Seasonal spikes and decades of model coverage make inventory decisions critical for margin protection.

Appliance OEMs face a choice: build custom forecasting systems requiring data science teams and 18-24 months, or adopt proven platforms that deploy in weeks with pre-trained models on appliance failure patterns, delivering 15-20% inventory reduction in first 90 days.

Building in-house forecasting systems requires assembling data science teams, training models on your specific appliance failure patterns, and iterating through seasonal cycles before accuracy improves.

HVAC and refrigeration parts demand spikes during extreme weather, creating stockout risk during peak season while leaving excess inventory in off-months if forecasts lack seasonal intelligence.

Maintaining parts for decades of appliance models creates thousands of SKUs with unpredictable demand patterns, making manual forecasting impossible and generic inventory systems ineffective.

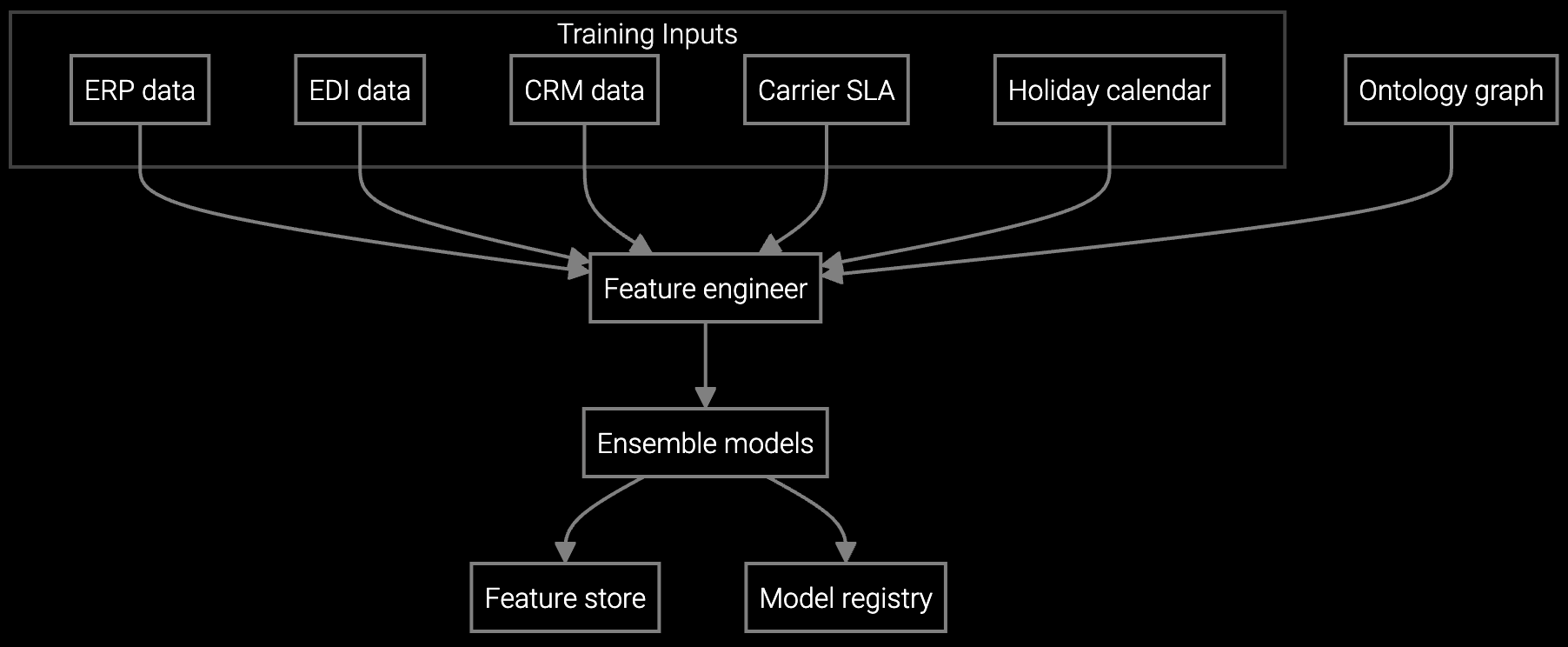

Building custom demand forecasting requires hiring data scientists familiar with time series models, acquiring historical warranty and service data across all product lines, and training algorithms to recognize appliance-specific failure patterns like compressor wear curves and heating element degradation rates. Most appliance OEMs underestimate the time needed to tune models for seasonal HVAC spikes and the long tail of older models still in service.

