Warranty reserves swing 20-40% quarterly when NFF rates spike—jeopardizing margin guidance and investor confidence.

Deploy AI for warranty claims by integrating BMC telemetry streams with claims data, training models to flag NFF patterns and fraudulent submissions, and automating entitlement verification at RMA intake—reducing reserve volatility by 15-25%.

No Fault Found returns spike unpredictably when hyperscale customers replace components preemptively. Finance teams struggle to model reserves when NFF rates fluctuate between 18% and 35% quarter over quarter, forcing conservative accruals that depress reported margins.

Entitlement verification for thousands of RMAs requires human lookup across fragmented systems. Each delay extends the window between shipment and final cost recognition, creating audit exposure and slowing quarterly close cycles.

Gray market resellers submit claims for out-of-warranty or counterfeit components. Manual review catches obvious fraud but misses sophisticated patterns—like serial numbers cycled across multiple claims or components swapped post-purchase.

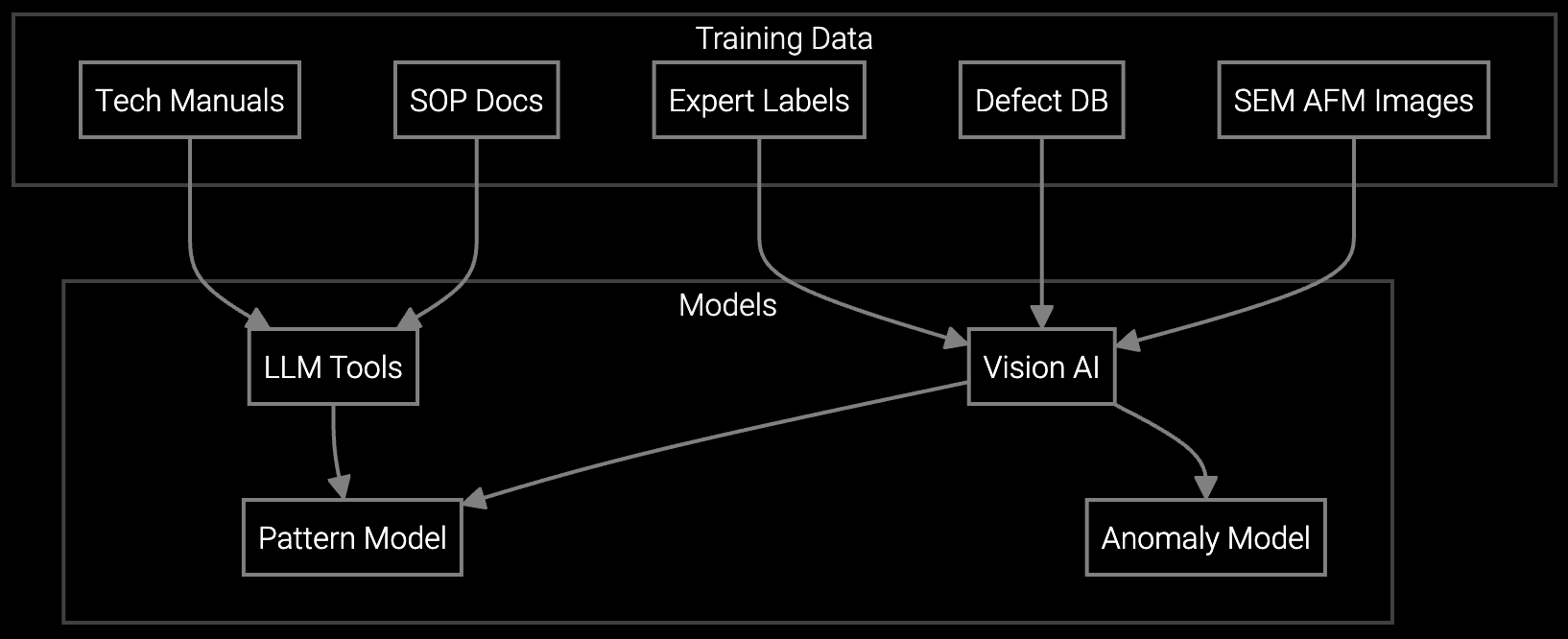

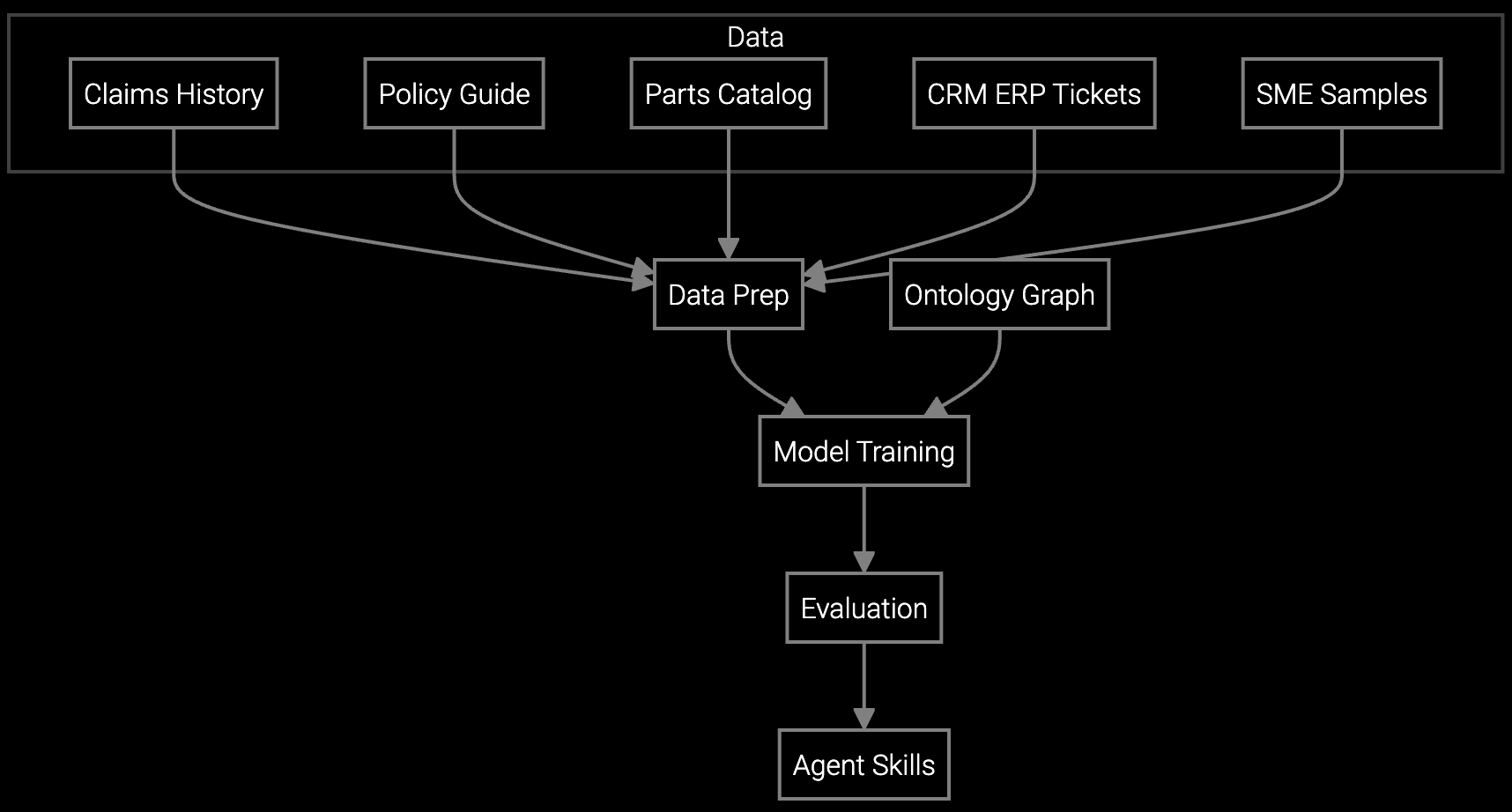

Bruviti integrates at three control points: upstream telemetry ingestion, RMA intake workflow, and refurbishment disposition. The platform consumes BMC/IPMI logs and correlates failure signatures with historical NFF patterns—flagging preemptive replacements before they enter the RMA queue. At intake, AI validates entitlement in real time by cross-referencing serial numbers, purchase dates, and warranty terms across ERP and CRM systems, eliminating the manual lookup bottleneck that delays close cycles.

