Five-nines uptime demands force strategic choices: proprietary inventory systems risk years of development while competitors deploy AI today.

Network OEMs face a strategic choice: build proprietary inventory systems or buy predictive platforms. Hybrid API-first approaches enable rapid deployment while preserving customization control and avoiding vendor lock-in.

Network equipment manufacturers carry safety stock across hundreds of SKUs to meet SLA commitments. Inaccurate demand forecasting locks working capital in slow-moving inventory while critical parts still stock out during equipment failures.

Parts spread across regional warehouses, partner depots, and field service vans create blind spots. Service teams waste hours locating available inventory while emergency shipments inflate logistics costs and delay network restoration.

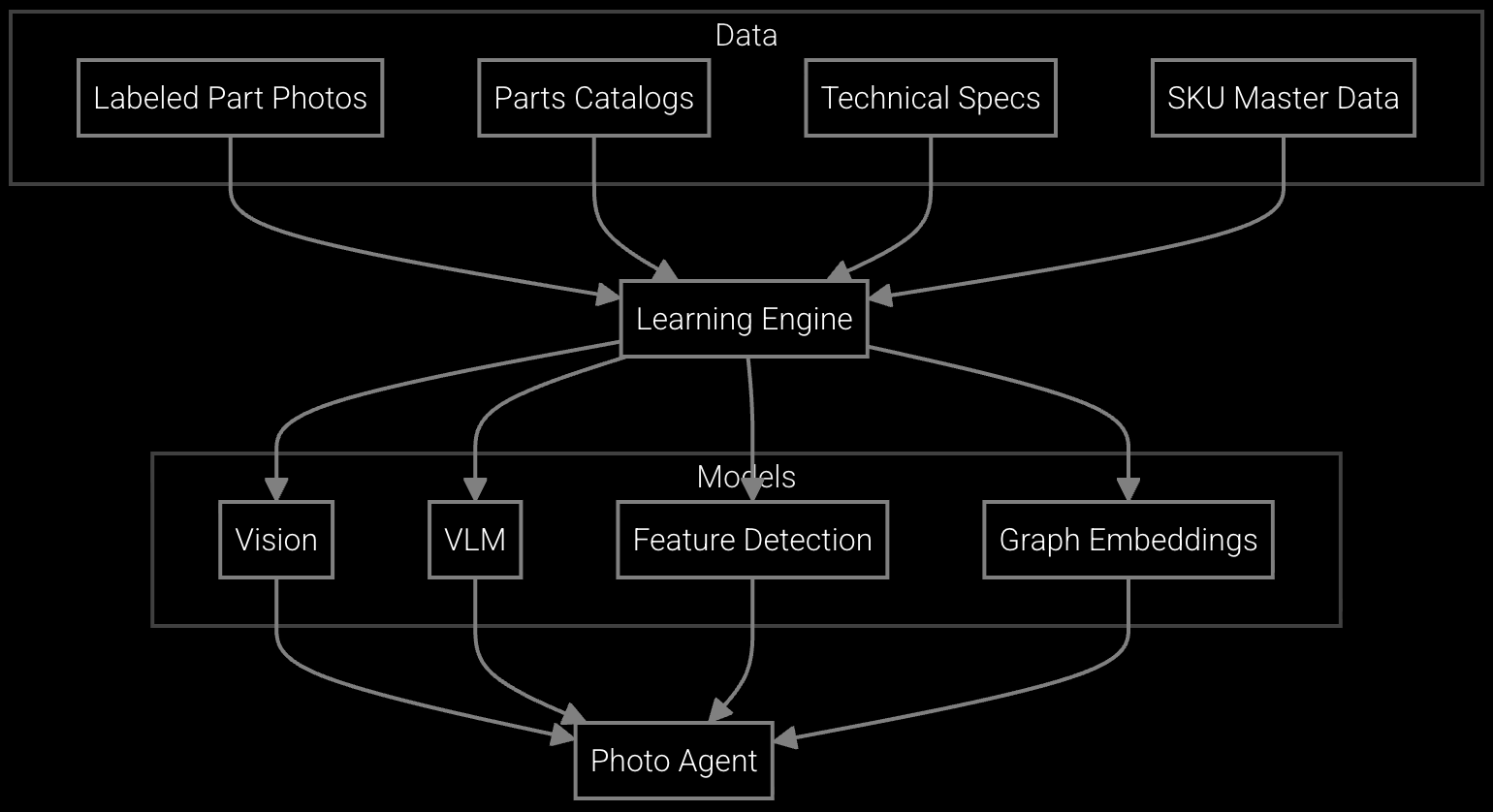

Telecom infrastructure operates for decades while component lifecycles shrink. Managing substitute parts and alternatives requires institutional knowledge that retires with senior staff, leaving service teams unable to fulfill commitments.