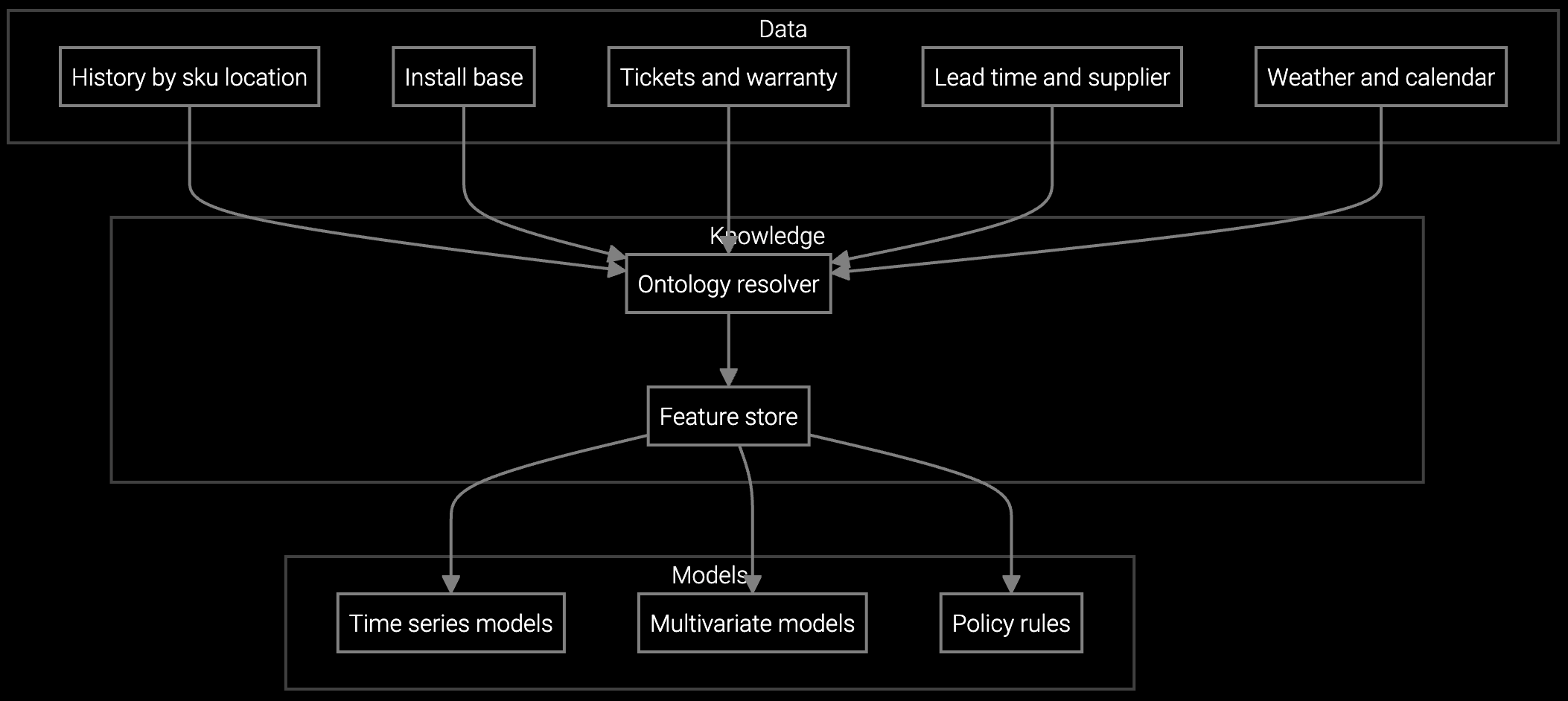

Platform approaches deliver pre-trained models that understand appliance failure physics and seasonal patterns out of the box. Bruviti's system ingests your service history, warranty claims, and installed base data to generate location-specific forecasts in weeks rather than years. The platform handles substitute parts matching automatically when original components reach end-of-life, a complexity that custom builds often defer until production.

Projects refrigerator compressor and HVAC component consumption based on installed base age, seasonal weather patterns, and regional service trends to optimize warehouse stocking levels.

Forecasts dishwasher pump and washing machine motor demand by distribution center and time window, reducing carrying costs while maintaining 95%+ fill rates during peak repair seasons.