For fraud detection, the system trains on years of claims history to identify anomalies: serial numbers appearing in multiple geographies, thermal signatures inconsistent with reported failure modes, or components returned outside plausible usage windows. The AI assigns risk scores to each claim, routing high-risk cases for manual review while auto-approving low-risk submissions. This two-tier workflow cuts processing time by 60% while capturing fraud that spreadsheet-based review misses entirely.

Analyze microscopic images of failed server memory and storage components to classify defect types, validate warranty claims, and reduce NFF returns from hyperscale customers.

Automatically classify RMAs by component type, failure mode, and warranty coverage—eliminating manual coding backlogs and enabling real-time reserve accrual adjustments.

Hyperscale customers replace components at the first hint of degradation—not failure—to maintain four-nines availability. This preemptive strategy floods warranty pipelines with functional parts, driving NFF rates above 30% and destabilizing reserve models. Traditional root cause analysis can't keep pace when RMA volumes scale with cloud expansion, and manual fraud detection misses gray market operators who exploit high-volume chaos to slip counterfeit claims into the stream.

Warranty AI intercepts this chaos at the data layer. By correlating BMC thermal and voltage telemetry with component serial numbers, the platform distinguishes genuine failures from preemptive swaps—enabling OEMs to challenge hyperscaler claims with forensic precision. For finance teams, this means predictable reserves tied to actual failure modes rather than customer behavior, eliminating the quarterly guidance volatility that punishes data center OEM valuations.

AI correlates BMC telemetry with historical NFF patterns to predict which returns will arrive as No Fault Found before they enter the RMA pipeline. This foresight lets finance teams model reserves based on actual failure signatures rather than guessing at customer behavior, stabilizing accruals within a predictable band and protecting quarterly margin guidance.