Network OEMs evaluating inventory optimization face a fundamental strategic choice. Building proprietary systems delivers maximum control but demands scarce data science talent, extended development timelines, and ongoing model maintenance. Pure-play vendor solutions promise rapid deployment but risk lock-in and inflexibility as business requirements evolve.

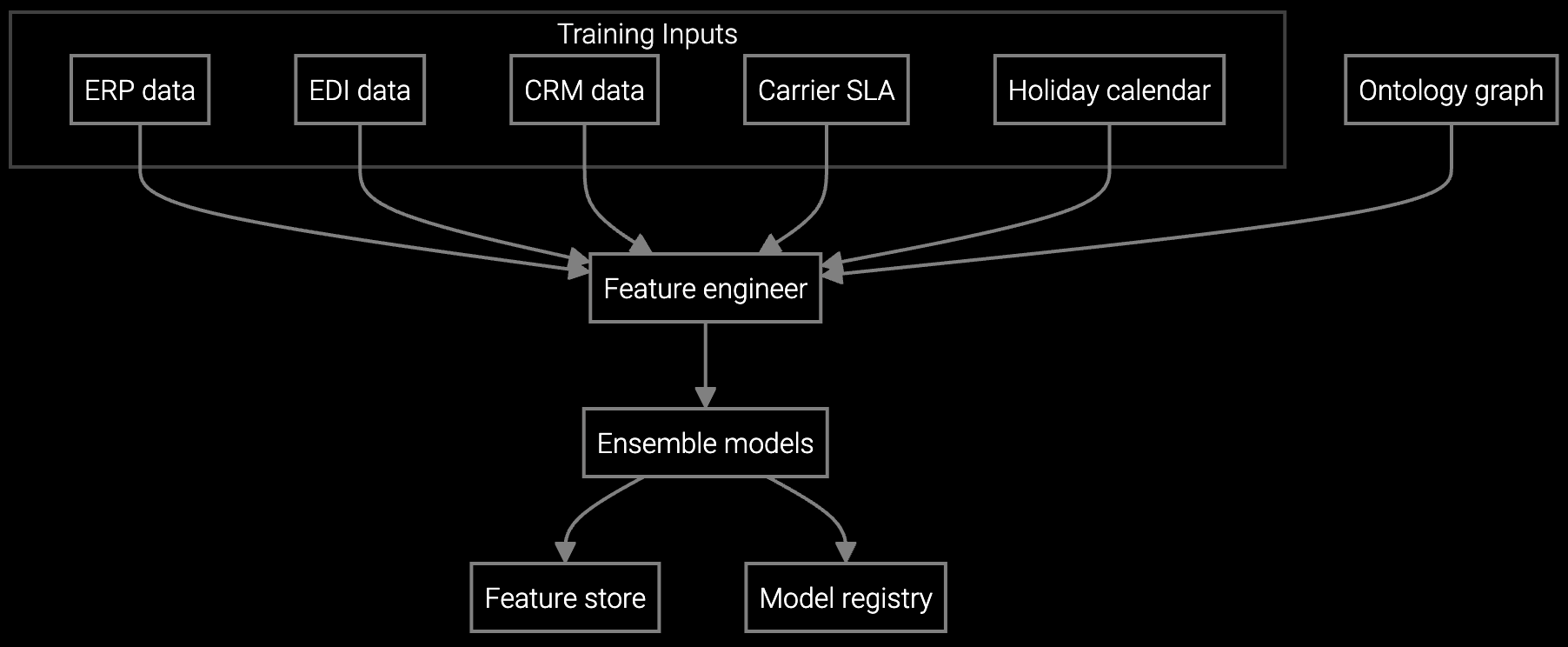

The platform approach combines pre-trained demand forecasting models with open APIs that integrate with existing ERP and service management systems. This hybrid strategy accelerates time-to-value while preserving the customization flexibility executives need for competitive differentiation. API-first architecture prevents vendor lock-in by enabling gradual adoption across product lines and geographies.

