Thin margins and seasonal spikes force appliance OEMs to choose between custom AI investments and off-the-shelf platforms that may lock them in.

Appliance OEMs face a hybrid choice: build custom forecasting for differentiation, buy platforms for speed, or adopt API-first solutions that combine pre-trained models with full integration control to optimize inventory without vendor lock-in.

HVAC and refrigeration parts see dramatic spikes during weather extremes. Traditional forecasting models trained on annual averages miss these windows, creating emergency shipment costs or lost service revenue.

Supporting products manufactured 15-20 years ago requires maintaining slow-moving inventory across thousands of part numbers. Excess stock ties up capital while stockouts delay service and erode customer trust.

Building internal forecasting models requires data science talent and multi-year commitments. Buying proprietary platforms risks vendor dependency. Neither path guarantees integration with existing ERP and service management systems.

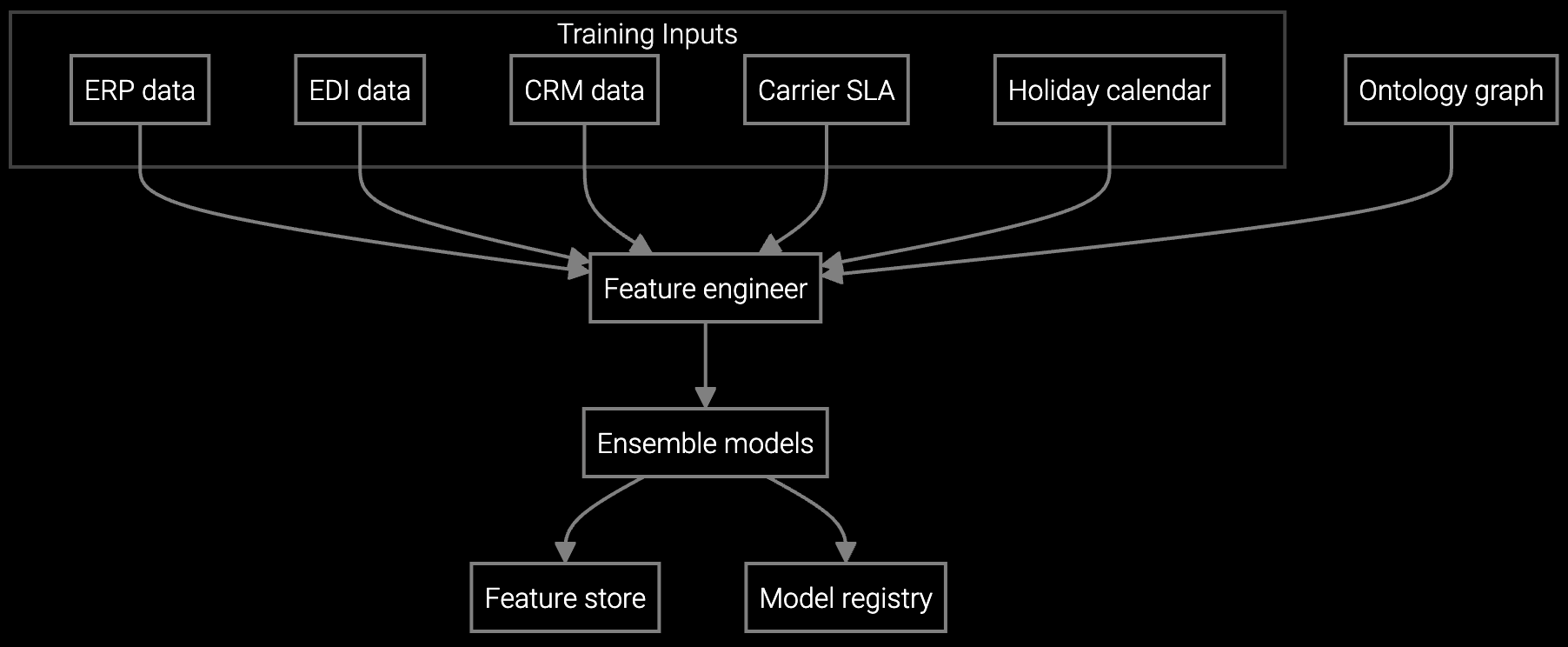

The build-versus-buy debate creates a false choice. Building custom demand forecasting models offers control but demands scarce data science resources and delays time to value. Buying closed platforms delivers speed but introduces vendor dependency and integration friction with existing SAP or Oracle ERP systems.

