Decades-long equipment lifecycles demand inventory systems that learn from failure patterns, not static spreadsheets.

Deploy AI-driven inventory in phases: pilot on high-volume parts, integrate telemetry feeds for demand signals, measure impact via carrying cost and fill rate before scaling to full catalog.

Attempting to forecast demand across tens of thousands of SKUs simultaneously overwhelms AI model training and delays time-to-value. Most implementations fail before proving any ROI.

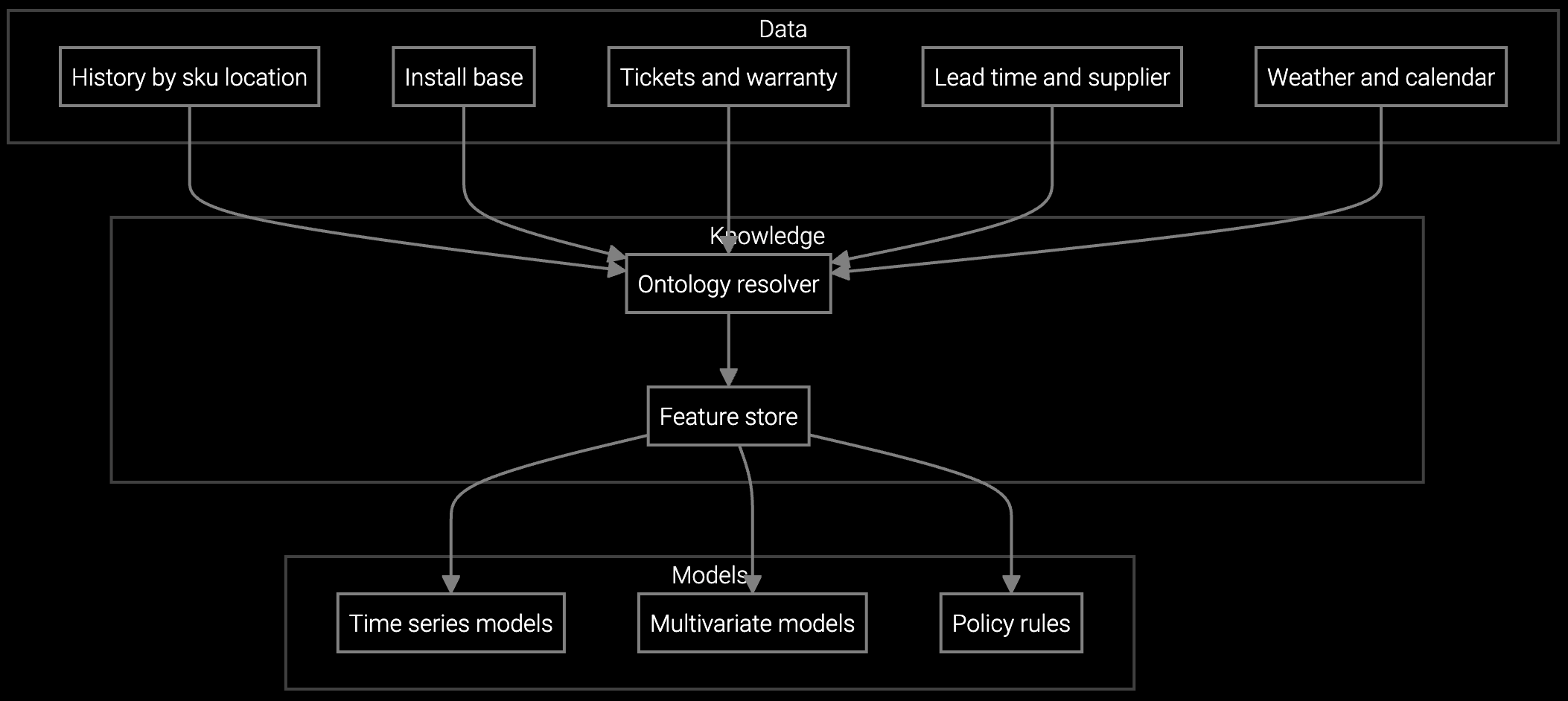

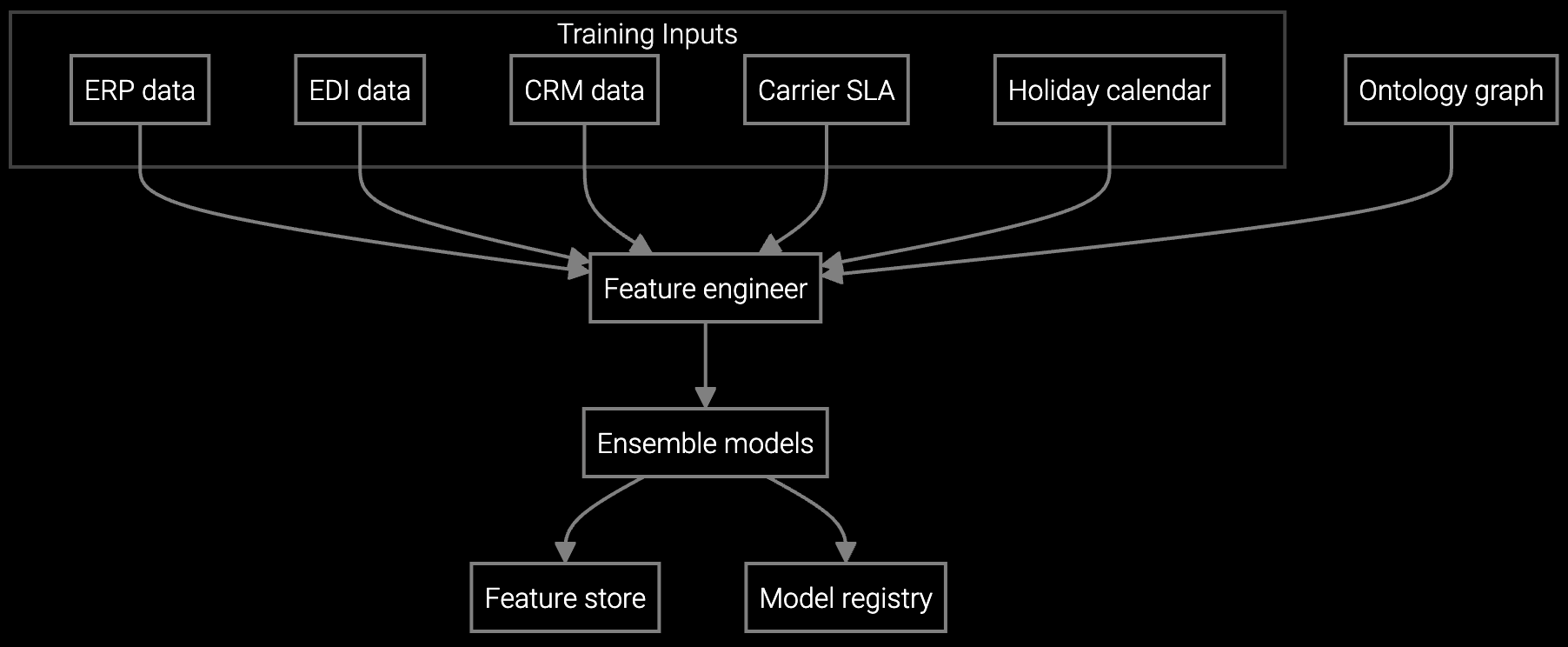

Without access to equipment telemetry, usage patterns, and failure history, AI forecasts remain statistically shallow. Integration gaps between SCADA, ERP, and service systems cripple predictive accuracy.

Tracking vanity metrics like model training speed instead of business outcomes creates false confidence. Unless carrying cost and fill rate improve within quarters, leadership loses patience.

Bruviti's platform follows a risk-controlled rollout model: select a pilot segment representing 20-30% of parts volume, connect existing telemetry and ERP feeds, train demand models on historical failure patterns, and validate forecast accuracy before expanding. This approach delivers measurable ROI within two quarters while minimizing disruption to ongoing operations.

The architecture integrates with SAP, Oracle, and legacy inventory systems via pre-built connectors, ingests SCADA and IoT sensor data to detect usage anomalies, and surfaces substitute parts recommendations when primary SKUs face obsolescence. Leadership gains visibility into carrying cost reductions and fill rate improvements through executive dashboards tied to financial KPIs.

Projects parts consumption for industrial machinery based on installed base age, run hours, and seasonal maintenance cycles.

Optimizes stock levels across regional warehouses by forecasting demand windows for critical pump and compressor components.