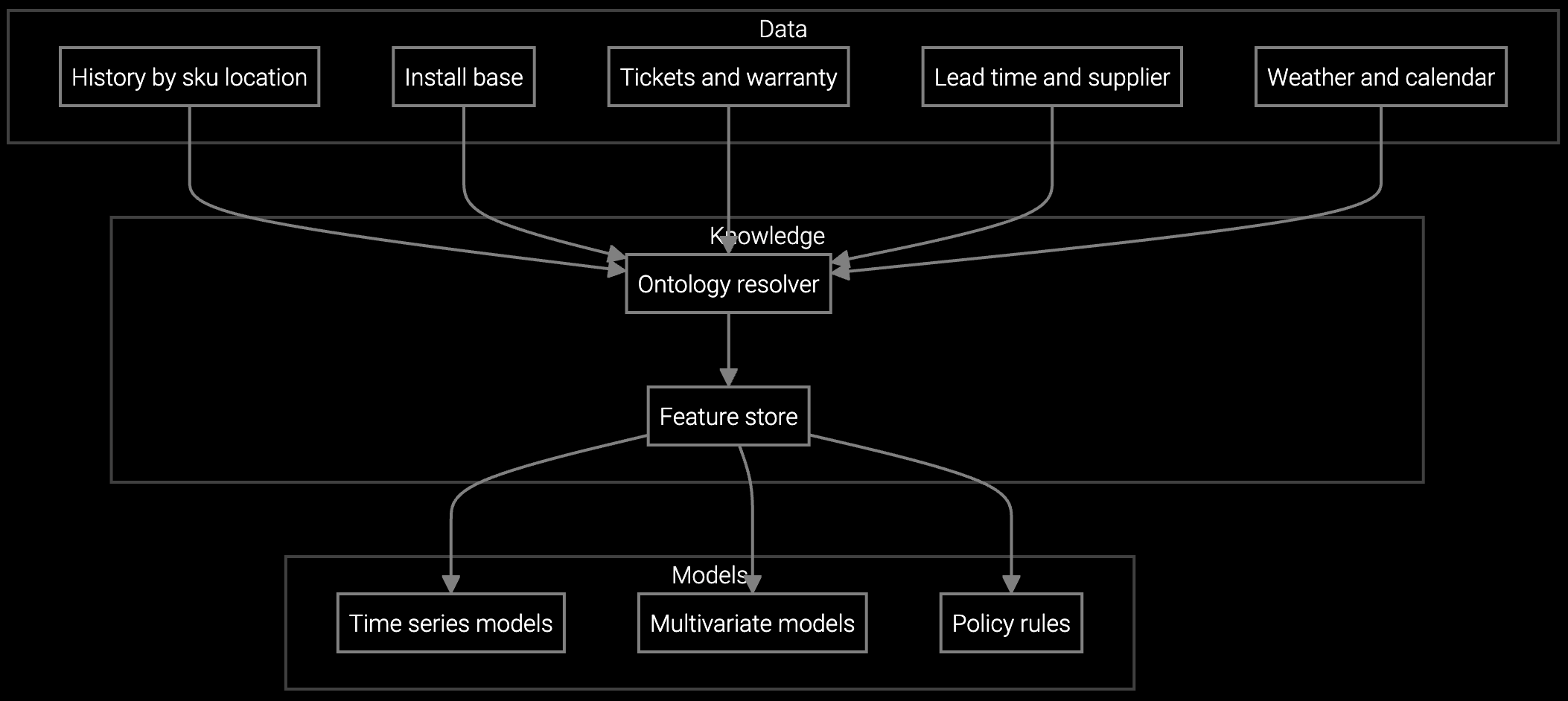

Projects router and switch component consumption based on installed base age, network traffic patterns, and seasonal maintenance windows for 5G infrastructure.

Forecasts optical transport and DWDM component demand by regional distribution center, optimizing stock levels while maintaining carrier-grade SLA commitments.

Network engineers photograph failed line cards and power supplies for instant part number identification and availability across warehouses, accelerating remote site restoration.

Network infrastructure OEMs operate under contractual uptime commitments where inventory stockouts directly trigger SLA penalties. Router, switch, and optical transport equipment failures demand four-hour response windows, making parts availability a competitive differentiator and revenue protection mechanism.

AI demand forecasting ingests telemetry from deployed equipment fleets, correlating MTBF patterns with environmental conditions, firmware versions, and usage intensity. This predictive approach right-sizes safety stock by location while identifying high-risk components before failure spikes occur, protecting both margins and customer relationships.

Evaluate time-to-value, internal data science capacity, and customization requirements. Building requires 12-18 months plus ongoing model maintenance. Buying accelerates deployment to 3-6 months but assess API flexibility for ERP integration and model tuning. Hybrid platforms offer pre-trained forecasting models with customization APIs, balancing speed and control.

AI systems track component lifecycle status across your catalog, flagging approaching EOL dates and suggesting substitute parts based on electrical compatibility and form factor. Machine learning analyzes historical service records to recommend last-time-buy quantities, preventing both excess obsolete inventory and critical stockouts for legacy infrastructure.

Network OEMs typically achieve payback within 9-12 months through carrying cost reduction and emergency shipping avoidance. First-quarter improvements of 10-15% in forecast accuracy translate to immediate working capital release. Full ROI including SLA penalty avoidance and margin protection manifests over 18-24 months as models learn seasonal patterns.

Open APIs integrate with existing ERP, warehouse management, and service ticketing systems without data migration or workflow replacement. This enables phased adoption by geography or product line while preserving the option to switch vendors or bring capabilities in-house as internal data science capacity matures.

Effective forecasting ingests service ticket history, RMA patterns, installed base age and firmware distributions, and seasonal maintenance windows. Additional value comes from equipment telemetry like error logs, temperature sensors, and power supply metrics that signal impending component failures before customers report issues.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

Discover how network OEMs are reducing carrying costs while improving parts availability with Bruviti's AI platform.

Schedule Strategic Consultation