The platform ingests warranty registration data, RMA history, component serial numbers, BMC/IPMI telemetry logs, and ERP entitlement records. By cross-referencing these streams, the AI identifies anomalies like serial numbers appearing in multiple geographies, thermal signatures inconsistent with reported failures, or components returned outside plausible usage windows.

Initial deployment focuses on high-NFF component categories and typically completes in 8-12 weeks. This includes BMC telemetry integration, ERP entitlement feed setup, and model training on 18-24 months of historical claims data. Pilots start flagging fraudulent claims and NFF predictions within 30 days of go-live, with full reserve impact visible by quarter two.

Yes. Bruviti connects via APIs to SAP, Oracle, Salesforce, and custom RMA platforms. The platform operates as a decision layer above existing systems—flagging high-risk claims, auto-validating entitlements, and routing exceptions—without requiring a rip-and-replace of warranty infrastructure. Most integrations use REST APIs and require minimal IT overhead.

Data center OEMs typically see warranty cost reductions of 12-18% within six months, driven by lower NFF returns, faster claims processing, and improved fraud detection. For a $500M revenue OEM with 3% warranty costs, this translates to $1.8M-$2.7M in annual savings. Reserve volatility drops by 40-60%, reducing the risk of margin guidance misses that trigger analyst downgrades.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how Bruviti's platform deploys in 8-12 weeks to cut NFF volatility and protect margin guidance.

Schedule Implementation Review