEMs see measurable inventory reduction within two quarters of deployment. Initial pilots typically focus on high-value consumables where small accuracy gains yield large savings. Full ROI—including emergency shipment reduction and obsolescence avoidance—materializes over 12-18 months as the AI learns equipment-specific patterns across your installed base.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

Discover how semiconductor OEMs are protecting margins with AI-driven demand forecasting.

Schedule Strategy Session