Network downtime costs $5,600 per minute, but excess inventory locks up millions in working capital.

Deploy predictive inventory optimization by integrating demand forecasting models with existing ERP systems, starting with high-failure-rate SKUs to validate accuracy before expanding to full catalog coverage.

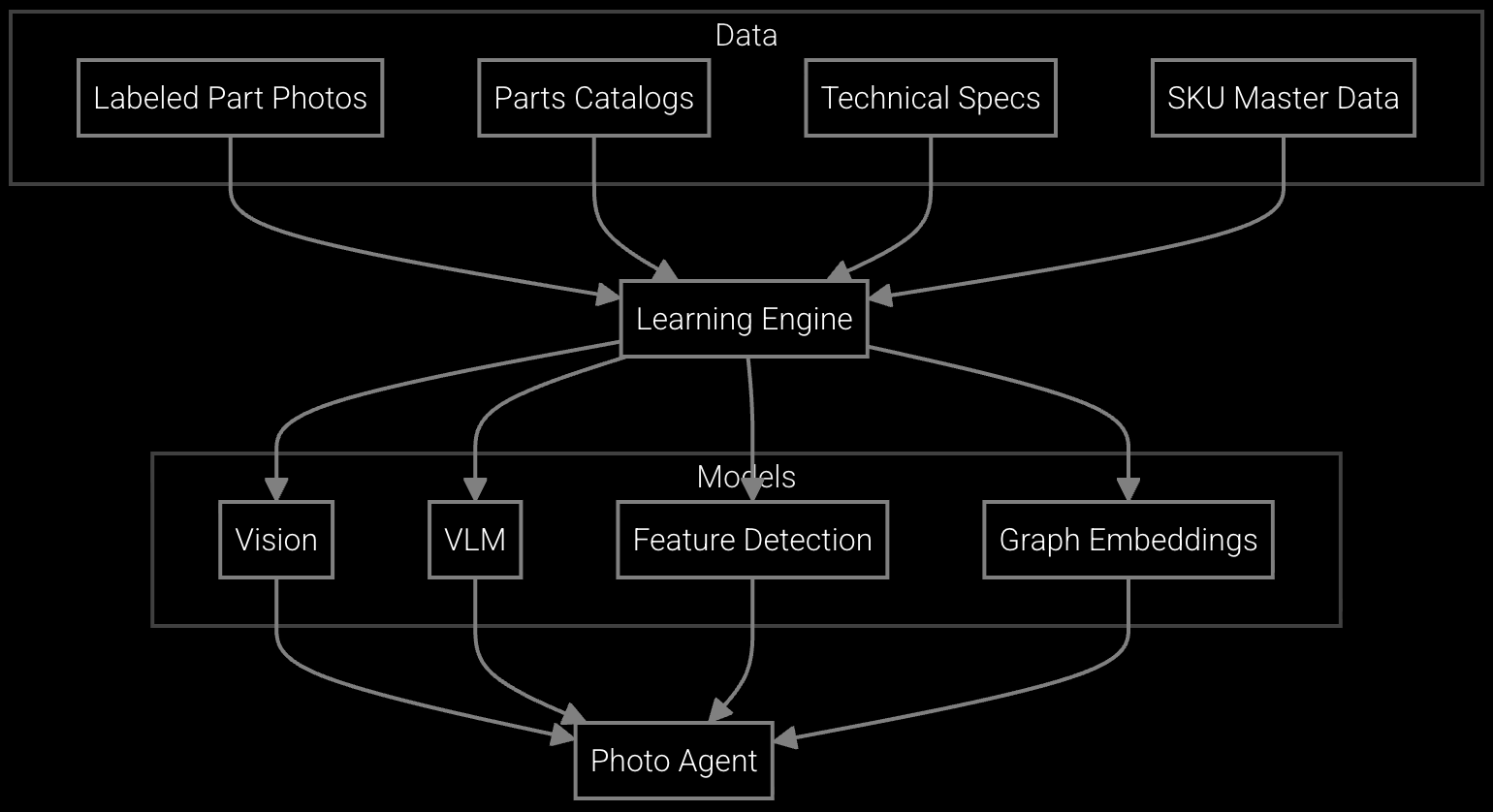

Network equipment OEMs maintain parts data across disconnected systems: ERP, warehouse management, service records, and RMA databases. This fragmentation blocks accurate demand forecasting and makes it impossible to predict which components will fail at which customer sites.

Finance teams demand concrete payback periods before approving AI initiatives, but initial inventory models require 6-9 months of training data before they outperform manual forecasting. This creates a credibility gap that kills executive sponsorship.

Legacy SAP and Oracle ERP systems lack modern APIs for real-time inventory updates. Custom integration requires months of IT resources, exposing data governance risks and requiring extensive change management across procurement and service operations teams.

