No Fault Found returns drain margin faster than any other warranty cost driver—and hyperscale customers have zero tolerance for processing delays.

Data center OEMs reduce No Fault Found rates by 40-60% using AI-powered warranty claim validation that cross-references BMC telemetry, configuration data, and failure patterns to identify invalid returns before processing.

Hyperscale customers replace entire server nodes at the first sign of trouble, flooding RMA queues with components that test perfectly. Each unnecessary return adds refurbishment cost, logistics expense, and warranty reserve erosion.

Manual validation of warranty status across thousands of configurations and service tiers creates processing bottlenecks. Each day of delay risks SLA penalties and customer escalations in mission-critical environments.

CFOs demand accurate warranty accruals, but without visibility into which claims will prove valid, reserves swing wildly. Overestimating hurts margins; underestimating triggers earnings restatements.

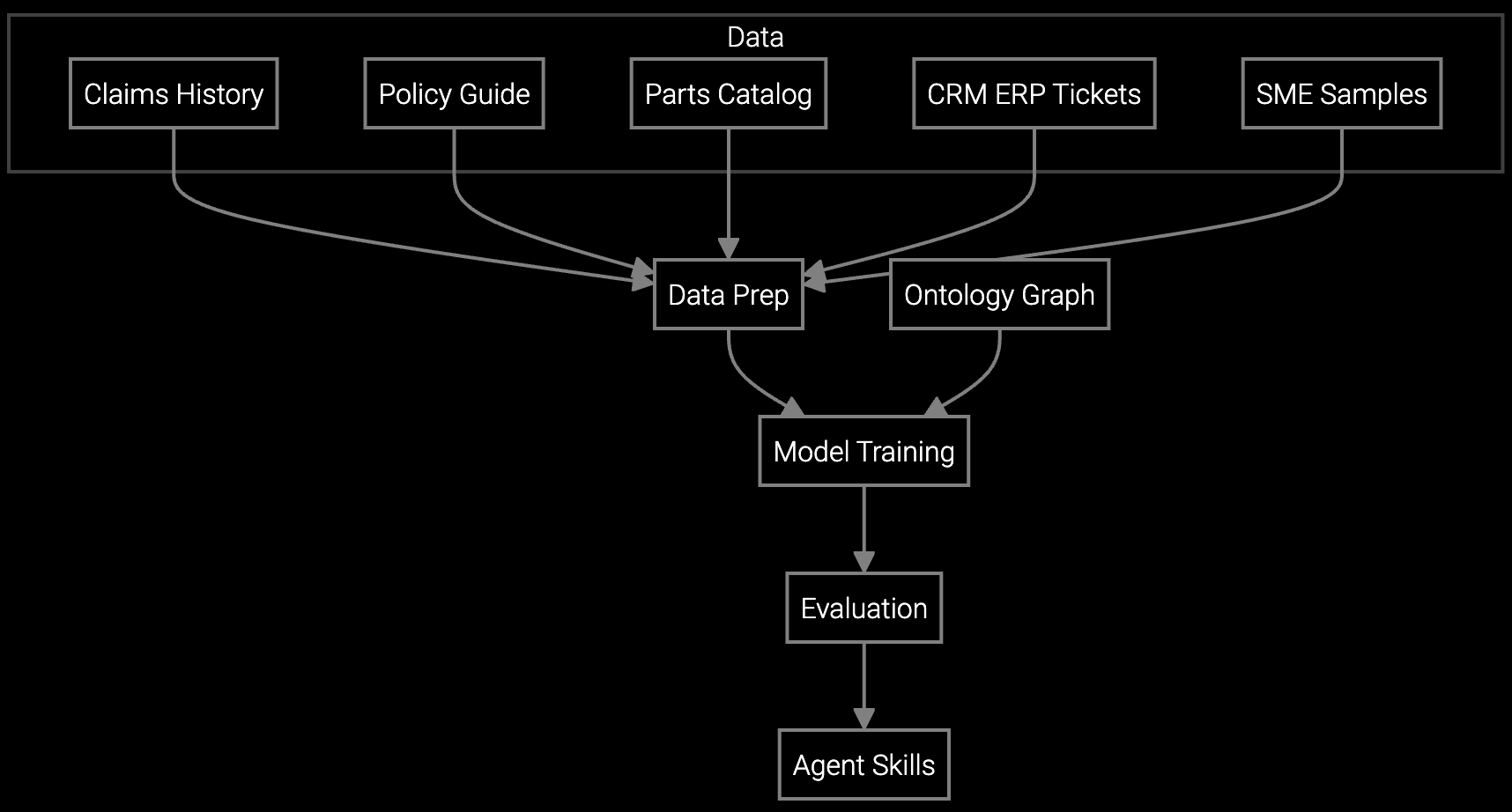

Bruviti's platform ingests BMC telemetry, IPMI logs, and configuration data to reconstruct the pre-failure state of every server component. When a claim arrives, the AI compares reported symptoms against actual hardware behavior patterns, identifying discrepancies that signal No Fault Found risk before the return ships.

The system learns from refurbishment outcomes, continuously refining fraud detection models to flag suspicious claims without blocking legitimate failures. For executives, this means predictable warranty reserves, lower NFF rates, and margin protection at hyperscale volumes where every percentage point matters.

Automatically classifies and codes warranty claims for data center hardware, reducing manual processing time and improving reserve forecasting accuracy.