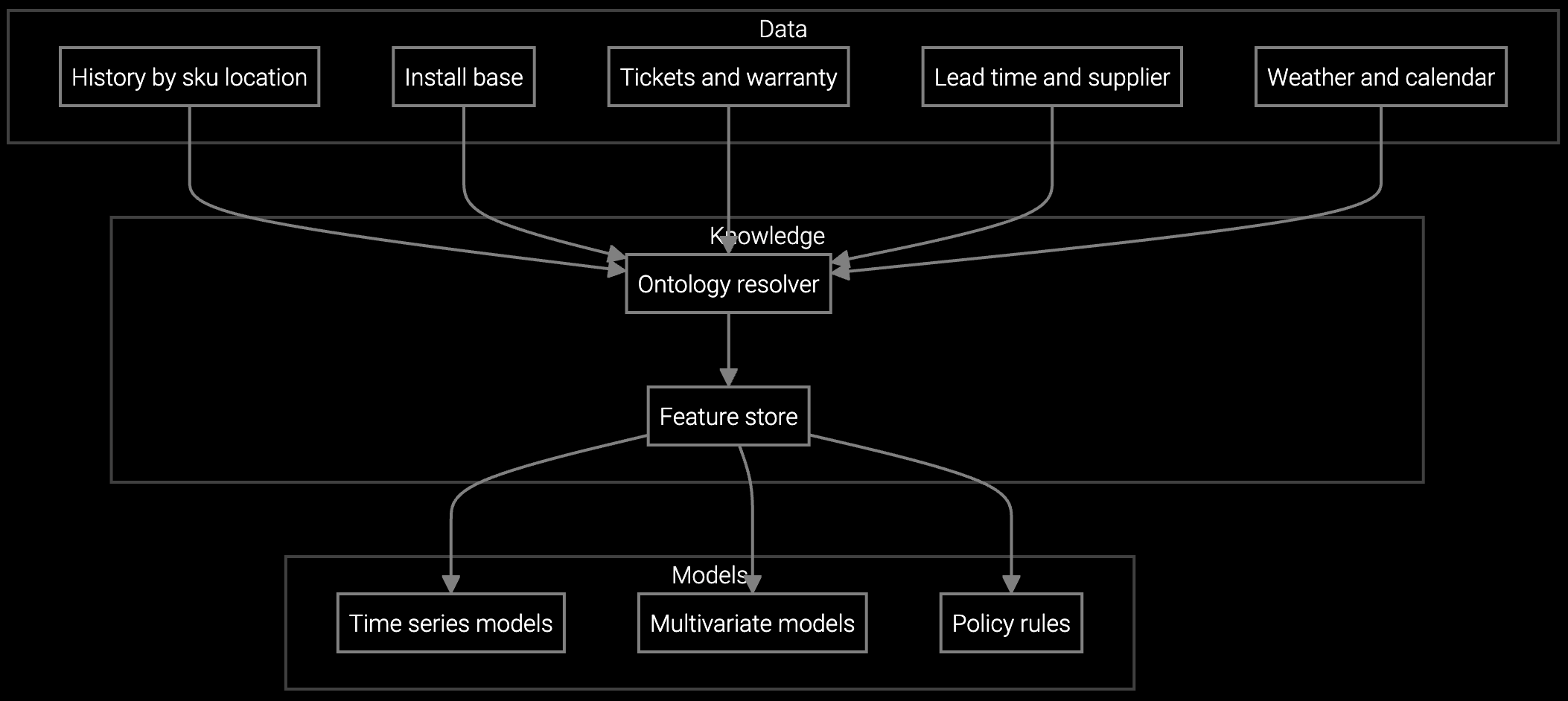

Bruviti's API-first architecture resolves this tension. Pre-trained models handle appliance-specific failure patterns and seasonal demand curves immediately, while open APIs allow your team to extend forecasting logic, customize substitute parts matching, and integrate directly with existing inventory management workflows. You gain the deployment speed of a platform with the technical flexibility of an in-house build, and you retain full control over data and integration points.

Projects HVAC compressor and refrigeration component demand by geography and season, preventing stockouts during summer heat spikes.

Optimizes stock levels for washing machine pumps and dishwasher control boards across regional service centers based on installed base age.