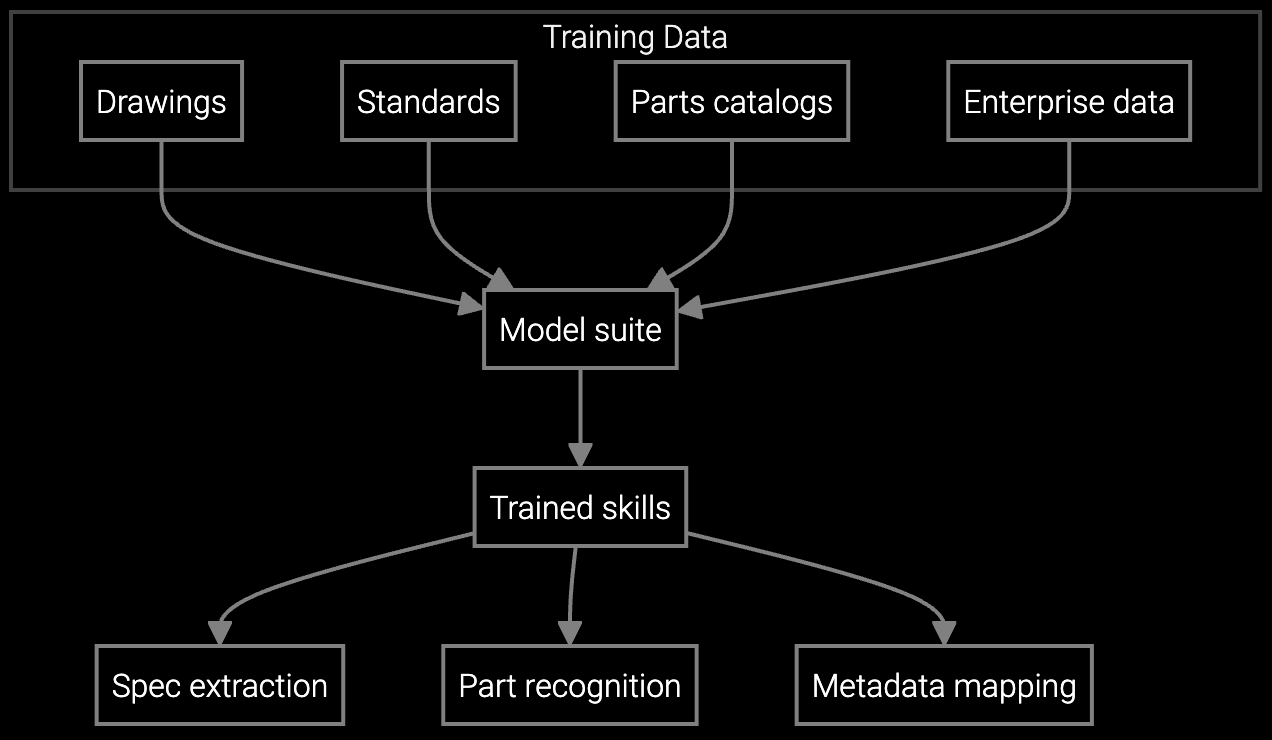

AI reads legacy technical drawings to identify obsolete part numbers and recommend modern substitutes during service quotes.

Industrial equipment manufacturers face unique inventory complexity: CNC machines, turbines, and automation systems remain in service for 10-30 years, creating ongoing parts obligations long after production ends. Parts obsolescence accelerates as component suppliers exit the market, forcing OEMs to stockpile critical inventory or develop costly substitutes.

Geographic distribution compounds the challenge. Equipment deployed across continents requires regional inventory positioning to meet service SLAs, but demand variability per location makes manual forecasting unreliable. Excess stock ties up working capital while stockouts trigger emergency freight costs and penalty clauses.

Minimum viable integration requires ERP inventory records, historical parts consumption data, and service case records. Enhanced forecasting accuracy comes from connecting equipment telemetry (SCADA, PLC, IoT sensors) and customer contract databases to identify usage patterns and installed base aging. Most deployments start with ERP and expand data sources iteratively.

Pilot deployments targeting high-volume parts typically show measurable impact within two quarters. Carrying cost reductions appear first as forecast accuracy improves stock positioning. Fill rate gains follow as stockout prediction prevents emergency shortages. Full catalog scaling extends ROI realization to 12-18 months depending on SKU complexity.

Target a parts segment representing 20-30% of total volume but concentrated in a single product line or equipment type. This scope provides sufficient statistical signal for model training while limiting implementation risk. Mature product lines with 5+ years of failure history yield faster accuracy improvements than newly launched equipment.

Bruviti ingests parts catalog data and supplier lifecycle notifications to flag obsolescence risk ahead of end-of-life dates. The AI recommends substitute parts based on dimensional compatibility, material properties, and historical usage patterns. This prevents last-time-buy panic and reduces stockpiling of components that may never be consumed.

The platform operates as a forecasting layer above existing ERP and inventory management systems rather than replacing them. Pre-built connectors for SAP, Oracle, and legacy databases enable read-only data ingestion without altering transaction workflows. Forecast outputs surface as recommendations within existing planning tools, allowing gradual adoption without forcing workflow migration.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

Talk to our implementation team about pilot scope, data integration, and ROI timelines for your parts catalog.

Schedule Implementation Review