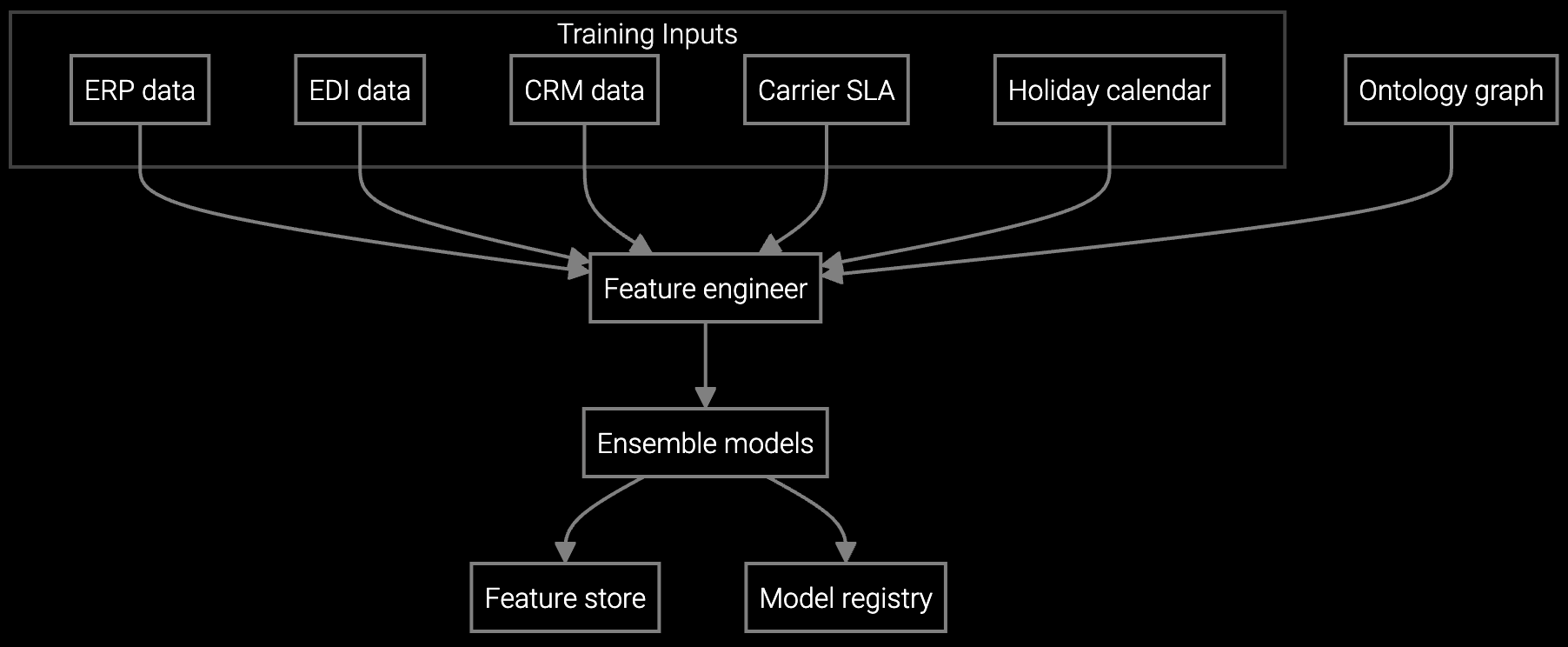

Bruviti's platform deploys through a phased integration that prioritizes immediate ROI validation. The first phase connects to existing ERP systems via SAP BAPI or Oracle Cloud connectors, extracting historical parts consumption data, service ticket patterns, and installed base configurations. This historical foundation trains demand forecasting models on network equipment failure patterns specific to router line cards, power supplies, and optical transceivers.

The second phase activates predictive inventory recommendations through a side-by-side validation approach. Bruviti's models run in parallel with existing manual forecasting processes for 60-90 days, generating stock level recommendations that procurement teams compare against their baseline approach. This validation window builds executive confidence by demonstrating forecast accuracy improvements before any operational changes commit resources.