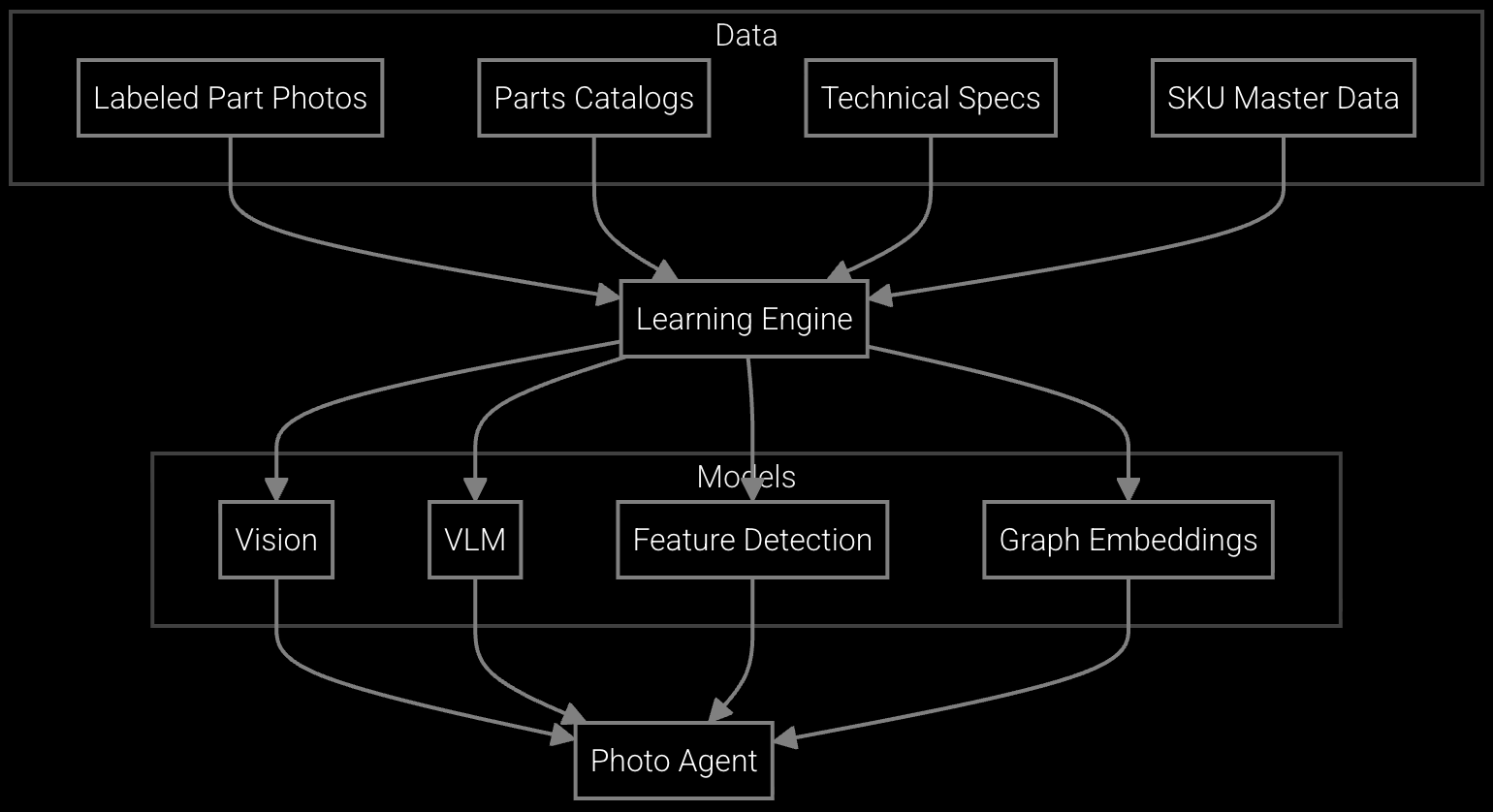

Identifies microwave magnetrons and icemaker assemblies from technician photos, speeding order fulfillment for legacy products.

Appliance manufacturers face margin pressure from retail consolidation and direct-to-consumer competition. Service becomes a margin protection lever, but only if parts availability supports first-visit resolution without tying up capital in excess inventory. The challenge intensifies for legacy products where failure patterns shift as units age beyond warranty periods.

The strategic question is whether to invest in custom forecasting models that account for product-line-specific aging curves and seasonal demand, or adopt third-party platforms that may not integrate cleanly with existing SAP inventory modules. A hybrid approach preserves integration control while leveraging pre-trained models that understand appliance failure modes, delivering value within a single planning cycle rather than across multiple fiscal years.

Appliance OEMs typically see measurable improvements in fill rate and carrying cost within 3-6 months of deployment. The fastest returns come from focusing on high-value, seasonal parts like HVAC compressors where demand spikes are predictable but traditional models underperform. Full ROI realization depends on phased rollout across product lines, but pilot programs often justify broader investment within one peak season cycle.

Closed platforms that control model training and integration endpoints create dependency on the vendor's roadmap and pricing. Appliance manufacturers with complex ERP integrations and multi-decade SKU portfolios face the highest risk. API-first solutions that expose model outputs, data pipelines, and integration logic reduce lock-in by allowing internal teams to customize forecasting rules and switch providers if needed, preserving the investment in integration work.

Build if you have in-house data science teams and differentiated data sources that create competitive advantage. Buy if you need speed to value and lack ML expertise. Most appliance OEMs benefit from a hybrid approach: adopt pre-trained models that understand appliance failure patterns and seasonal demand, then extend them via APIs to incorporate proprietary data like service contract telemetry or regional weather forecasts. This delivers platform speed with build-level customization.

Legacy SKUs with sparse failure histories benefit from transfer learning approaches that apply patterns from similar product lines and age cohorts. For example, refrigeration compressor failure rates from 2005-2010 models inform forecasts for 2008-2012 units even when direct data is limited. The key is using failure physics and installed base age curves rather than relying solely on historical sales data, which misses emerging patterns as products move beyond design life.

Three integrations drive value: ERP systems for real-time inventory levels and replenishment triggers, service management platforms for failure demand signals, and logistics systems for lead time and shipping cost data. Appliance OEMs with SAP or Oracle ERP require API endpoints that preserve existing procurement workflows rather than forcing process changes. The goal is enriching current systems with better forecasts, not replacing them.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how appliance OEMs are reducing carrying costs and improving fill rates without replacing existing systems.

Schedule Strategy Session