Network downtime penalties make parts availability non-negotiable—but excess inventory kills margins.

AI orchestrates demand forecasting, substitute matching, and stock replenishment across multiple locations—reducing carrying costs while maintaining fill rates above 95% for network equipment spare parts.

Network OEMs overstock routers, switches, and optical modules across regional warehouses because demand patterns are unpredictable. High-value inventory sits idle while carrying costs erode service margins.

When network equipment fails, customers demand immediate replacement. Missing parts trigger SLA penalties and emergency air shipments that destroy quarterly service profitability.

Network equipment has long service contracts, but components reach end-of-life. Without substitute part matching, OEMs hold obsolete inventory or face backorder penalties.

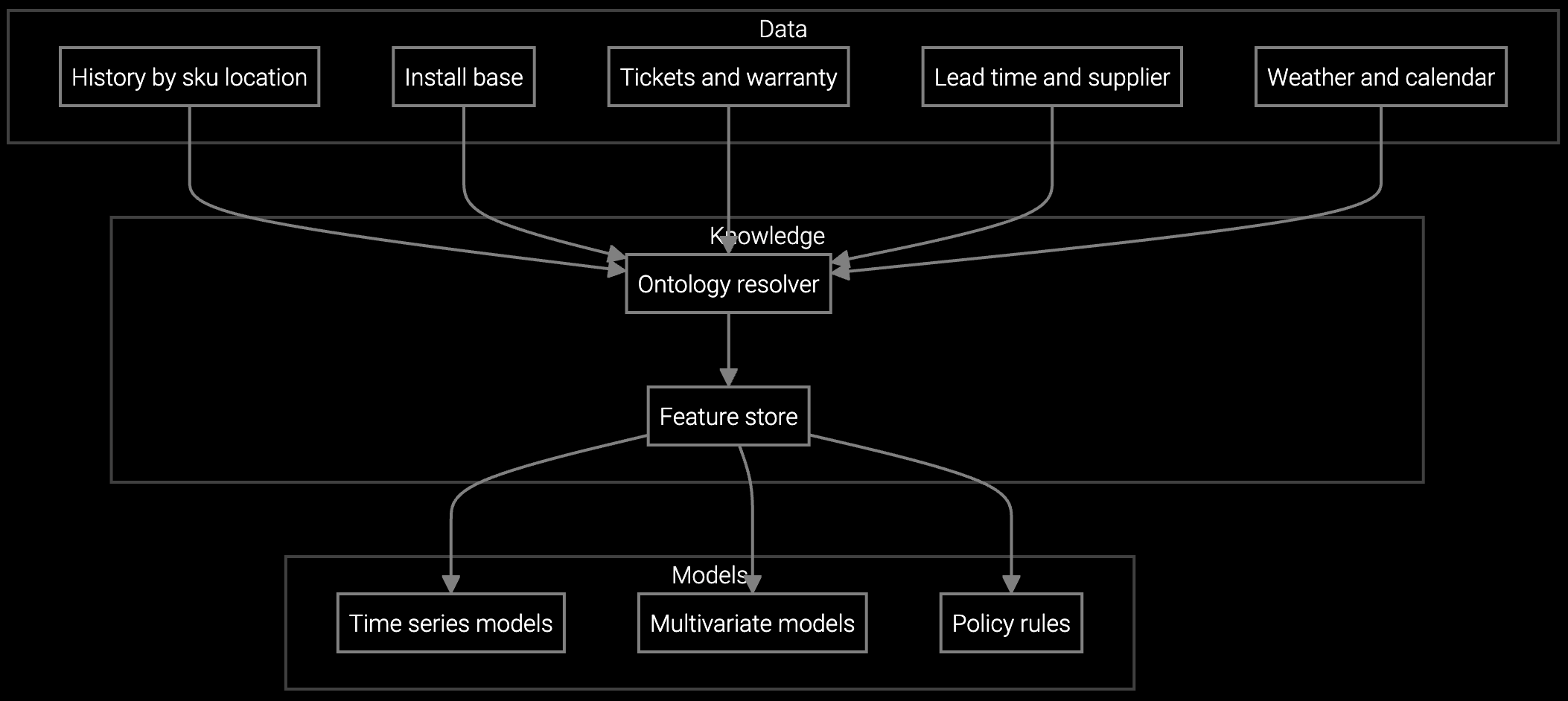

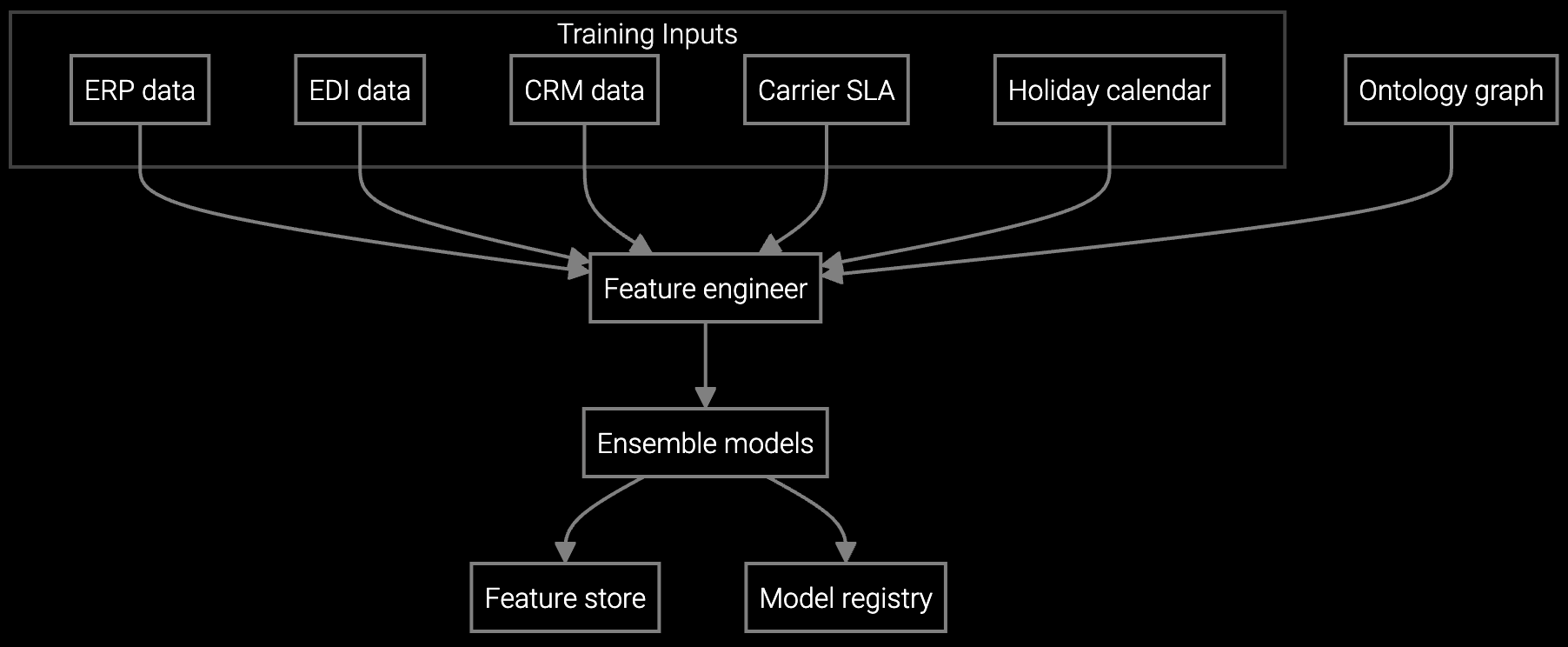

Bruviti's platform executes the entire parts workflow—from demand signal detection to warehouse allocation decisions—without manual intervention. The AI continuously ingests SNMP traps, RMA patterns, and installed base telemetry to predict which router models, power supplies, or optical transceivers will fail in the next 30-90 days. It then auto-adjusts stock levels across regional distribution centers, maintaining target fill rates while eliminating the safety stock buffer that inflates carrying costs.

For network OEMs managing thousands of SKUs across dozens of locations, the platform replaces spreadsheet-based replenishment with real-time orchestration. When a critical switch failure triggers an RMA, the system instantly identifies available inventory, suggests compatible substitutes if the original part is EOL, and auto-generates the fulfillment order—turning a four-hour manual process into a 90-second automated workflow.

Predicts router and switch spare parts demand by analyzing installed base age, firmware vulnerabilities, and seasonal traffic spikes—optimizing stock levels across regional warehouses.

Forecasts network equipment part requirements by location and time window, ensuring high-value optical modules and power supplies are positioned where failures are likely to occur.