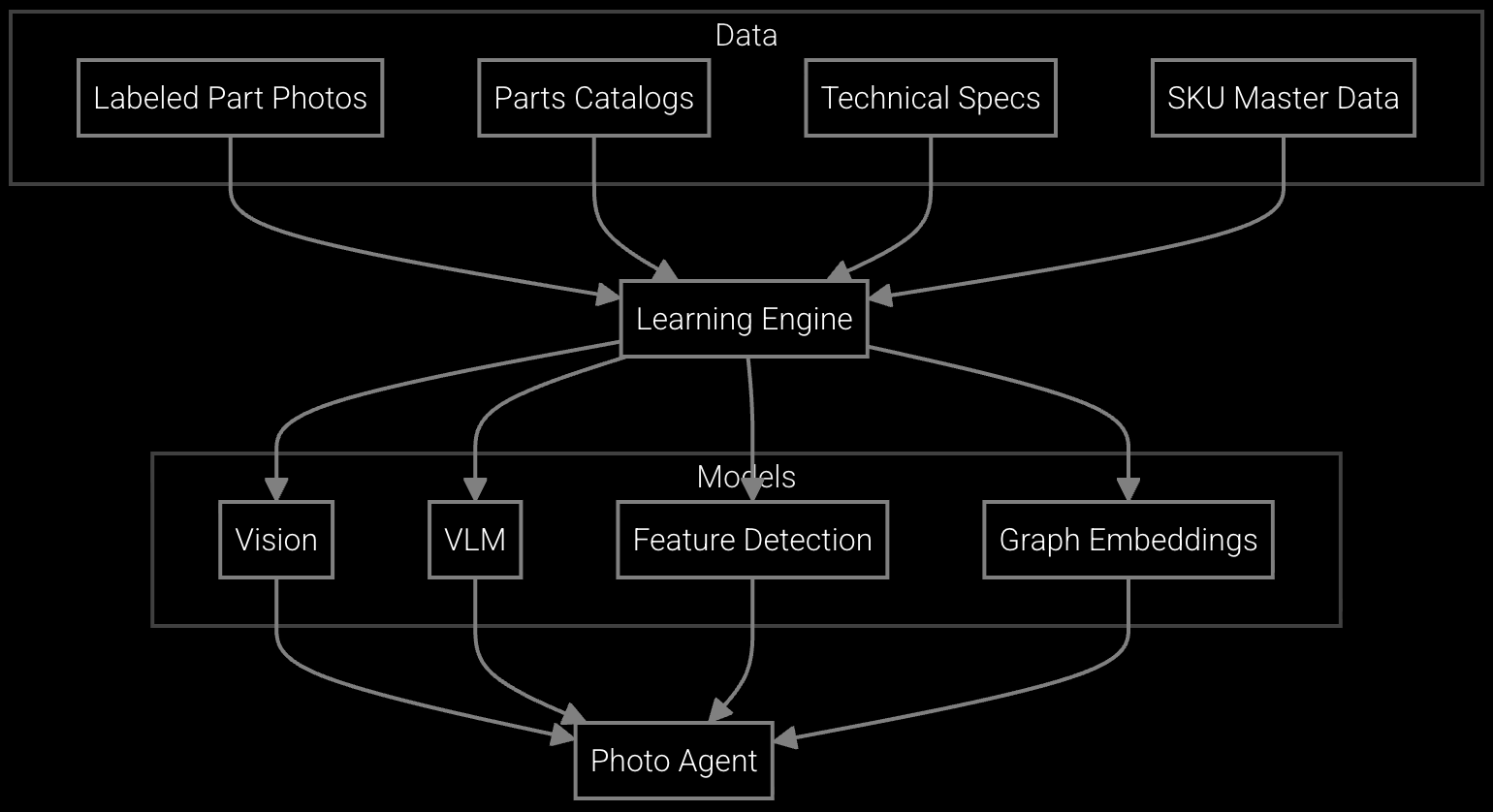

Enables service teams to photograph broken oven igniters or refrigerator door seals and instantly receive part numbers with substitute options when originals are obsolete.

Appliance OEMs face compressed service margins as connected appliances increase warranty exposure and consumers expect immediate resolution for home disruptions. The strategic window for inventory optimization is narrowing as competitors adopt AI-driven forecasting to reduce service costs and protect warranty reserves.

Platform adoption lets you capture savings during the next HVAC peak season rather than waiting 18 months for custom builds to deliver results. Early movers gain competitive advantage through superior parts availability while reducing carrying costs that directly impact service profitability on thin appliance margins.

Platform deployments typically deliver 10-15% inventory reduction within the first 90 days as models tune to your appliance failure patterns and regional demand differences. Full 15-20% reduction appears after one complete seasonal cycle when the system has learned peak HVAC demand patterns.

Effective demand forecasting requires three years of service order history, warranty claims data with symptom codes, and installed base records showing product age and location. Most appliance OEMs already have this data in their ERP and warranty systems, making platform integration straightforward.

Modern platforms automatically identify when original parts reach end-of-life and recommend compatible substitutes based on form, fit, and function analysis. This capability is critical for appliance OEMs maintaining parts support for 10-15 year product lifecycles where many original components are discontinued.

Custom builds require 18-24 months including at least one full seasonal cycle to train models on HVAC peak patterns. Platforms come pre-trained on appliance seasonality and begin optimizing for your specific regional patterns within weeks, capturing savings during the first summer or winter peak.

Custom builds require permanent data science teams for model maintenance, seasonal retraining, and feature updates, typically costing $500K-$1M annually. Platform subscriptions include model updates, new feature releases, and support, with pricing based on transaction volume rather than headcount.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how Bruviti delivers inventory reduction in weeks, not years.

Schedule Demo