Incomplete asset data and configuration drift cost network OEMs millions in missed renewals and reactive service.

Network OEMs can build custom asset tracking systems (high control, long timeline) or buy pre-built platforms (faster deployment, potential lock-in). A hybrid API-first approach delivers speed with customization—AI models track configuration drift and predict failures while allowing full integration with existing systems.

Missing serial numbers and configuration data prevent proactive service. Legacy routers and switches often lack modern telemetry, leaving OEMs blind to field conditions until customer-reported failures.

Actual device states diverge from records as firmware updates, patches, and changes accumulate. This drift erodes confidence in asset data and undermines predictive maintenance strategies.

Without visibility into EOL/EOS timelines and equipment health, renewal conversations happen too late or not at all. OEMs leave margin on the table.

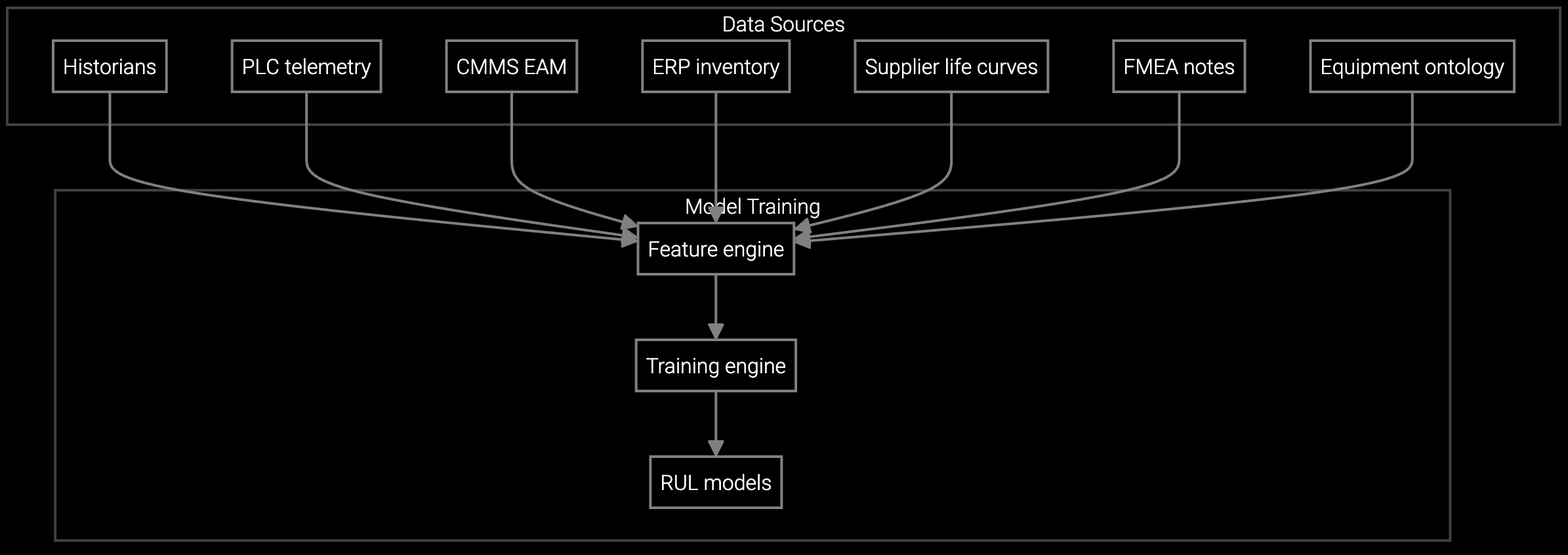

Bruviti's platform combines pre-built AI models with full API access, eliminating the build-vs-buy tradeoff. The AI ingests SNMP traps, syslog streams, and firmware manifests to construct accurate asset registries—tracking configuration changes, predicting failures, and flagging EOL equipment without manual inventory audits.

Unlike closed vendor systems, the platform integrates directly with existing ERP, CRM, and NOC tools via REST APIs. This approach delivers the speed of a SaaS deployment with the control of an in-house build. No data lock-in. No proprietary formats. Your team extends the models to address network-specific failure modes while the platform handles the heavy lifting of telemetry parsing and anomaly detection.

Analyzes SNMP and syslog streams from routers and switches to identify anomalies before they trigger SLA breaches.

Estimates when network devices will fail based on firmware version, uptime, and error log patterns—enabling planned maintenance windows.

Schedules proactive interventions based on actual device health rather than fixed intervals, reducing downtime risk.

Network OEMs manage routers, switches, and firewalls deployed across carrier NOCs, enterprise data centers, and remote branch locations—often numbering in the hundreds of thousands. The platform ingests telemetry from diverse firmware versions and hardware generations, normalizing syslog formats and SNMP MIBs to create unified asset records.

Configuration management becomes tractable at scale. The AI detects when firmware versions drift from approved baselines, flags CVE-vulnerable devices, and identifies candidates for EOL/EOS upgrades. This visibility transforms contract renewal conversations from reactive (responding to customer RFPs) to proactive (presenting data-driven upgrade paths before contracts lapse).

Custom builds for network OEMs typically require 18-24 months from requirements definition to production deployment. This includes data pipeline engineering, telemetry normalization across device types, AI model training, and integration with ERP/CRM systems. Pre-built platforms reduce this timeline to 3-6 months by providing ready-made connectors and trained models.

Proprietary platforms often use closed data formats and limited export capabilities, making migration costly. API-first platforms mitigate this risk by exposing all data and models via REST APIs, allowing gradual migration or parallel operation with legacy systems. Evaluate contract terms for data portability and model ownership before committing.

AI models parse unstructured telemetry—syslog entries, SNMP traps, firmware version strings—to automatically populate and update asset records. This eliminates manual data entry errors and keeps configuration records synchronized with actual device states, even as firmware updates and patches are applied across the installed base.

Network OEMs typically see 15-25% increases in contract attachment rates by identifying renewal candidates earlier. Proactive EOL/EOS identification converts reactive service costs into planned upgrade revenue. Reduced configuration drift lowers RMA rates by catching misconfigured devices before they fail in the field.

Yes. API-first platforms allow you to inject custom telemetry streams and train models on OEM-specific failure patterns. For example, you might track optical signal degradation in DWDM systems or packet loss trends in carrier routers—metrics unique to your equipment portfolio that pre-built models don't address out of the box.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Discover how Bruviti's API-first platform delivers custom control with SaaS speed for network equipment OEMs.

Schedule Strategic Consultation