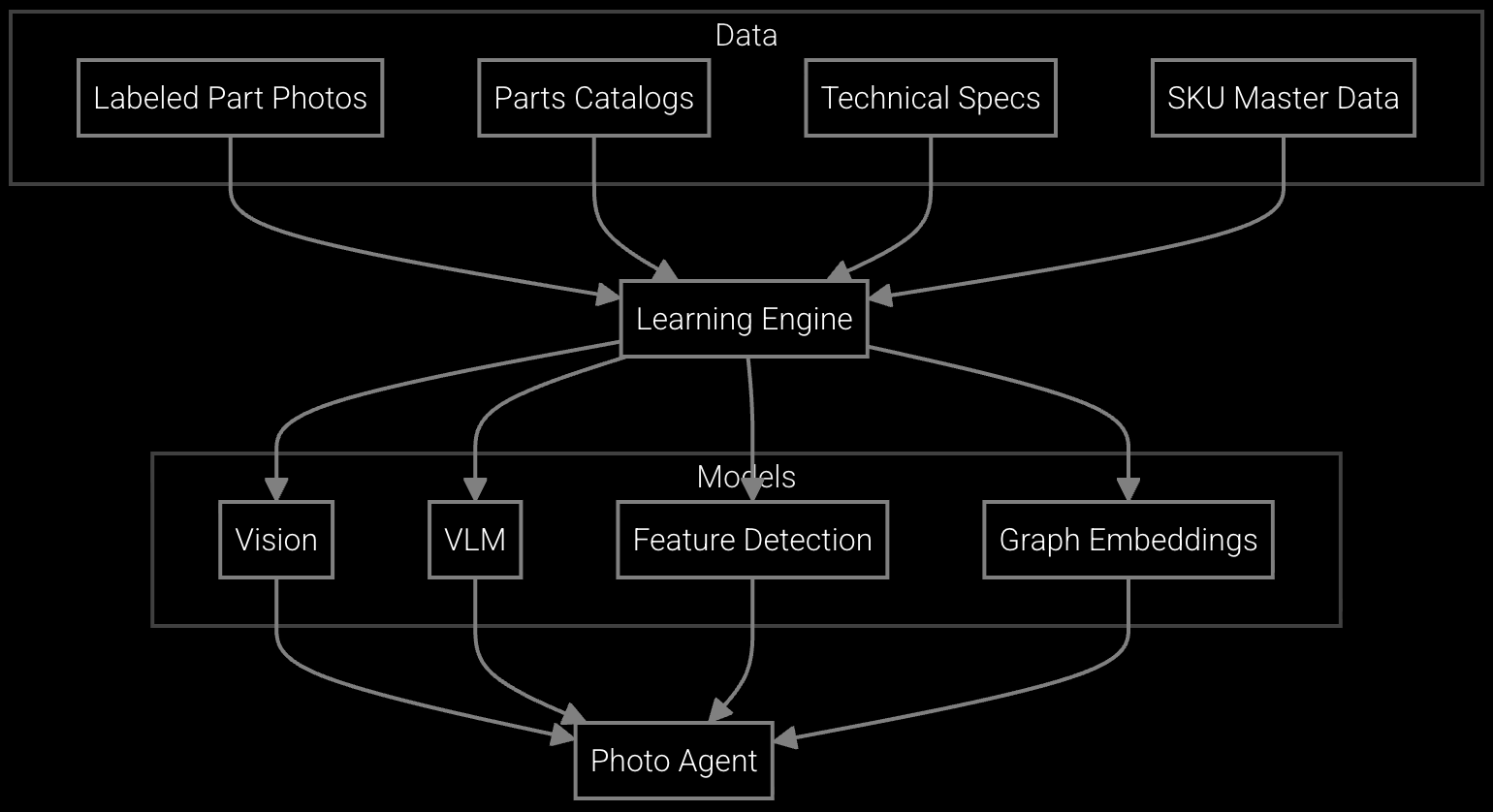

Enables field engineers to photograph failed network components and instantly receive part numbers, substitute options, and availability—accelerating the ordering workflow.

Network OEMs face a unique inventory challenge: optical transceivers, line cards, and power modules cost $800-$15,000 per unit but have unpredictable failure rates. Traditional min-max replenishment creates bloated safety stock because planners fear SLA penalties. The AI breaks this trade-off by predicting failures at the device serial number level, using telemetry patterns that precede hardware faults by 60-90 days.

For carrier-grade equipment under 99.999% uptime SLAs, the platform prioritizes stock positioning over aggregate inventory levels. A router deployed in a Tier 1 data center gets higher spare parts priority than the same model in an enterprise branch office—optimizing fulfillment speed and cost simultaneously.

Traditional models use historical consumption rates to set static reorder points. AI forecasting ingests real-time telemetry, firmware vulnerability data, and installed base aging patterns to predict failures before they occur—allowing OEMs to position inventory proactively rather than reactively. This eliminates the need for large safety stock buffers across all locations.

Network equipment OEMs see measurable carrying cost reduction within 90 days of deployment. The AI begins optimizing stock levels immediately, but it takes one full demand cycle to realize the complete benefit. Emergency shipment reductions appear faster—often within 30 days—because the platform prevents stockouts on high-priority parts.

The AI maintains a substitute part matrix trained on component specifications, connector types, and firmware compatibility. When a part reaches EOL, the platform auto-suggests alternatives and adjusts demand forecasts to shift orders to the substitute SKU. This prevents obsolete inventory accumulation while ensuring contract obligations are met.

Yes. The platform analyzes installed base geography, average service response time requirements, and freight costs to determine optimal stock positioning. It continuously rebalances inventory between regional distribution centers based on predicted demand, minimizing both carrying costs and fulfillment lead times.

Minimum viable data includes RMA history, parts consumption records, and installed base inventory. Enhanced forecasting adds device telemetry (SNMP traps, syslog), firmware version data, and warranty claim patterns. The platform adapts to available data sources, with accuracy improving as more signals are integrated.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how Bruviti's platform reduces carrying costs while improving parts availability for network OEMs.

Schedule Demo