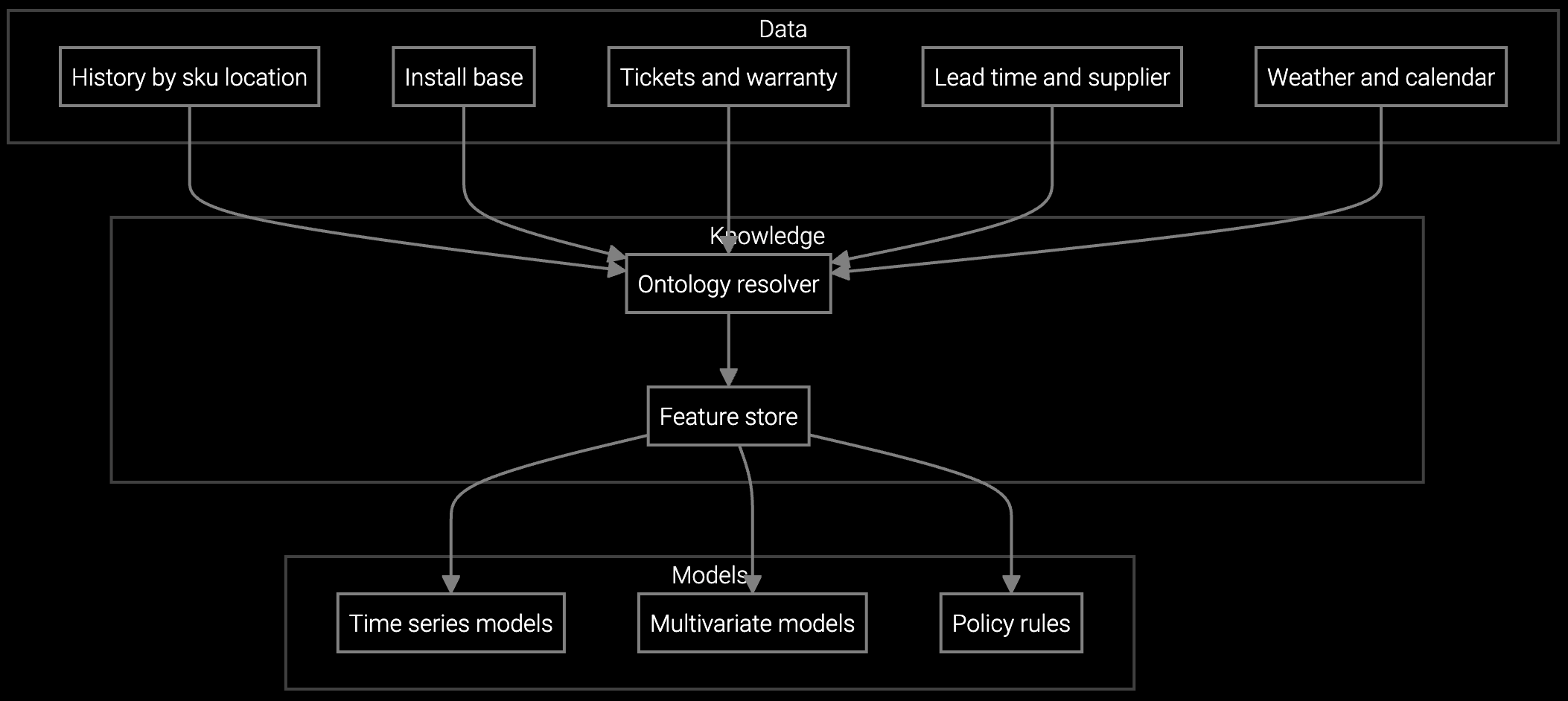

Forecasts demand for network equipment spare parts by analyzing historical RMA patterns, installed base telemetry, and seasonal traffic surges to optimize regional warehouse stock levels.

Projects consumption rates for router components and optical modules based on firmware update cycles, installed base age distribution, and network expansion trends.

Network operations teams photograph failed line cards or modules on-site, instantly receiving part numbers and cross-reference data for substitute components when original SKUs are obsolete.

Network equipment OEMs face unique inventory challenges driven by 24/7 uptime requirements and rapid technology transitions. Carrier-grade routers and switches operate in mission-critical environments where a single power supply failure can disrupt service for thousands of end users, creating immediate pressure for parts availability. Simultaneously, technology refresh cycles force early obsolescence of optical transceivers and line cards, leaving warehouses holding inventory that may never be consumed.

Successful AI deployment addresses both extremes: maintaining sufficient stock of high-failure components like fans and power supplies while aggressively managing slow-moving inventory for EOL platforms. The platform ingests SNMP telemetry from installed equipment, correlating environmental factors like temperature and humidity with component failure rates to predict which customer sites will require service parts in the next 30-90 days.

Initial models typically achieve 70-75% forecast accuracy within 90 days when trained on at least 18 months of historical parts consumption data. Accuracy improves to 85-90% after six months as the platform ingests real-time service ticket patterns and RMA data. Network equipment OEMs see fastest improvement on high-volume components like power supplies and optics where failure patterns are statistically significant.

Bruviti provides pre-built connectors for SAP ECC and S/4HANA that extract historical parts data via BAPI calls without requiring SAP modifications. Initial integration takes 4-6 weeks including data mapping and validation. The platform runs in read-only mode during validation, eliminating risk to existing procurement workflows while building executive confidence through parallel forecast comparisons.

Minimum viable training requires 18 months of parts consumption history, service ticket records with equipment serial numbers, and installed base configuration data showing which products are deployed at which customer sites. Network equipment OEMs achieve better accuracy by adding SNMP telemetry logs, firmware version distributions, and RMA return codes that correlate environmental factors with component failures.

Deploy Bruviti in validation mode for 60-90 days where AI-generated forecasts run parallel to existing manual processes without changing procurement decisions. Track prediction accuracy against actual consumption, quantifying potential savings through reduced emergency freight costs and lower safety stock levels. This side-by-side comparison provides concrete evidence for CFO approval before operational integration.

Procurement teams require training on interpreting AI-generated reorder recommendations and understanding confidence intervals for each forecast. Warehouse operations need process updates for exception handling when predicted demand deviates significantly from historical patterns. Most network equipment OEMs phase rollout by product line, starting with high-failure-rate components where forecast value is immediately visible before expanding to full catalog coverage.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how Bruviti's platform integrates with your ERP to reduce carrying costs and improve parts availability.

Schedule Implementation Review