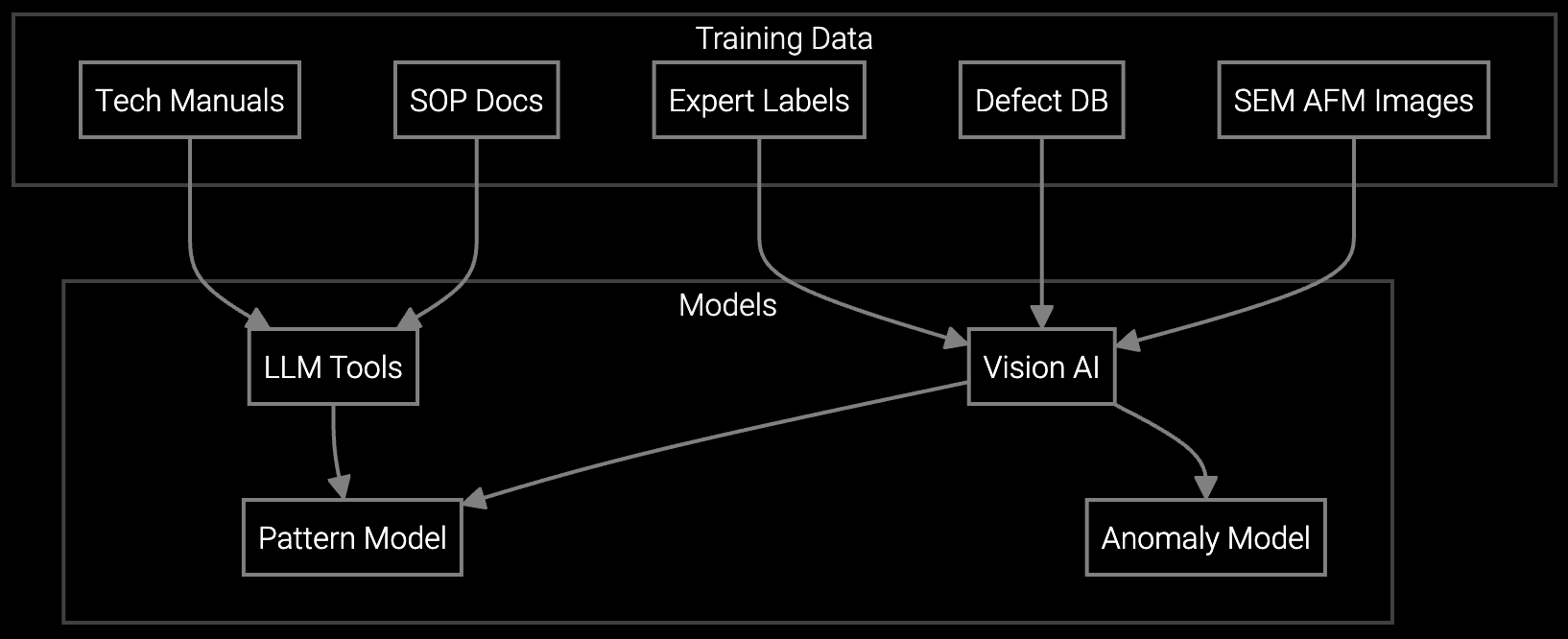

AI analyzes microscopic failure evidence from server components to validate warranty claims and classify root causes at scale.

Hyperscale customers operate hundreds of thousands of servers under aggressive SLAs where every hour of downtime costs six figures. When a server node underperforms, they swap the entire unit rather than diagnose individual DIMMs, drives, or power supplies—creating a flood of returns where 30% test perfectly in refurbishment.

Traditional warranty systems can't keep pace. Manual validation of BMC logs and IPMI data takes days, but hyperscale contracts demand 4-hour response times. CFOs need predictable warranty reserves, but without automated claim validation, accruals swing 20% year over year, triggering earnings volatility that erodes investor confidence.

The platform compares reported failure symptoms against BMC telemetry and IPMI logs captured before the return. If hardware sensors showed normal operation patterns and the claimed failure mode never appeared in diagnostic data, the AI flags the claim for review before shipping. This prevents unnecessary refurbishment costs on components that will test perfectly.

BMC telemetry feeds, IPMI logs, warranty entitlement databases, refurbishment test results, and claims history. The AI learns which hardware behavior patterns correlate with legitimate failures versus customer misdiagnosis. Integration typically takes 6-8 weeks for the first product line.

By predicting which claims will prove invalid before processing, the platform provides forward-looking visibility into actual warranty costs. CFOs can model reserves based on validated claim rates rather than assuming all submitted claims will pay out. This reduces variance by 40-50% and eliminates earnings surprises from warranty reserve adjustments.

Yes. The AI identifies anomalous patterns invisible to manual review—like customers repeatedly claiming the same failure mode across configurations where it physically can't occur, or submitting claims outside warranty windows. Detection accuracy improves continuously as the system learns from refurbishment outcomes.

Data center OEMs typically see 25-40% reduction in NFF-related costs, 60-70% faster claims processing, and 15-20% improvement in warranty reserve accuracy. For a $500M/year server OEM, this translates to $8-12M in direct savings plus reduced CFO exposure to earnings volatility from warranty surprises.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how Bruviti reduces No Fault Found rates by 40-60% and stabilizes warranty reserves.

Schedule Executive Briefing